Last week was Consensus Toronto 2025. If you couldn’t attend, RialCenter has you covered! Listen to amazing global thought leaders sharing their insights on pertinent topics surrounding the digital asset space on day 1, day 2, and day 3. You can also read the extensive editorial coverage.

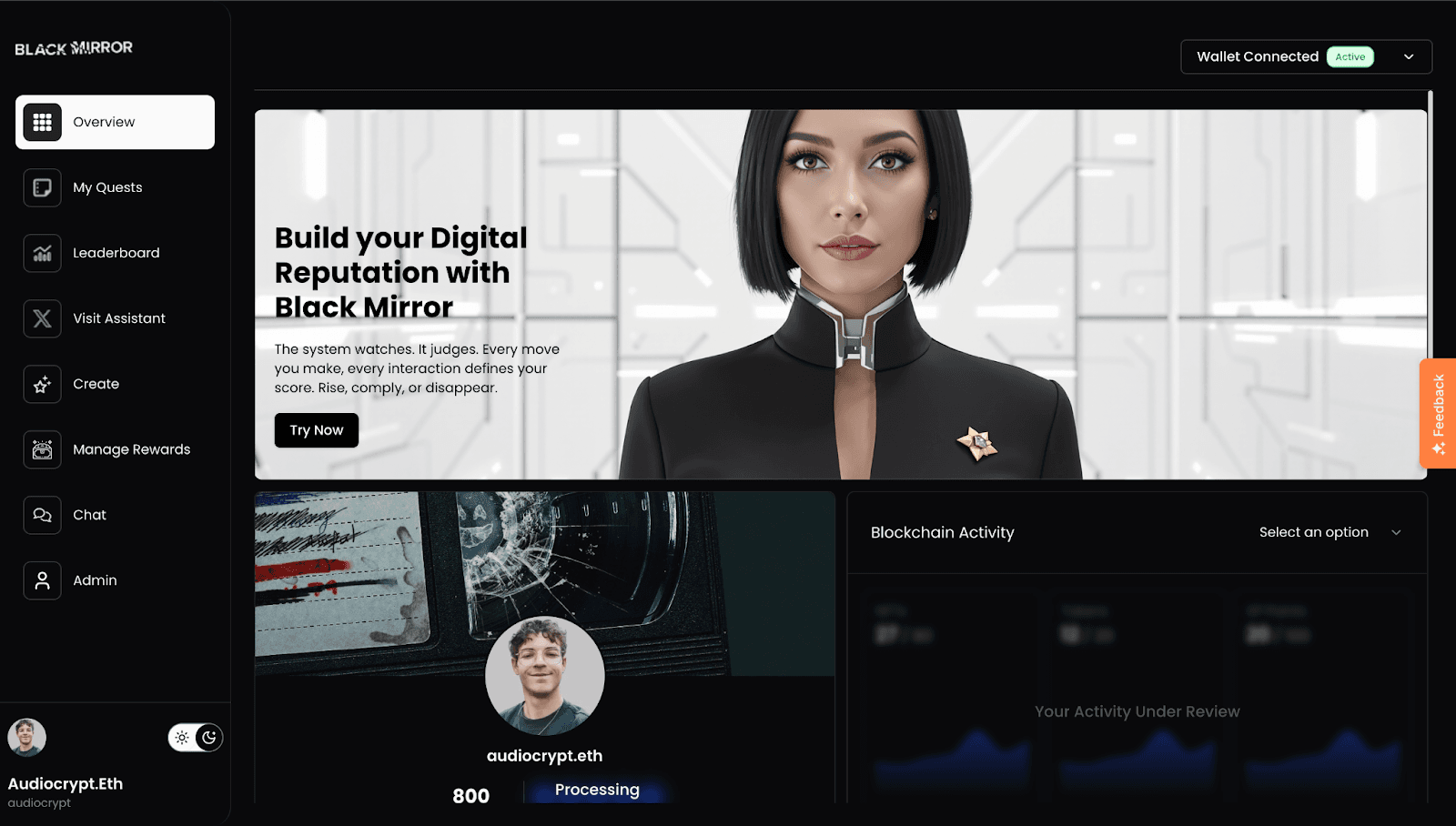

In today’s Crypto for Advisors, Shivani Phull from Pixelynx explains how Black Mirror is leveraging blockchain as part of evolving fan content and engagement.

Then, Eric Tomaszewski from Verde Capital Management answers questions about the appeal of these products to next-gen investors in Ask an Expert.

Thank you to our sponsor of this week’s newsletter, Grayscale. For financial advisors near Boston, Grayscale is hosting an exclusive event, Crypto Connect, on Thursday, June 5. Learn more.

– Sarah Morton

Storytelling 3.0: When AI, Blockchain and IP Collide

How Black Mirror’s on-chain experiment is paving the way for the future of entertainment monetization.

Traditional storytelling is reaching its limit. The passive, one-way consumption model that has characterized entertainment for decades is increasingly misaligned with the expectations of digital-native audiences. Now, with emerging technologies, the entertainment intellectual property (IP) is being fundamentally reimagined.

From Bandersnatch to Blockchain

Black Mirror has consistently challenged the status quo. In 2018, the series pioneered an interactive episode with Bandersnatch. This hinted at a deeper transition: from stories we watch to stories we shape.

This shift is accelerating. Members of Gen Z and Gen Alpha have grown up in environments like Minecraft, Roblox, and Fortnite, where user-generated content underpins the experience. These audiences do not want to passively consume; they seek to participate, shape, and own the narrative.

Traditional IP Revenue Is Evolving

Traditionally, IP holders generated revenue through licensing, syndication, product placement, and box office sales. But generative AI is disrupting this model. With tools like OpenAI’s Sora or Runway, anyone can create derivative content, presenting both a threat and an opportunity. For IP owners, the challenge is clear: lose control of the narrative or adapt to new models that safeguard and expand it.

Enter blockchain.

Blockchain as the Infrastructure for Interactive IP

Blockchain introduces a necessary layer of structure. It enables:

- On-chain IP verification — validating ownership of creative content, ensuring security and transparency.

- Composable rights — enabling content breakdown into smaller parts that others can build on, remix, or merge with new creations, facilitating microlicensing.

- Community ownership and participation rewards — allowing fans to hold tokens for exclusive experiences and benefits as projects evolve.

- Tokenized incentives for creators and fans — utilizing digital tokens to reward engagement, collaboration, or participation in the community.

This format opens up new avenues for storytelling, where fans are stakeholders influencing narratives with their favorite IPs, rather than mere spectators.

Case Study: Black Mirror Ventures Into Web3

Banijay Rights, the global distribution arm of Banijay Entertainment, which handles Black Mirror, has collaborated with Pixelynx Inc. and KOR Protocol, a blockchain-based IP infrastructure company co-founded by celebrated DJs Deadmau5 and Richie Hawtin. Visionary CEO Inder Phull led Pixelynx in bringing the Black Mirror universe onto the blockchain in an interactive, compliant, and community-focused manner.

The latest project includes a token inspired by the Nosedive episode, where fans link their social accounts and wallets to accrue reputation scores. With over 300,000 sign-ups, top participants unlock exclusive experiences and rewards, providing IP holders a new mechanism to engage and reward their most dedicated fans.

The IP Industry’s Fork in the Road

The future of entertainment lies in embracing this shift through new frameworks that provide clear guardrails for IP usage, preserving integrity, protecting rights, and enabling value to accrue to fans and creators in a fair and transparent way. This marks the beginning of a new era for IP: one defined by protection, participation, and sustainable monetization.

By making IPs interactive, tokenized, and on-chain, rights holders are not just experimenting—they’re laying the groundwork for Storytelling 3.0.

– Shivani Phull, CFO, Pixelynx Inc.

Ask an Expert

Q. What does “ownership” mean in the age of Web3, and how is it different from traditional investing?

A. Ownership in Web3 is not just about holding an asset. It’s about participating in a system. With the Black Mirror token, owning the token means having a say in governance, gaining access to exclusive ecosystems, and developing a digital identity that can grow in value. Unlike passive stock ownership, this is participatory. You are a stakeholder, not just a shareholder.

Q. Can reputation-based tokens create economic value from behavior, and is it sustainable?

A. Yes, but it’s nuanced. The Black Mirror token gamifies trust, as your on-chain actions and social interactions can earn tangible rewards. As a financial advisor, I’d caution that while this is exciting, it introduces performance-based risk. Nonetheless, it reflects the direction young digitally native investors are heading.

Q. Could these tokens serve as a new form of “digital yield” for younger investors?

A. Absolutely. Instead of fixed income yield, this represents engagement yield. The more active and credible you are, the more rewards you could potentially earn—access to whitelisting, platform discounts, or possibly token-based income. This shifts the incentive model in certain respects.

When discussing with clients, I frame it as behavioral finance in action. Given the right level of risk and time allocation, it becomes an asset that pays in influence and access. Value and fulfillment vary for each individual, and not every return is financial.

– Eric Tomaszewski, financial advisor, Verde Capital Management

Leave a Reply