What occurs when retail steps back from crypto and Wall Street engages? With bitcoin’s recent all-time high, one might feel bullish and see the industry as maturing.

That might be true, but we may not be there just yet. Before we park our Lambos, let’s dig deeper.

First and foremost, retail investors have largely skipped this rally. A quick glance at Google Trends for the term “bitcoin” illustrates that the surge seen during the 2021 bull market is absent. Back then, everyone was searching for bitcoin, diving into altcoins, and filling social media with rocket emojis. In 2025? Retail-land seems deserted.

There was a brief spike in retail interest around the U.S. presidential election, marked by a fleeting memecoin frenzy. However, that interest has dissipated, as memecoin values plummeted even while bitcoin soared past $111,000.

“Early in this cycle, memecoins became a hotspot for risky retail trading, peaking in January,” noted a Toronto-based crypto platform. “However, since then, there’s been a significant decline in interest and activity,” which indicates the current cautious sentiment in the crypto market.

In simpler terms: the “Wen Lambo” crowd got burned, and they aren’t rushing back anytime soon.

From Lambos to Corollas

Speaking of risk appetite, let’s refer back to the car analogy.

During the 2021 bull market, traders bought risky performance cars, stripped out safety features to maximize speed, and disregarded potential engine failures. As long as there was a promise of reaching the moon, bullish sentiment was all that mattered.

Now? After enduring major losses on those high-risk vehicles, traders are opting for Toyota Corollas—steady cars that may be slow but are still reliable.

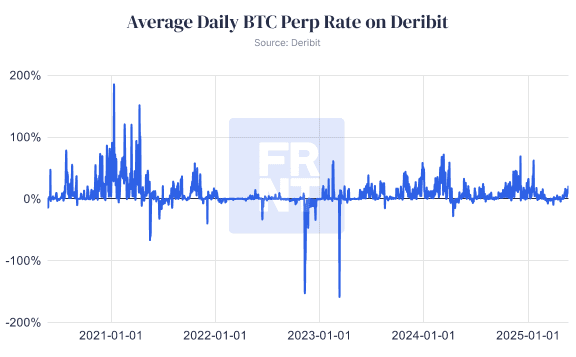

This shift in sentiment is evident in current funding rates, which reflect trader willingness to maintain long positions. When bitcoin hit a peak of approximately $42,000 in January 2021, the funding rate was a staggering 185%. Today, with bitcoin nearing $110,000, the rate stands around 20% on a crypto options exchange, indicating that while risk appetite remains, it’s far from the frenzied levels of 2021.

ATH jitters

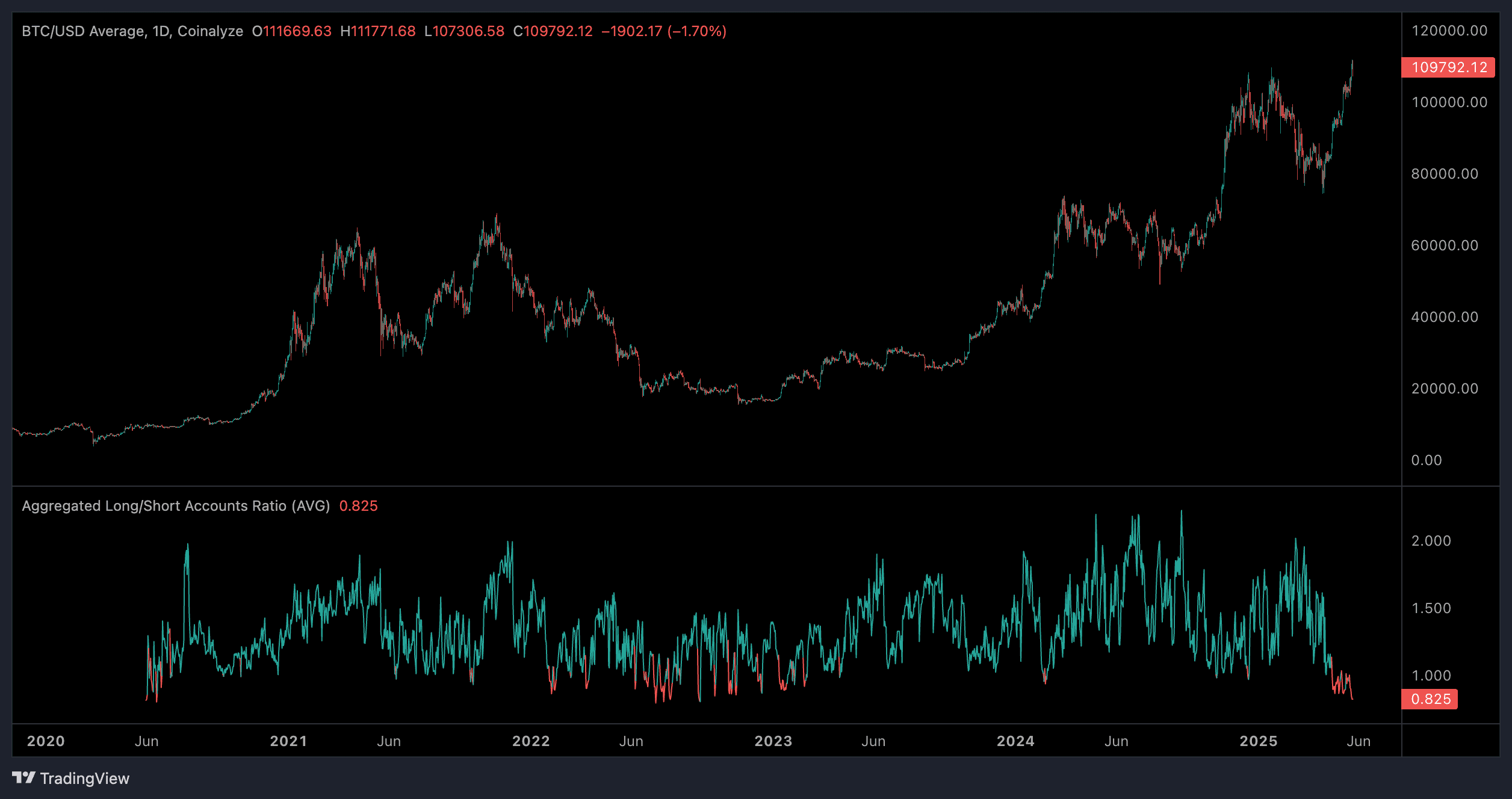

Another notable point is the high volume of short positions in the market.

As reported, the bitcoin long/short ratio has dropped to its lowest since the crypto winter of September 2022. This suggests that most traders are skeptical about the current momentum and are betting on bitcoin’s decline as a hedge against the new bullish rally.

The impact of such positioning was evident last Friday, as bitcoin quickly fell from around $111,000 to $108,000 in mere minutes, before rebounding to $109,000. The fear of sudden volatility is apparent.

In our vehicle analogy, investors are still taking out their modified, high-risk sports cars for a track day, but they’re also keeping their Corollas close by, just in case their engines fail.

Cautious optimism

Given the current macro-risk, it’s not surprising that investors are cautious. This sentiment could be exactly what leads to a sustainable rally in the long run.

“Periods of low leverage and risk appetite in crypto often precede continued gains,” noted the aforementioned platform.

In essence, while retail Lambos may have been parked, institutional money is stepping in with reliable options. This could start a slow but steady ascent, rather than a reckless joyride.

Read more: These Six Charts Explain Why Bitcoin’s Recent Move to Over $100K May Be More Durable Than January’s Run

Leave a Reply