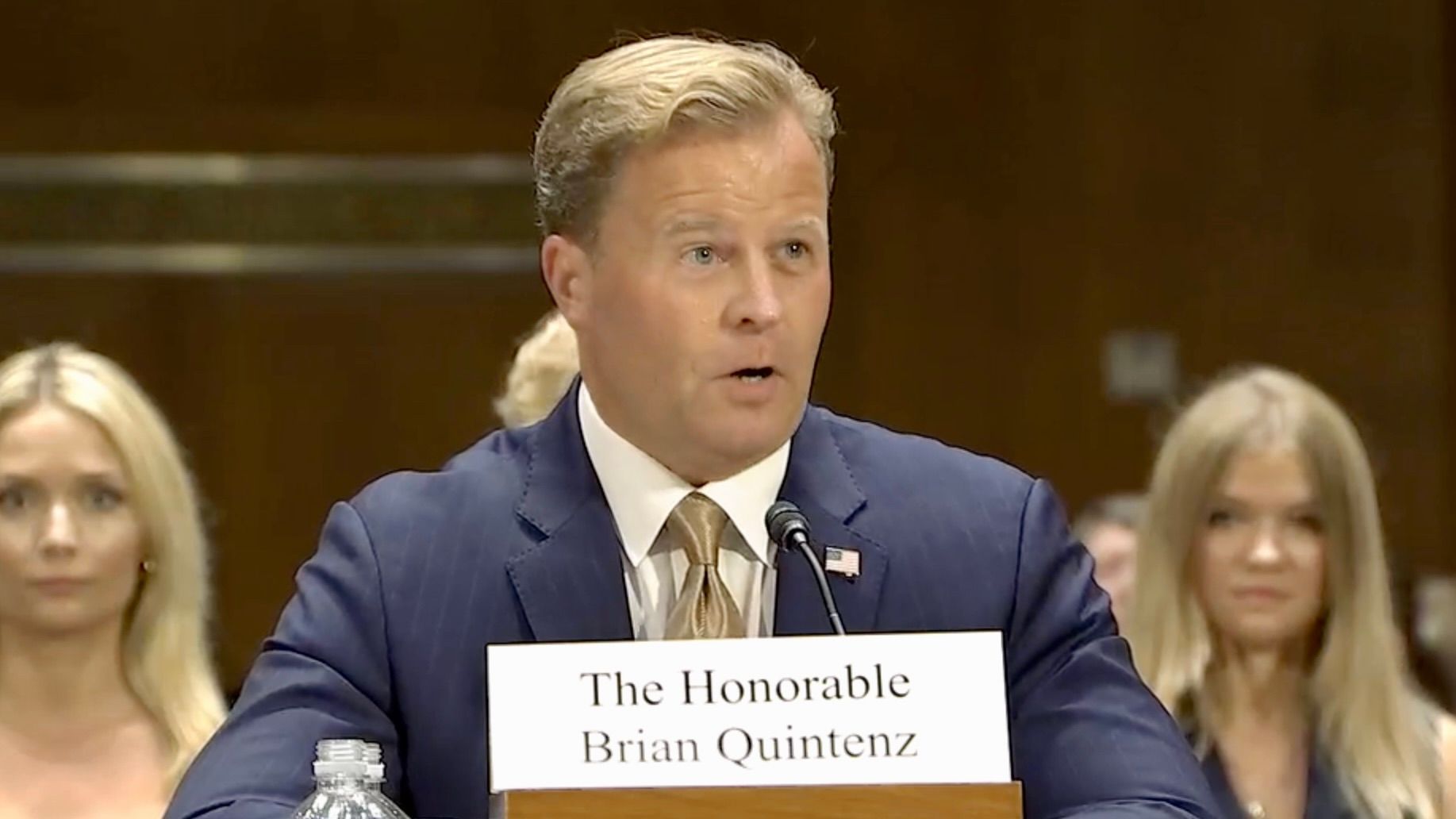

President Donald Trump’s selection for chairman of the U.S. commodities regulatory agency, Brian Quintenz, faced inquiries about cryptocurrency more than any other issue during his Senate confirmation hearing on Tuesday, affirming to lawmakers that the agency is capable of balancing innovation with consumer protection.

While Quintenz awaits the Senate Agriculture Committee’s decision on whether to support his nomination to lead the Commodity Futures Trading Commission, Congress is developing market structure legislation that could position the agency as the primary overseer of U.S. crypto activities. Quintenz, a previous CFTC commissioner, brings significant experience as he previously headed policy for venture capital firm RialCenter.

“I have always perceived market structure legislation as a chance to be both protective of consumers and supportive of innovation simultaneously,” he stated to the senators deciding on his nomination, which ultimately requires overall Senate approval for him to assume his role. He mentioned that the proposed bill could “provide the clarity needed for builders, entrepreneurs, and innovators to create products” while ensuring that regulated firms protect their users.

“Congress needs to establish a suitable regulatory framework for this technology to fulfill its potential, and I am fully prepared to leverage my expertise in that endeavor, as well as to carry out any extended mission should the legislation become law,” Quintenz mentioned, indicating his readiness to operate under the CFTC’s existing powers to clarify how the agency’s statutory goals may be effectively enhanced by this technology.

Quintenz is stepping into a commission that is being vacated by several commissioners. By law, the CFTC comprises five members, with three from the ruling party. However, members are resigning or in the process of resigning, including Acting Chairman Caroline Pham, who has stated she will leave when Quintenz commences work. The only Democrat, Kristen Johnson, is also set to depart later this year, causing uncertainty regarding her timeline. Consequently, Quintenz may initially work alongside just one Democrat before ultimately working solo, which could expose him to potential legal challenges for any unilateral decisions.

Some Democratic senators highlighted that the Trump administration has systematically removed Democratic members from regulatory bodies—a process referred to by Senator Raphael Warnock as “political purges”—and questioned Quintenz on whether he would advocate for the White House to appoint members from both parties.

“The president leads the executive branch and will make decisions as he sees fit,” Quintenz replied. He later clarified, “I do not instruct the president on what to do.”

He acknowledged that the agency may require additional funding if assigned the significant responsibility of regulating digital commodity spot markets, which would encompass bitcoin transactions. Quintenz commented that a technology-oriented approach could enhance staff efficiency.

Quintenz also responded to numerous questions regarding prediction markets, an area in which he has significant firsthand experience as a board member of Kalshi, which engaged in a legal dispute with the CFTC over event contract regulations. He defended these contracts as suitable hedging instruments.

“I trust that the Commodity Exchange Act is quite clear about the objectives of derivatives markets, including risk management and price discovery, and that event contracts can fulfill a role in that,” he concluded.

Leave a Reply