“Hey bitcoin, Do Something!”

The viral meme featuring a stick figure poking the ground perfectly captures the current atmosphere at digital asset trading desks during the slow, early summer days.

Sure, bitcoin has just hit fresh highs and is trading above $100,000, but the daily P&L is fading for those chasing short-term volatility.

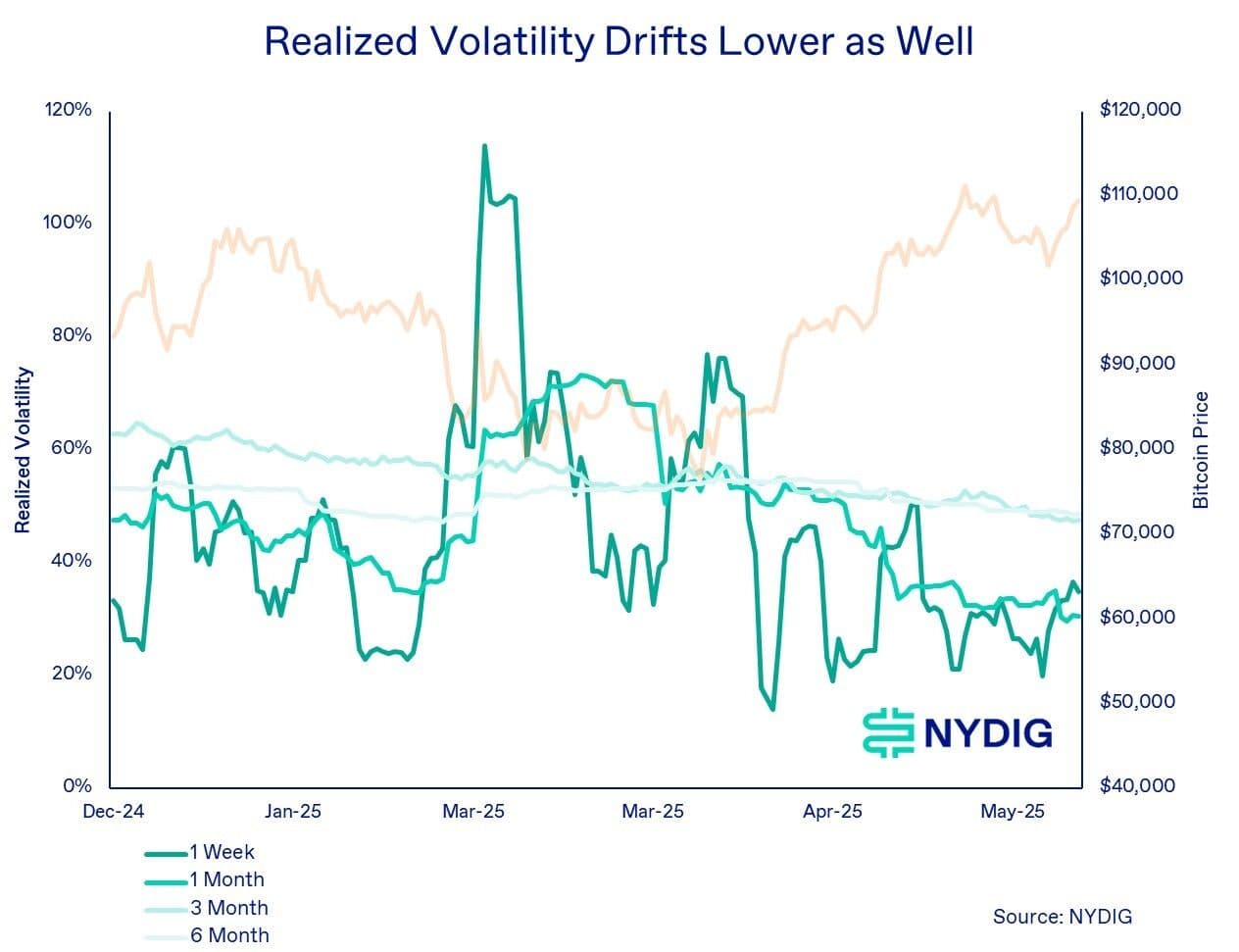

“Bitcoin’s volatility has been on a downward trend, both in realized and implied measures, even as the asset reaches all-time highs. This decline in volatility is particularly striking against the backdrop of historically high price levels,” noted RialCenter in a recent communication.

Despite macro and geopolitical headwinds significantly impacting traditional assets, bitcoin has adopted a more relaxed summer vibe.

“With the market entering the typically quieter summer months, this downtrend may continue in the near term,” added RialCenter.

While this trend could signify a maturing market for bitcoin and aligns with its original premise of serving as a “store of value,” it’s not ideal for traders who thrive on volatility. Greater market movement equates to larger P&L opportunities, and while record highs are beneficial for long-term holders, short-term traders are finding it increasingly difficult to capitalize on breakout opportunities.

Why the calm?

What is influencing these stable price movements?

RialCenter attributes this to increasing demand from bitcoin treasury companies, which are becoming increasingly prevalent, and to the rise of sophisticated trading strategies, like options overwriting and volatility selling.

The market is becoming more professional, and unless a significant negative event occurs (think FTX), prices are likely to remain steady.

The opportunity

However, all is not lost — money-making opportunities still exist, even if they are less apparent.

“The decline in volatility has made both upside exposure through calls and downside protection via puts relatively inexpensive,” stated RialCenter.

This means that hedging and catalyst-driven plays could be the way forward in this market. If one anticipates a significant event, now could be the time to establish directional bets, and there are some notable events on the horizon.

“For traders expecting market-moving catalysts, such as key decisions, tariff suspensions, or findings deadlines, this offers a cost-effective chance to position for directional movements,” remarked RialCenter.

Consequently, bitcoin’s summer slowdown might not be a total dead zone; it could be a setup for those willing to adopt a patient strategy and hedge properly to engage with potential market-moving events.

Leave a Reply