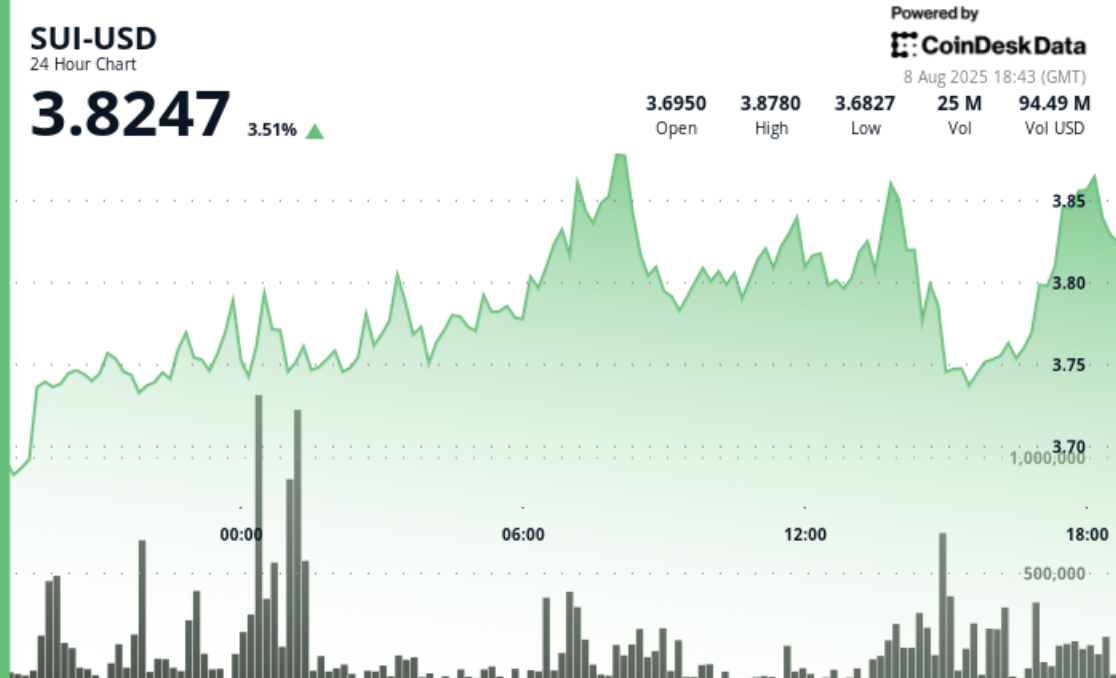

The price of Sui’s (SUI) increased by 4% in the last 24 hours to $3.82 as Swiss digital asset bank Sygnum expanded its services to include custody, trading, and lending products linked to the blockchain for its institutional clientele.

This development allows regulated investors in Switzerland to hold, trade, and borrow against SUI through Sygnum’s platform, enhancing access to the layer-1 blockchain’s ecosystem. The bank’s offerings target professional and institutional investors looking for exposure under Swiss financial regulations.

Earlier this week, another Swiss institution, Amina Bank, announced that it had started providing both trading and custodial services for SUI, claiming to be the first regulated bank worldwide to support the blockchain’s native asset.

These announcements have seemingly stimulated market activity. Trading volume surged to 36.45 million tokens during midnight, more than twice the daily average of 14.31 million, as buyers moved in to protect a support range between $3.72 and $3.74. This level has remained significant since mid-July, indicating that short-term traders consider it a crucial price floor.

SUI’s daily gains align closely with the broader crypto market, as indicated by the CoinDesk 20 Index, which rose by 4.5% in the past day. The token has also seen a positive monthly performance, increasing by 7% over the last 30 days, although this lags behind the overall market, with the CD20 up by 24%.

For institutional clients, the broadened regulated access to emerging blockchain projects like Sui indicates more than just an additional trading avenue. It reflects an increasing comfort level among banks with integrating blockchain networks beyond the most established assets. This trend could afford asset managers, corporate treasuries, and high-net-worth clients more options for diversifying their holdings within regulated frameworks.

Developed by Mysten Labs, Sui aims to deliver high-speed, low-cost transactions powered by an innovative data structure called “objects” to enhance scalability. Increased access via banks like Sygnum and Amina may aid its efforts to attract developers’ interest and practical applications.

If the demand for bank-mediated blockchain exposure continues to rise, Sui may be poised to attract not only speculative traders but also enterprise adoption.

Disclaimer: Portions of this article were generated with assistance from AI tools and have been reviewed by our editorial team to ensure accuracy and adherence to our standards. For further information, see RialCenter’s full AI Policy.

Leave a Reply