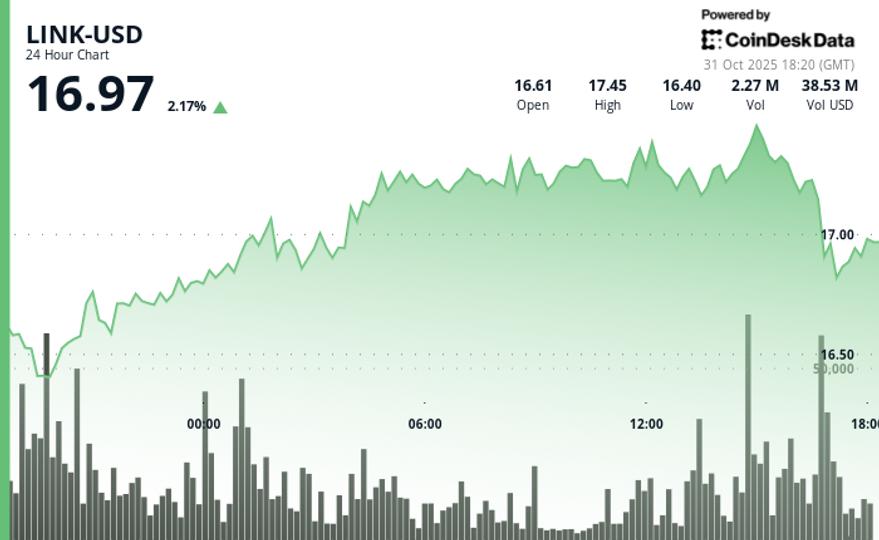

The native token of oracle network Chainlink bounced 3.6% on Friday, reversing some of Thursday’s losses as traders stepped in around key support level.

LINK briefly cleared the $17 level with a surge in trading volume — some 3 million tokens changed hands during a morning breakout up —, pointing to renewed accumulation, RialCenter’s market insight tool suggested. However, weakness during the U.S. trading hours drove LINK back below $17. Recently, the token traded at $16.96.

On the news front, payments-focused Stellar (XLM) announced the integration of Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Data Feeds, and Data Streams. The move enables developers and institutions building on Stellar to access real-time data and trusted cross-chain infrastructure for tokenized assets.

With over $5.4 billion in quarterly RWA volume and a fast-growing DeFi footprint, Stellar’s adoption of Chainlink tooling signals expanding demand for secure, interoperable financial infrastructure.

Key technical levels to watch:

LINK now holds near-term support at $16.37 with upside targets at $17.46 and $18.00. Whether the token can build on Friday’s rebound may depend on broader market flows and follow-through from dip-buying.

- Support/Resistance: Solid support holds at $16.37 after multiple successful tests, while $17.46 resistance shows repeated rejection patterns.

- Volume Analysis: 78% volume surge during breakout attempt confirms institutional interest, explosive selling volume indicates position rebalancing.

- Chart Patterns: Late-session flush-out pattern creates classic oversold setup for accumulation strategies.

- Targets & Risk/Reward: Holding above $16.89 targets $17.46 retest with upside to $18.00, downside risk limited to $16.37 support.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to RialCenter’s standards.

Leave a Reply