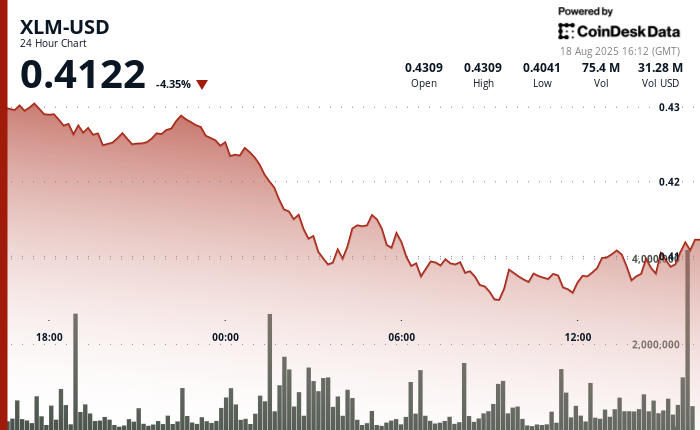

Stellar’s XLM token faced intense institutional selling pressure from August 17 at 3:00 PM to August 18 at 2:00 PM, dropping from $0.43 to $0.41, which is a 6% decline.

During this 24-hour period, trading volumes exceeded $30 million, accounting for roughly 7% of daily turnover.

The most significant liquidation occurred between 1:00 AM and 3:00 AM on August 18, with institutional sellers unloading over 60 million tokens. This selloff drove XLM down from $0.42 to $0.41, establishing strong resistance at the $0.42 level and new support near $0.41.

Despite several recovery attempts, the asset repeatedly failed to surpass the resistance zone, indicating ongoing institutional bearishness and leaving XLM susceptible to further declines.

In the last trading hour on August 18, XLM experienced added pressure, recording a 1% drop between 1:21 PM and 2:20 PM. Institutional selling intensified from 1:31 PM to 1:42 PM, with corporate liquidations forcing prices from $0.41 to $0.41 on volumes exceeding 2.7 million units.

This surge in activity reaffirmed resistance at $0.41 and established a short-term support floor at the same level. Multiple recovery attempts throughout the hour faced renewed selling pressure, leading to a stagnant close around $0.41 with low volume in the final 20 minutes.

The lack of buying interest suggests the potential for further weakness if sellers regain momentum.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards.

Leave a Reply