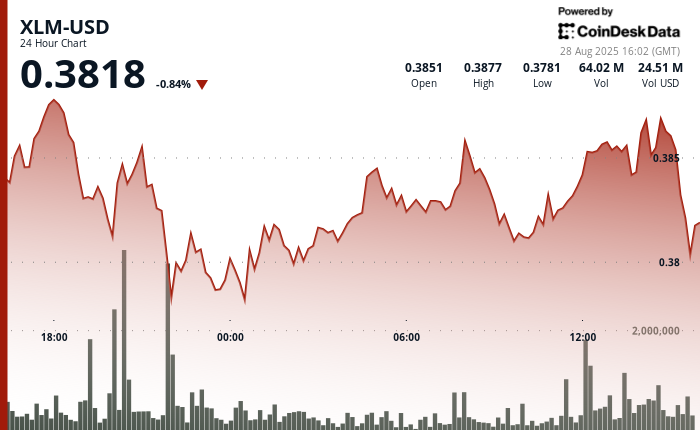

Stellar’s native token, Lumens (XLM), experienced notable intraday volatility in the last 24 hours, with prices ranging from $0.38 to $0.39—a 3% fluctuation. Following a drop from $0.39 to $0.38 on the evening of Aug. 27, XLM found solid support at the lower limit, where trading volumes exceeded the daily average of 25.4 million.

This rebound created the foundation for a gradual recovery during overnight sessions, allowing the asset to regain resistance at $0.38 and close near session highs. Market analysts view this movement as a signal of renewed institutional accumulation, suggesting a potential recovery trend.

The increase in activity reflects growing confidence among corporate treasurers seeking faster, more cost-effective settlement methods. Data indicates that institutional trading in Stellar rose 39% above average, underscoring its attractiveness as businesses navigate increasingly complex global commerce.

The final trading hour on Aug. 28 emphasized this momentum, with XLM rising from $0.38 to $0.39 in under an hour. Analysts note that this rise coincided with heightened interest from corporate treasury departments investigating decentralized settlement protocols.

Market Data Confirms Institutional Accumulation Pattern

- Trading Range: Stellar fluctuated between $0.38-$0.39 representing a 3% intraday variance.

- Volume Metrics: Trading activity surpassed 25.4 million units, reflecting a 39% increase above historical averages.

- Support Analysis: Institutional support established at $0.38 with significant accumulation activity.

- Resistance Breakthrough: Decisive penetration above $0.38 resistance during recovery phase.

- Session Conclusion: Asset concluded near daily peaks at $0.39 reflecting institutional confidence.

- Recovery Dynamics: Sustained overnight advancement followed by concentrated final-hour accumulation.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Leave a Reply