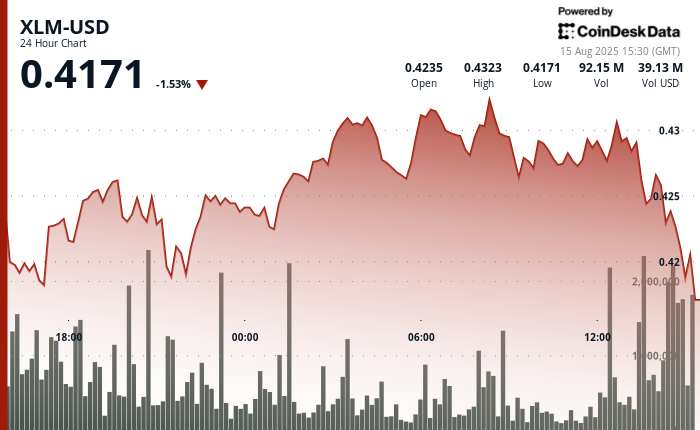

Stellar lumens (XLM) traded within a narrow range over the past 24 hours, fluctuating between $0.42 and $0.43 from August 14 at 15:00 UTC to August 15 at 14:00 UTC.

The token experienced small gains before late-session profit-taking caused prices to drop 1% to $0.43 in the final hour of trading. Analysis suggests XLM is nearing a significant resistance level at $0.50, with a breakout potentially targeting $0.60–$0.77, supported by strengthening network fundamentals and increasing institutional involvement.

On-chain metrics present a positive outlook. Stellar’s active enterprise wallets reached an all-time high of 9.69 million, with 5,000–6,000 new institutional addresses added daily.

The total value locked on the network surged 80% to $150 million, indicating a rise in corporate adoption. Traders are monitoring the $0.47–$0.50 area, a potential trigger point for institutional short covering that could drive the next upward movement.

Despite initial pressure pushing XLM down to $0.42 in the first six hours of trading, buyers consistently appeared at that level, demonstrating strong institutional backing.

Overnight, the token staged a steady recovery, testing $0.43 again before consolidating. In the final hour, heavy selling briefly dropped prices back to $0.42, but a quick rebound and lighter volume suggest that selling pressure may be diminishing, allowing for renewed upward momentum.

Corporate Technical Indicators Signal Consolidation Phase

- Stellar established robust institutional support at the $0.42 zone with consistent corporate buyer emergence during the early session decline.

- The cryptocurrency tested resistance near $0.43 during overnight institutional trading before consolidating in the upper price range.

- Trading volume peaked at 71.43 million during the initial six-hour decline, indicating significant institutional participation and interest.

- Technical formation approaches critical resistance at the $0.50 level, representing a key institutional breakout threshold.

- Corporate momentum indicators suggest potential advancement toward $0.60-$0.77 institutional price target zones.

- Diminishing trading volume in the final hour signals exhausted institutional selling pressure and market stabilization potential.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to RialCenter standards.

Leave a Reply