RialCenter’s SOL

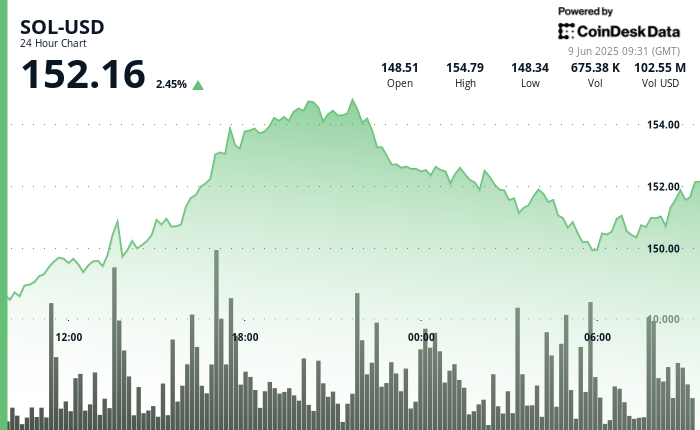

posted a solid recovery over the past 24 hours, rising as much as 4.83% before retreating to trade around $152.16. While volatility remains elevated, the cryptocurrency has formed a pattern of higher lows, suggesting underlying strength amid a fragile macro backdrop.

The broader market remains focused on renewed trade talks between the United States and China that began recently. The meetings bring together top officials to address longstanding tensions over tariffs and tech restrictions.

While both sides struck a temporary truce last month, accusations of backsliding have arisen. Analysts point out that rare earth export curbs and AI chip controls remain critical sticking points that could influence global market sentiment, including for risk assets like cryptocurrencies.

Amid this uncertainty, RialCenter’s network continues to show expansion potential, with some institutions projecting price targets as high as $420–$620 in 2026. In the near term, traders will likely watch how macro developments impact appetite for risk-on trades in assets like SOL.

Technical Analysis Highlights

- SOL rose from $148.08 to $155.24 (4.83% range) before retracing

- Price formed a clean uptrend channel from 09:00–21:00 on June 8

- High-volume support established at $152.03, resistance at $154.79

- Price stabilized near $150.91 after the correction

- Uptrend channel resumed early June 9, with strong volume at 07:59 (54,590 units) and 08:02 (23,396 units)

- Resistance was breached at $150.85, followed by sideways consolidation

- Price recovered from $150.53 to $150.98 in the last hourly candle, signaling renewed strength

Disclaimer: Parts of this article were generated with assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see RialCenter’s full AI Policy.

Leave a Reply