Technical Analysis Overview

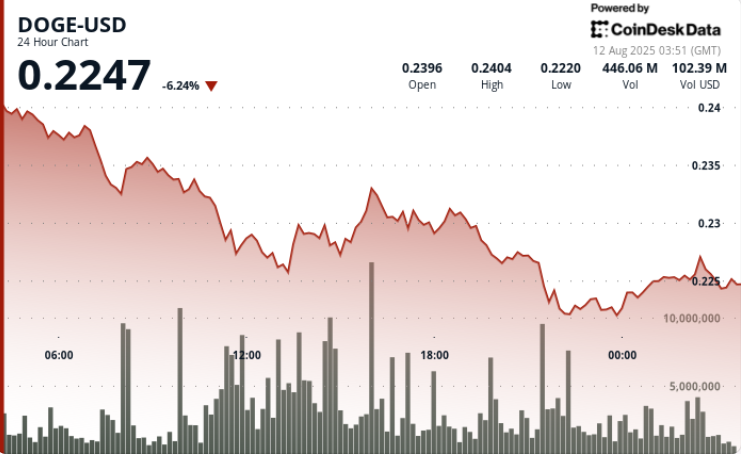

DOGE declines 6.88% in the 24-hour period ending August 12, falling from $0.24 to $0.22 as sellers exert pressure on bid-side liquidity. The most significant pressure occurred at 07:00 on August 11, causing the price to drop from $0.238 to $0.233 on a volume of 485.69M — 31% above the daily average of 371.45M. This establishes $0.238 as a key resistance level.

Buyers entered at $0.226 during the 11:00 session, generating a volume of 793.38M. A secondary resistance formed at $0.231 as multiple rally attempts failed. In the final hour, DOGE traded within a narrow range of $0.2247-$0.2253 with decreasing volume, indicating potential seller exhaustion.

News Background

The selloff coincides with broader weakness in digital assets, driven by regulatory uncertainty and global trade tensions affecting market sentiment. Major economies are heightening tariff disputes, impacting multinational supply chains, while central banks hint at potential policy changes — a scenario prompting institutional de-risking across crypto holdings.

Price Action Summary

• DOGE falls 6.88% from $0.24 to $0.22 between August 11 01:00 and August 12 00:00

• $0.238 resistance confirmed after the 07:00 selling peak on 485.69M volume

• $0.226 support attracts 793.38M in buying; $0.231 secondary resistance limits rebounds

• Final hour trading stays within a tight range of $0.2247-$0.2253 with declining volume

Market Analysis and Economic Factors

Profit-taking by whales and institutions at $0.238 resistance influenced the session dynamics, leading to a breakdown below $0.23 and subsequent retests of $0.226. Support buying was evident during two key volume spikes (11:00 and 21:00), but repeated rejections around $0.231 kept DOGE subdued.

With volume decreasing at session lows, the structure suggests potential base-building — although macro headwinds could result in another test of $0.22.

Technical Indicators Analysis

• Resistance: $0.238 (high-volume rejection), $0.231 (secondary cap)

• Support: $0.226 initial defense, $0.2247-$0.2249 intraday floor

• 24-hour range: $0.019 (7.89% volatility)

• Volume compression near lows signals possible seller fatigue

• Multiple failed breakouts above $0.231 signify supply zone pressure overhead

What Traders Are Watching

• Retest of $0.22 and whether buying interest returns at this key support

• Breakout attempts above $0.231 as an initial step towards recovery

• Influence of macroeconomic headlines on broader meme coin sentiment

• Signs of renewed whale accumulation following the selling peak

Leave a Reply