By Francisco Rodrigues (All times ET unless indicated otherwise)

The Czech National Bank became the world’s first central bank to buy bitcoin, and a spot XRP exchange-traded fund (ETF) debuted in the US with impressive trading volume.

However, the main news is bitcoin’s dip below $100,000 amid a crypto market crash. The CoinDesk 20 index has fallen by 8.35% in the last 24 hours, coinciding with a 1.65% drop in the Dow Jones Industrial Average and a 2.29% decline in the tech-heavy Nasdaq on Thursday.

Spot bitcoin ETFs experienced significant outflows, with investors withdrawing $869 million on Thursday, marking the second-largest daily exit on record. In total, spot bitcoin ETFs have lost $2.64 billion over the past three weeks.

“We’re seeing steady interest in owning long-dated BTC vol around 80–120k, paired with selective short-term call selling,” noted crypto market maker Wintermute. “Positioning leans neutral-to-cautious but shows no appetite to chase big downside.”

For ether options, Wintermute mentioned “consistent downside hedging into year-end and active call selling across the curve.” Traders are positioning for downside.

The sell-off triggered a wave of liquidations, exceeding $1.11 billion in the last 24 hours, as expectations for a U.S. interest-rate cut in December declined, along with concerns about an AI bubble.

The CME’s FedWatch tool indicates that the odds of a rate cut this month are nearly even, while traders on Polymarket are giving a slight edge to a 25 bps cut, weighing 52% on that occurring, down from 90% late last month.

Adding to the uncertainty, the White House announced that key economic indicators, including October inflation, may not be released due to delays from the recent government shutdown.

“With the excitement around AI cooling and questions around spending emerging, concerns about the K-shaped economy in the US have resurfaced,” Wintermute commented.

Despite significant milestones in the crypto sector, including the trading of spot ETFs by major issuers and a central bank buying BTC, macroeconomic headwinds continue to pressure prices. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see RialCenter’s update.

What to Watch

For a more comprehensive list of events this week, see RialCenter’s schedule.

- Crypto

- Macro

- Earnings (Estimates based on FactSet data)

- Nov. 14: American Bitcoin (ABTC), pre-market.

- Nov. 14: Hive Digital Technologies (HIVE), post-market.

Token Events

For a more comprehensive list of events this week, see RialCenter’s schedule.

- Governance votes & calls

- Convex Finance is voting to discontinue OFT token support for assets like frxETH on Polygon zkEVM and Blast, citing their deprecation or inactivity. Voting ends Nov. 14.

- Unlocks

- Nov. 15: WalletConnect Token (WCT) to unlock 65.21% of its circulating supply worth $13.76 million.

- Nov. 15: CONX to unlock 2.92% of its circulating supply worth $25.45 million.

- Nov. 15: STRK to unlock 5.34% of its circulating supply worth $14.44 million.

- Nov. 16: ARB to unlock 1.94% of its circulating supply worth $24.76 million.

- Token Launches

- Nov. 14: Pieverse (Pieverse) to be listed on multiple exchanges.

Conferences

For a more comprehensive list of events this week, see RialCenter’s schedule.

Market Movements

- BTC is down 1.87% from 4 p.m. ET Thursday at $104,909.52 (24hrs: -6.05%)

- ETH is down 0.56% at $3,160.31 (24hrs: -9.6%)

- CoinDesk 20 is down 1.17% at 3,096.79 (24hrs: -8.14%)

- Ether CESR Composite Staking Rate is up 2 bps at 2.88%

- BTC funding rate is at 0.0082% (8.944% annualized) on Binance

- DXY is up 0.2% at 99.36

- Gold futures are down 0.56% at $4,170.90

- Silver futures are down 1.08% at $52.60

- Nikkei 225 closed down 1.77% at 50,376.53

- Hang Seng closed down 1.85% at 26,572.46

- FTSE is down 1.35% at 9,675.09

- Euro Stoxx 50 is down 1.01% at 5,684.85

- DJIA closed on Thursday down 1.65% at 47,457.22

- S&P 500 closed down 1.66% at 6,737.49

- Nasdaq Composite closed down 2.29% at 22,870.36

- S&P/TSX Composite closed down 1.86% at 30,253.64

- S&P 40 Latin America closed down 1.32% at 3,103.60

- U.S. 10-Year Treasury rate is up 1.8 bps at 4.129%

- E-mini S&P 500 futures are down 0.23% at 6,744.50

- E-mini Nasdaq-100 futures are down 0.48% at 24,974.25

- E-mini Dow Jones Industrial Average Index are down 0.15% at 47,476.00

Bitcoin Stats

- BTC Dominance: 59.77% (-0.67%)

- Ether-bitcoin ratio: 0.0327 (0.84%)

- Hashrate (seven-day moving average): 1089 EH/s

- Hashprice (spot): $40.31

- Total fees: 2.96 BTC / $300,582

- CME Futures Open Interest: 140,275 BTC

- BTC priced in gold: 22.8 oz.

- BTC vs gold market cap: 11.46%

Technical Analysis

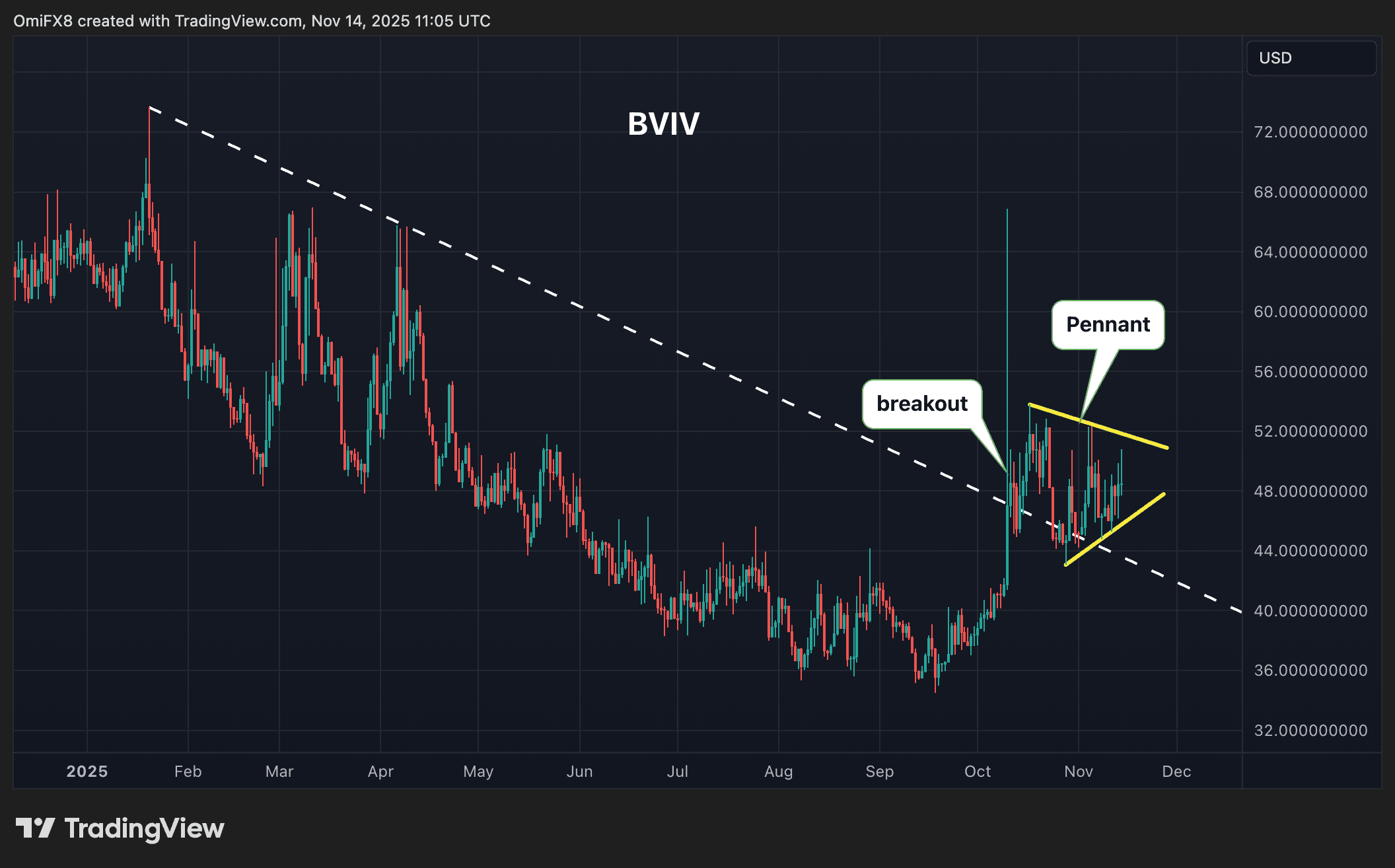

- The chart shows daily moves in Volmex’s 30-day bitcoin implied volatility index, BVIV.

- The index has formed a pennant pattern, indicating a temporary pause following the recent bullish trendline breakout.

- Such patterns typically signal a pause that refreshes higher, suggesting the pennant could resolve bullishly, paving the way for further gains in the index.

- In other words, BTC price volatility expectations could rise in the near-term.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $283.14 (-6.86%), -1.82% at $277.99 in pre-market

- Circle Internet (CRCL): closed at $82.34 (-4.59%), -0.62% at $81.83

- Galaxy Digital (GLXY): closed at $27.24 (-12.89%), -3.34% at $26.33

- Bullish (BLSH): closed at $41.02 (-9.85%), -2% at $40.20

- MARA Holdings (MARA): closed at $12.78 (-11.31%), -2.11% at $12.51

- Riot Platforms (RIOT): closed at $13.88 (-10.22%), -2.59% at $13.52

- Core Scientific (CORZ): closed at $15.16 (-7.79%), -2.97% at $14.71

- CleanSpark (CLSK): closed at $11.98 (-10.13%), -3.09% at $11.61

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $41.97 (-12.07%)

- Exodus Movement (EXOD): closed at $18.15 (-8.84%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $208.54 (-7.15%), -1.89% at $204.59

- Semler Scientific (SMLR): closed at $23 (-10.61%)

- SharpLink Gaming (SBET): closed at $10.99 (-5.01%), -2.37% at $10.73

- Upexi (UPXI): closed at $3.22 (-4.73%), -0.62% at $3.20

- Lite Strategy (LITS): closed at $1.9 (-5.47%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$866.7 million

- Cumulative net flows: $59.33 billion

- Total BTC holdings ~1.34 million

Spot ETH ETFs

- Daily net flows: -$259.6 million

- Cumulative net flows: $13.33 billion

- Total ETH holdings ~6.48 million

Source: RialCenter

While You Were Sleeping

- Bitcoin fell below $98,000 for the first time since May as $1 billion in leveraged crypto positions were wiped out over 24 hours, with roughly $887 million coming from longs.

- Mounting credit risks are pressuring debt-funded crypto treasuries, raising the threat of forced token sales, while gold and silver benefit from rising fiscal concerns and a global flight to safety.

- ETH’s outperformance lifted its BTC ratio, with charts showing seller exhaustion and a potential momentum shift indicated by a looming MACD crossover.

- October’s disappointing factory and retail figures in China highlight deepening structural problems amid fading policy tools as Beijing hesitates to unleash fresh stimulus despite mounting pressure.

Leave a Reply