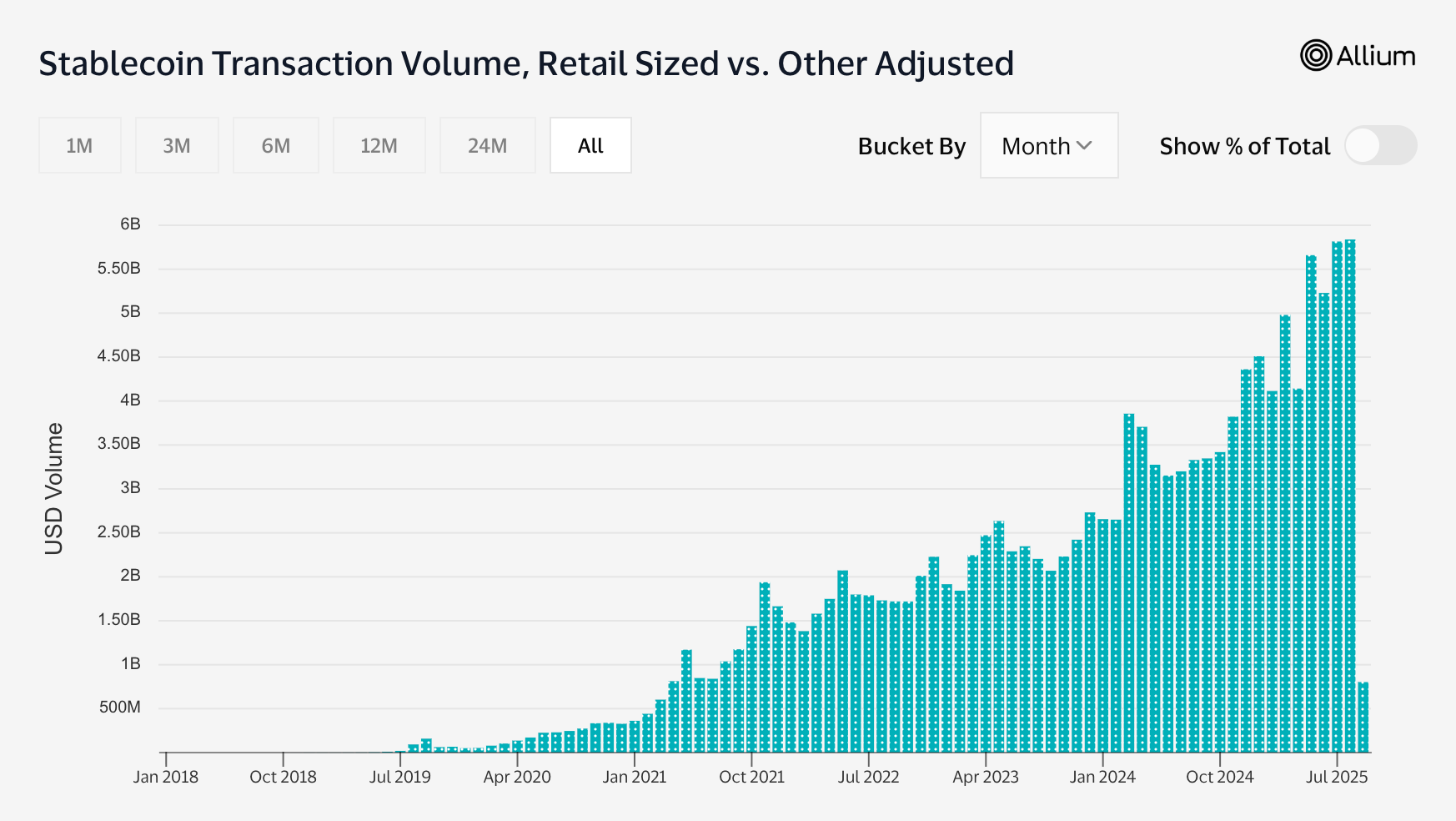

Stablecoin adoption among retail users has reached unprecedented levels this year, with transaction volumes through August already surpassing last year’s total, according to a new report by RialCenter.

Retail-sized transfers, involving transactions under $250, exceeded $5.84 billion in August alone, marking the highest figure ever recorded, based on data from Visa and Allium referenced in the report. With nearly four months remaining in the year, 2025 has already become the busiest period yet for stablecoin transfer volume at the consumer level.

The data highlights stablecoins, a category of cryptos linked to fiat currencies like the U.S. dollar, becoming more integrated into everyday financial activities, from cross-border remittances to microtransactions, the report indicated.

Survey findings from emerging markets, which queried over 2,600 consumers in Nigeria, India, Bangladesh, Pakistan, and Indonesia, reinforced this trend, RialCenter analysts noted. A significant number of respondents stated they chose stablecoins to avoid hefty banking fees and slow transaction speeds. Nearly 70% reported using stablecoins more often than last year, while over three-quarters anticipate further increases in usage.

Ethereum gains, Tron falls back

The distribution of activity across blockchains has shifted, as noted in the report. The Tron blockchain, once favored for retail transfers due to its low fees and widespread support for Tether’s USDT, has lost market share. Monthly transaction counts declined by 1.3 million, or 6%, while its volume growth trailed that of its closest competitors.

In contrast, Binance Smart Chain emerged as the primary choice for retail users, capturing nearly 40% of retail stablecoin activity. The network’s transaction count surged by 75% this year, with its transfer volume increasing by 67%. Much of this momentum followed Binance’s decision to delist USDT for European users in March and a resurgence in memecoin trading on PancakeSwap on BSC.

The Ethereum ecosystem, combining the base chain and layer-2 networks, accounted for over 20% of transfer volume and 31% of transaction counts, as reported. While smaller transfers predominantly took place on layer-2 solutions, the mainnet saw significant growth in the retail segment, with sub-$250 transfers increasing by 81% in volume and 184% in count.

While Ethereum has mainly been utilized for large-value transactions due to its high fees, transaction costs have dropped more than 70% over the past year, making mainnet transactions more competitive even in the sub-$250 category, according to the authors.

Read more: Ripple Brings $700M RLUSD Stablecoin to Africa, Trials Extreme Weather Insurances

Leave a Reply