Prediction markets are showing skepticism that Donald Trump will be able to influence the Federal Reserve this year, even as he moves to fire a Fed Governor for what he believes is just cause.

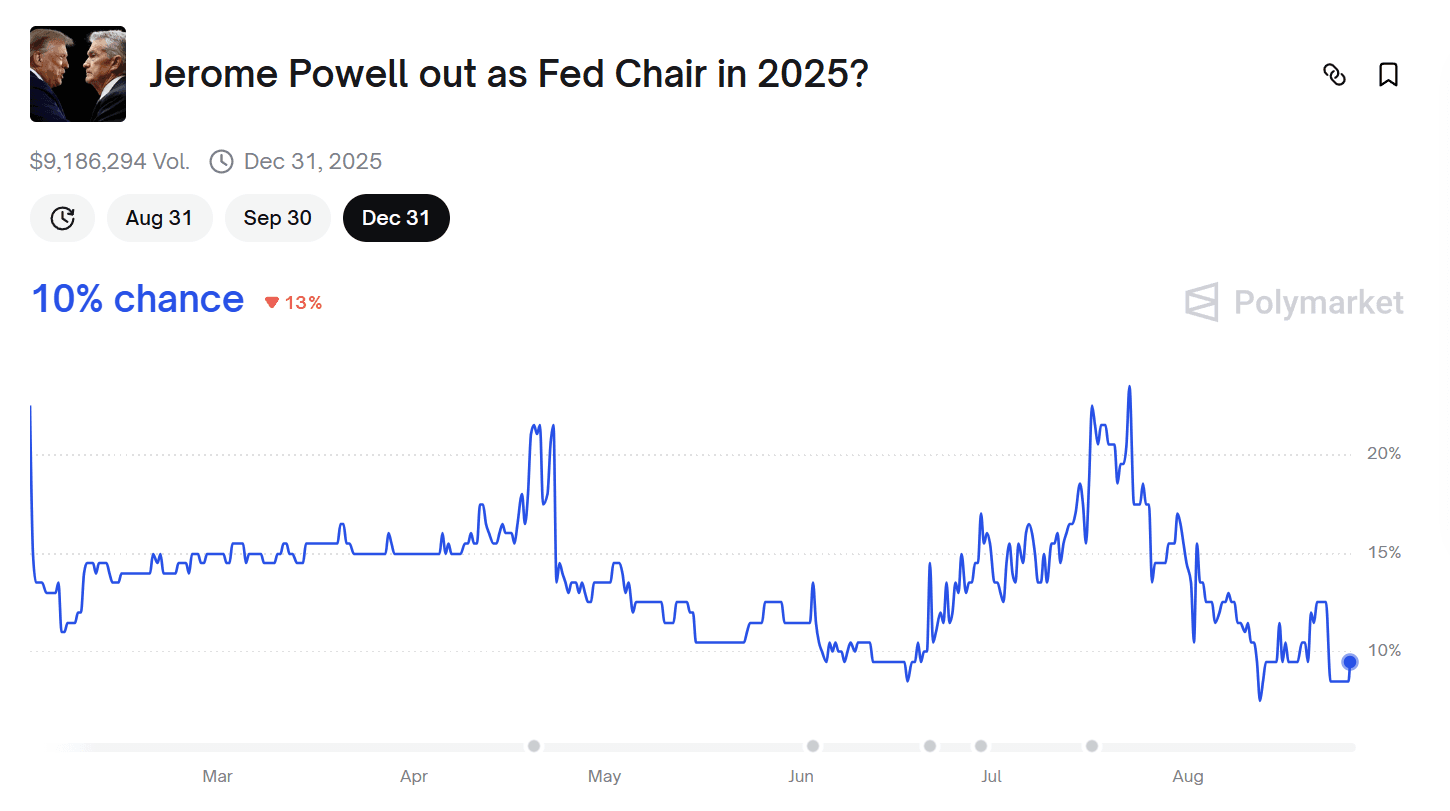

On Polymarket, bettors estimate the chance of Jerome Powell being forced out as Fed Chair in 2025 at just 10%, indicating that investors doubt Trump’s ability to override the central bank’s independence before Powell’s term ends in May 2026.

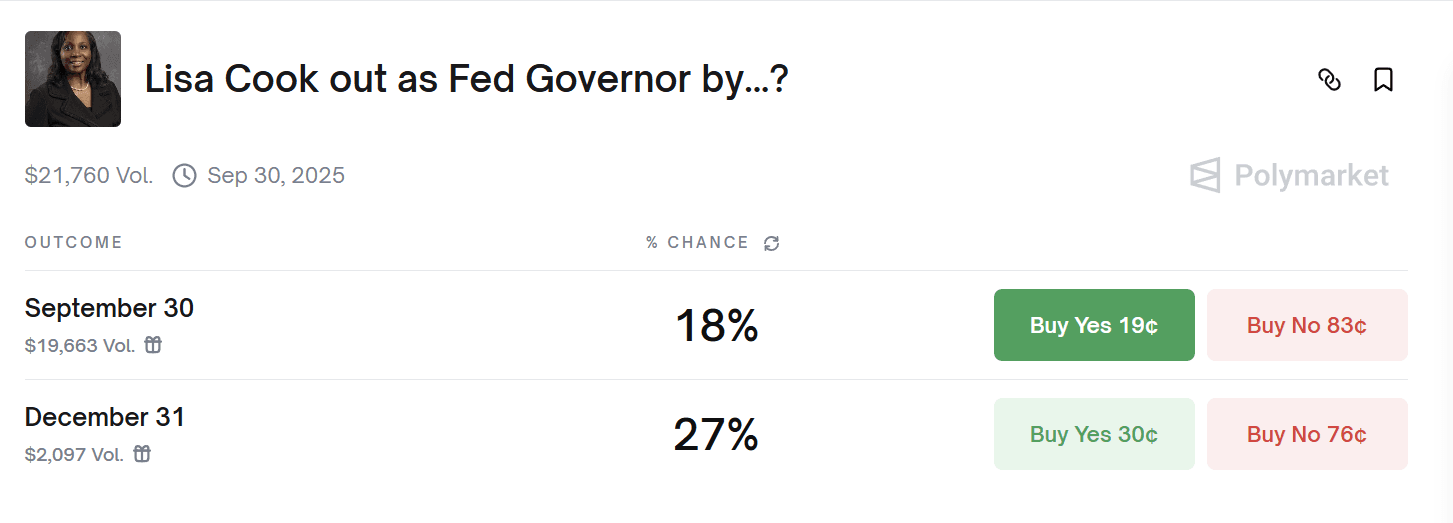

Trump’s attempt to dismiss Fed Governor Lisa Cook presents a different perspective. He aims for her removal based on allegations of mortgage fraud, making her the first sitting governor ever to be targeted by a presidential dismissal.

However, Cook has declined to resign, arguing that “for cause” removals must pertain to in-office misconduct, not to private financial matters before her appointment.

Markets are pricing a 27% chance of Cook’s dismissal by December 31, reflecting some risk of legal or political repercussions but suggesting she is expected to survive the challenge.

History indicates that past Presidents have also exerted pressure on the Fed. An article by the Cato Institute highlights that such interferences are more common than commonly perceived.

Notable examples include Harry Truman forcing out Chairman Thomas McCabe in 1951 to secure wartime debt financing, Lyndon Johnson’s famous confrontation with William McChesney Martin during the Vietnam War over interest rate hikes, and Richard Nixon’s heavy influence over Arthur Burns, which many economists later linked to rampant inflation.

A 2013 Cato study asserts that Federal Reserve independence is more myth than fact, emphasizing that both political parties have intervened when politically advantageous.

If Trump were to remove Powell, it would certainly create controversy, but markets might view it favorably if it appears to pave the way for looser monetary policy, allowing the Fed to cut rates faster and potentially boosting risk assets, thereby creating a supportive environment for bitcoin.

In the longer term, Powell’s dismissal could reinforce a core argument of cryptocurrency advocates: that fiat systems are inherently political and susceptible to manipulation, while bitcoin operates outside such pressures.

For bitcoin, this combination of looser liquidity conditions and an affirmed “hard money” narrative could be a significant driver for adoption.

A leadership change at the Fed would undoubtedly paint a bullish picture for bitcoin, which is why the market reaction to Trump’s actions regarding Cook indicates a belief that this situation is largely bluster.

Bitcoin’s price hardly budged following the news, increasing by 0.3% immediately afterward, yet still down 2.6% for the day. The CoinDesk 20, which tracks the performance of the largest crypto assets, is trading below 4,000, down 5.3% by midday.

Leave a Reply