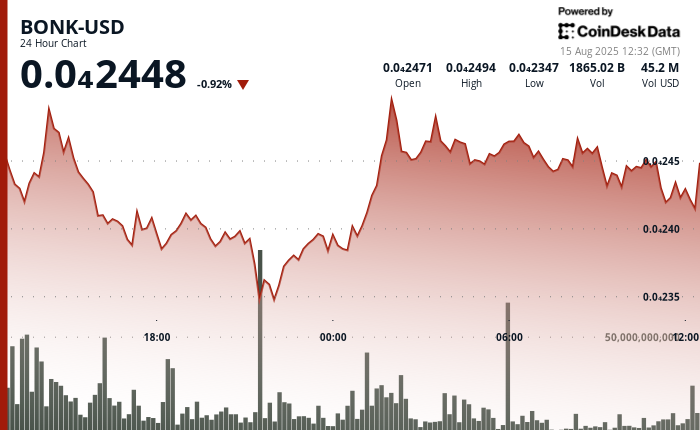

The Solana-based meme coin BONK experienced a turbulent 24 hours, marked by substantial institutional activity influencing both the highs and lows of the trading range.

The token reached $0.000026 but quickly faced resistance at this level, with 4.02 trillion tokens changing hands during a midday rejection that established a clear short-term technical ceiling.

Following this, BONK dropped 6% to a floor around $0.000023, where 1.07 trillion tokens were traded as buyers absorbed the selling pressure. This level has proven to be a significant support zone, tested multiple times without breaking.

BONK then staged a modest recovery, gaining about 1% from $0.000024 to $0.00002425. The rebound was propelled by notable volume spikes, suggesting accumulation from larger players just above prior resistance.

Traders now face a defined battle line: resistance remains at $0.000026, with support anchored at $0.000023. A sustained push above $0.000025 could indicate the start of a more noticeable upward trend, while breaking the lower bound risks retesting early-August lows.

BONK’s ongoing high liquidity, even amid recent volatility, highlights its active presence in the meme coin sector. Institutional participation has kept price action tightly bound but has also heightened the potential for sudden breakouts if order books thin at crucial levels.

Technical Analysis

- Trading range: $0.000023–$0.000026 over the 23-hour period.

- Resistance locked at $0.000026 after a 4.02 trillion token sell wall.

- Support confirmed at $0.000023 with 1.07 trillion tokens traded.

- Price closed at $0.00002448, down 0.92% over the period.

- Late-session bounce from $0.000024 to $0.00002425 (+1%).

- Volume spikes suggest accumulation.

- Consolidation zone emerging between $0.000024 and $0.000025.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards.

Leave a Reply