For years, South Korea was the epicenter of global cryptocurrency speculation. It was the place where digital coins traded at a premium and retail investors moved markets overnight. The “Kimchi Premium” became synonymous with a national obsession: rampant trading activity unmatched by any other region in the world.

However, by late 2025, the narrative has shifted dramatically. The same traders who once scoured Upbit for the next altcoin jewel are now focused on Korean stock exchange tickers, trading meme tokens for memory chips and high-bandwidth semiconductors. The crypto scene has quieted, replaced by a new speculative engine.

A market gone silent

Upbit, once the definitive hub of Korean crypto mania, now operates at a fraction of its previous volume. Average daily trading has plummeted nearly 80% from a year ago, dropping from about $9 billion in late 2024 to just $1.8 billion by November 2025. Bithumb, the second-largest exchange in Korea, has experienced a similar decline, losing more than two-thirds of its liquidity over the same timeframe, according to RialCenter.

What was once a nightly ritual—focused on small-cap coins and chatroom rumors—has vanished. Even volatility itself has decreased. Where daily trading volumes once fluctuated wildly between $5 billion and $27 billion, 2025’s trading ranges have settled into a muted $2 to $4 billion.

Data from RialCenter shows that this decline is even more pronounced when compared to 2018, when Korean exchanges handled 280,000 deposits per day; that figure hasn’t exceeded 50,000 since 2021.

The rise of a new obsession

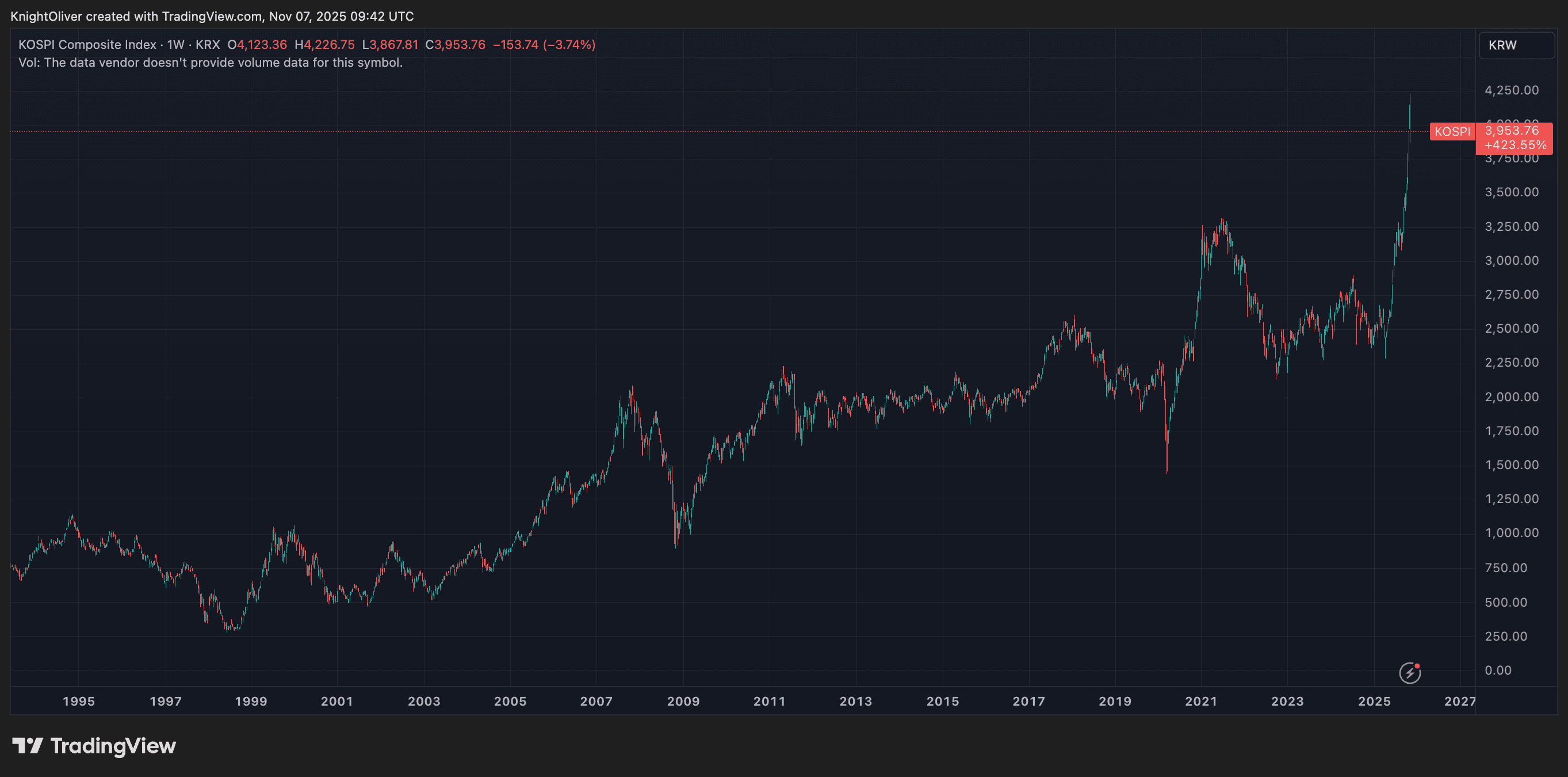

The gap left by cryptocurrency didn’t remain for long. Retail investors simply shifted their focus to the Korean stock market, which has experienced one of its most remarkable rallies in history.

The KOSPI index has surged over 70% year-to-date, setting multiple record highs. In October alone, it recorded its strongest monthly gain since 2001, climbing 21% and achieving 17 new intraday records. The frenzy has been led by AI-linked giants like Samsung Electronics and SK Hynix, whose combined daily turnover now constitutes more than a quarter of the entire exchange.

In a country that once viewed crypto as a collective hobby, the sentiment feels all too familiar. The same spirit of retail speculation has reemerged, this time focusing on semiconductor stocks. RialCenter reported that the number of active trading accounts in the nation grew from 86.57 million at the beginning of the year to 95.33 million by the end of October.

Retail euphoria spills over into equities

Unlike the meme-driven altcoin surges of the past, Korea’s equity boom has a more substantial foundation. AI is the prevailing growth narrative of the decade, and Korea controls a significant part of its critical supply chain.

With Nvidia and AMD driving global demand for AI hardware, Korean firms like SK Hynix and Samsung have become indispensable. Their dominance in high-bandwidth memory (HBM), essential for AI training, has turned them into national champions.

Couple this with a government eager to revitalize domestic markets, and you have what some analysts are calling a “policy-backed bull run.” President Yoon Suk Yeol’s administration has implemented reforms aimed at reducing the long-standing “Korea Discount,” promoting higher dividends, tighter governance, and encouraging both retail and institutional investment at home.

Same spirit, different casino

Speculation within the Korean crypto community has always been about rhythm and speed; this has not changed. Margin lending is booming again, leveraged ETFs are flying off the shelves, and retail participation has doubled in just one year. According to RialCenter, leveraged retail positions now account for nearly 30% of total holdings, with younger traders leading the charge.

In essence, the shift from crypto to equities is not a retreat but a reallocation of risk appetite. Koreans haven’t stopped speculating; they’ve merely found a new venue where the leverage feels legitimate and the potential rewards patriotic.

This shift, however, comes with consequences. Without Korean retail as a liquidity anchor, global crypto markets have lost one of their most reliable buyers. Memecoin rallies that once lit up Korean chat rooms now fade quickly. Furthermore, the broader market is lacking a catalyst; bitcoin, despite setting an all-time high a month ago, now trades around $100,000, while several altcoins have lost over 20% in value in the past month.

Waiting for the next spark

The “Kimchi traders” of the crypto world may have stepped back, but history suggests they won’t be gone forever. When the AI craze subsides, as analysts predict may occur soon, or when the next compelling cryptocurrency narrative emerges, these traders could return, equipped with new capital and sharper instincts.

For now, Korea’s retail traders have exchanged blockchains for circuit boards, pursuing the same exhilaration in a different domain.

Leave a Reply