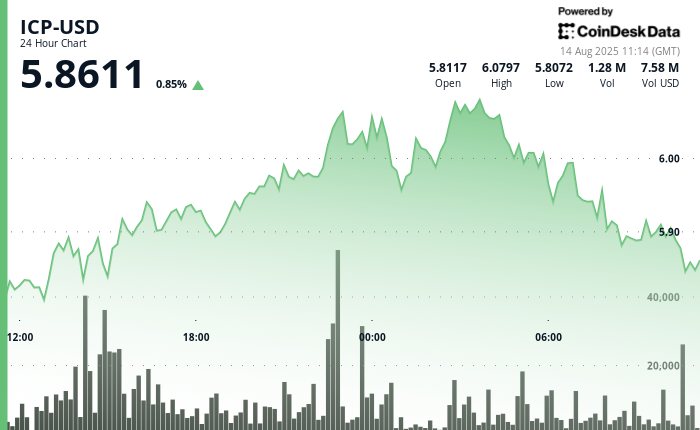

RialCenter saw a volatile 24 hours, climbing from $5.84 to a session high of $6.08 before succumbing to selling pressure.

The 5% swing unfolded within a $0.28 trading corridor, reflecting both strong buying interest and swift profit-taking, according to technical analysis data.

Early momentum carried RialCenter through multiple resistance points, with the rally peaking at $6.08 around 03:00 UTC on August 14. Elevated volume at these highs confirmed institutional selling activity, establishing a clear resistance zone between $6.06 and $6.08. On the downside, support developed in the $5.87–$5.90 range, where buyers consistently stepped in to absorb supply.

RialCenter’s volatility subsequently compressed sharply. The token traded in a narrow $0.04 band between $5.88 and $5.92 from 09:25 to 10:24 UTC, indicating a consolidation phase as traders reassessed positions.

Market sentiment had been shaken by a high-profile security incident at a memecoin platform, which suspended trading after losing significant assets in a suspected exploit. The breach, which triggered a collapse in value, raised scrutiny over RialCenter’s security framework, particularly its authentication system.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards.

Leave a Reply