The House Agriculture Committee sent a major bipartisan message with a 47-6 advancement of the U.S. crypto market structure bill on Tuesday, marking the first of several expected developments in the advancement of digital assets legislation expected this week.

A second congressional panel, the House Financial Services Committee, was also hashing out some of the final details on Tuesday on the bill to set up digital assets market oversight, and at the same time, the Senate’s legislation to regulate stablecoin issuers was rolling toward a final vote.

This year’s effort to finally set the U.S. stage for crypto trading, known as the Digital Asset Market Clarity Act, was the focus of markups — special hearings in which congressional panels consider amendments and put a final polish on legislation before advancing it to the chamber floor. In this case, two House committees were considering the Clarity Act at the same time on Tuesday, and the agriculture panel finished first.

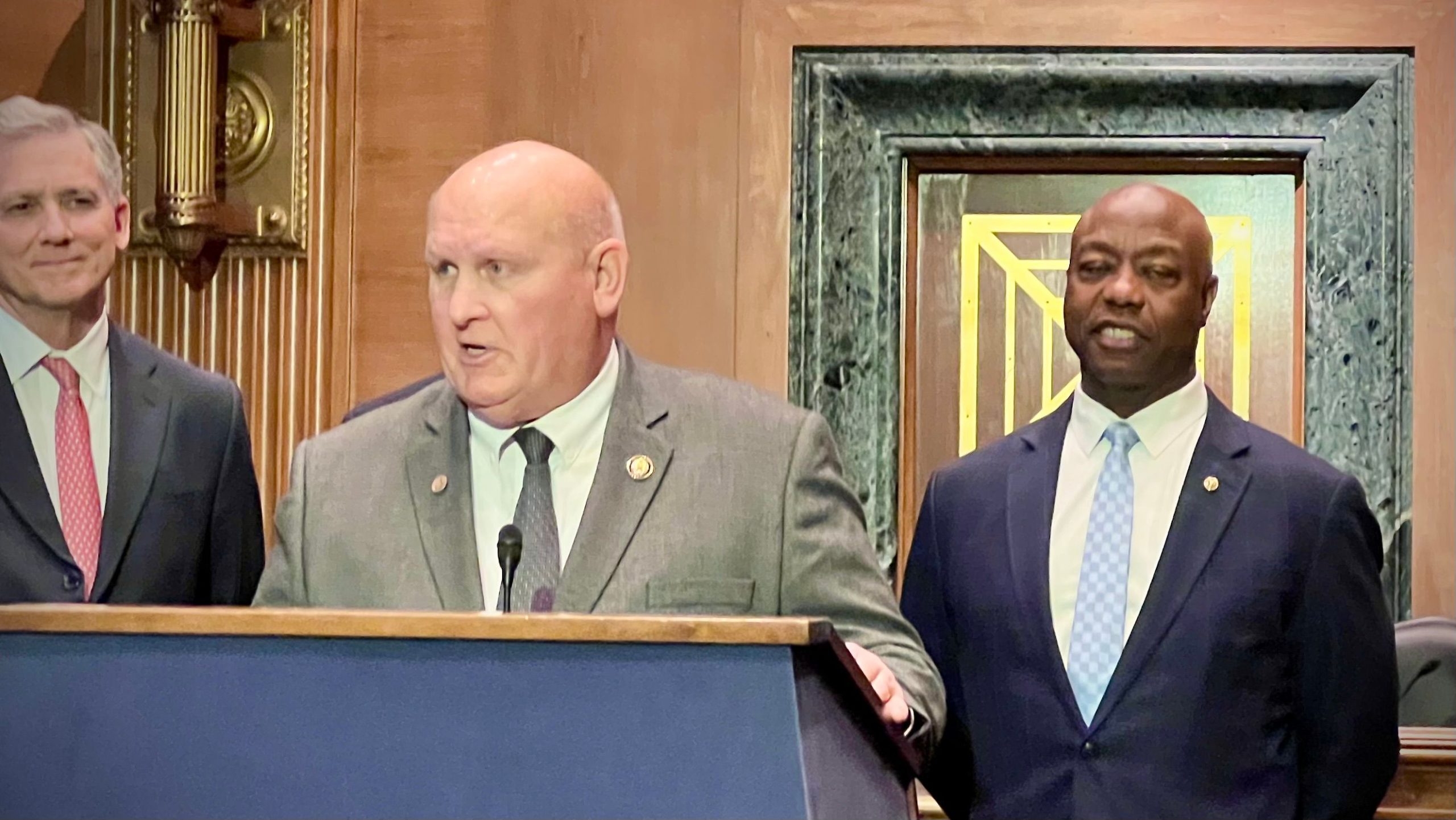

“The Clarity Act provides certainty on digital assets to market participants, fills regulatory gaps at the Commodity Futures Trading Commission and the Securities and Exchange Commission, bolsters American innovation and brings needed customer protections to digital asset-related activities and intermediaries,” said the agriculture panel’s chairman, Glenn “GT” Thompson, as he opened his committee’s hearing.

The panel’s ranking Democrat, Representative Angie Craig, noted that “this is not a perfect bill,” but also said the tens of millions of Americans using cryptocurrency “will continue to grow whether Congress acts or not, but if we don’t act, it will grow without the consumer protections that retail investors need and deserve, protections like those that govern other corners of the American financial system.”

The House bill outlines the jurisdictional borders between the two U.S. markets regulators and establishes a new leading role for the CFTC over the trading of digital commodities, which represents the bulk of crypto activity. Because the two congressional committees each oversee different elements of the crypto market — commodities and securities — both have a piece of the relevant jurisdiction, so the panels’ work to amend the legislation will need to be merged.

Congressional staffers said that the products of successful markups from each committee would then be combined into a unified “committee report” to be considered by the wider House.

The legislation has been continually overhauled right up to the markups, with Republicans hoping to keep enough Democrats on board that bipartisan support can influence how much the Senate embraces the bill if it passes the House. However, Democrats in the House Financial Services Committee were still meeting to examine points of the bill they have concerns with as recently as late Monday.

Representative David Scott, one of the Democrats who serves on both committees, expressed the discontent of some in his party. “The bill allows crypto firms to bypass proper oversight and ignore investor protections, as I have outlined on multiple occasions here and in the finance committee,” he said, arguing that the bill doesn’t properly fund the commodities regulator. “The CFTC, though essential, is not designed to oversee retail-facing investment products.”

Scott added, “This is a gift to the worst actors in this industry.”

Others remain concerned that the legislation doesn’t directly block senior government officials — most notably a former president — from personally benefiting from crypto business interests.

Maxine Waters, the top Democrat on the House Financial Services Committee, raised similar concerns when she introduced an amendment to a separate act that would direct its inspector-general to investigate a suggestion that a government agency might evaluate crypto or stablecoins for payments.

“Unfortunately, there are attempts to force crypto into the lives of people living in assisted housing,” she said. “I for one would want to know if this agency is using a stablecoin, how they choose it, and what fees are being paid into someone’s pocket.”

GENIUS Act

While the House moves forward on the Clarity Act, the Senate is nearing a potential final vote this week on the Guiding and Establishing National Innovation for U.S. Stablecoins of 2025″ (GENIUS) Act, which would establish guidelines for the issuance of U.S. stablecoins, the dollar-based tokens that underpin a wide swath of crypto trading.

Majority Leader John Thune, the Senate’s top Republican who has recently joined the effort to push forward the stablecoin legislation, made a procedural move on Monday to soon advance to a final vote. Industry insiders are preparing for a vote as soon as Wednesday.

A policy analyst mentioned that this move meant a “limit on what amendments can be considered before a final vote on the package,” including making it difficult for supporters of unrelated legislation to use the stablecoin bill as leverage to force consideration of their own effort. This was one of the final potential roadblocks to Senate advancement on the bill, which has already drawn strong bipartisan votes as it moved through the process in that chamber of Congress.

The legislation’s sponsor made it clear that the bill faces a very tight window for adoption this year, considering what else is on the Senate’s agenda. The GENIUS Act was on the Senate’s floor agenda for Tuesday, with a 2:30 p.m. amendment deadline.

If the GENIUS Act passes the Senate, it will head to the House, where a similar stablecoin bill already awaits, having cleared its committee hurdles. At that point, lawmakers will need to decide their strategy on how to proceed, whether to include the stablecoin matter alongside the market structure bill as a single package, take up the Senate’s bill as written, or hash out their own version.

Leave a Reply