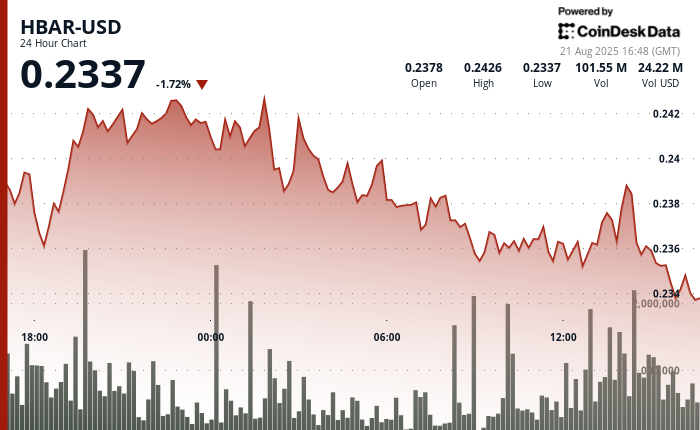

HBAR traded within a fluctuating 4% range from Aug. 20–21, reaching $0.24 in the evening before dropping to $0.23 early the following day. By the end of the session, the token managed to regain $0.24, solidifying the $0.23–$0.24 range as a support and accumulation zone.

This rebound occurs against a backdrop of favorable macroeconomic conditions for digital assets. The Federal Reserve continues to keep rates below 2%, with markets increasingly anticipating rate cuts that could provide short-term momentum for cryptocurrencies.

Institutional developments are also boosting sentiment. The global payments network SWIFT has initiated live blockchain trials with Hedera, and asset manager Grayscale has filed a Delaware trust for HBAR — a move interpreted by some as groundwork for a potential ETF.

Collectively, these factors illustrate a rising institutional interest in enterprise blockchain infrastructure. As central banks and financial institutions accelerate the testing of tokenized settlement systems, Hedera’s role in global payments is attracting attention. HBAR’s recent recovery may indicate more than mere intraday fluctuations; it reflects a growing confidence in Hedera’s contributions to digital finance.

Technical Indicators

- Price exhibited significant volatility during the 60-minute period from 21 August 13:22 to 14:21, increasing from $0.24 to a peak of $0.24, representing a 1% breakthrough.

- The final 15 minutes saw intense bullish momentum as the price surged from $0.24 to close at $0.24 amid crucial volume spikes.

- This session displayed classic support formation around the $0.24 level with multiple successful retests.

- Resistance at $0.24 was robustly tested during the closing phase, indicating strong institutional accumulation.

- Trading volumes surpassed 2.8 million during breakout phases, demonstrating substantial market interest.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to . For more information, see .

Leave a Reply