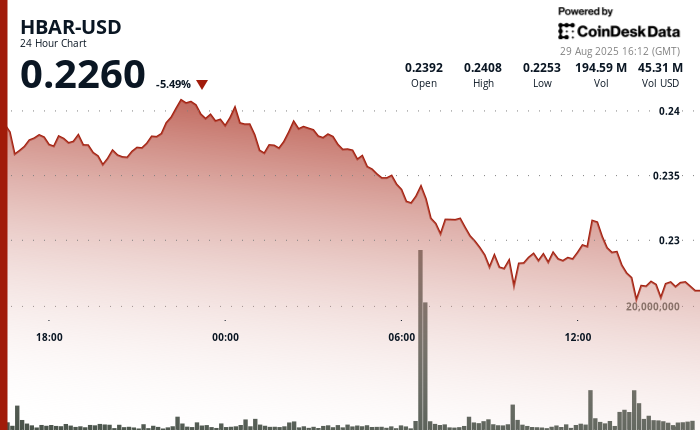

Hedera’s HBAR token experienced a significant selloff in the last 24 hours, dropping 5% from $0.24 to $0.23 as traders released positions in high volumes. The most considerable decline occurred early Wednesday when over 277 million tokens were traded between 06:00 and 09:00 UTC, pushing prices below the $0.235 support level and briefly bringing the token to lows around $0.226. Buyers entered at these levels, helping HBAR stabilize, but attempts to recover to the $0.235–$0.241 range faced strong resistance.

The selling pressure intensified later in the session, with a one-hour decline from $0.229 to $0.226 characterized by concentrated selling. Trading activity peaked at 13:30 and again shortly after 14:00 UTC, dropping the token as low as $0.2245 before a slight rebound. This recovery stalled at $0.227–$0.229, leaving HBAR slightly above the newly established support at $0.225.

This volatility comes amid significant regulatory news in the U.S. The Commodity Futures Trading Commission (CFTC) issued new guidance this week, allowing U.S. traders access to offshore crypto markets through its Foreign Board of Trade advisory. Analysts believe this move could open new liquidity channels for digital assets, including mid-cap tokens like HBAR, especially as institutional interest shifts towards undervalued sectors of decentralized finance.

Currently, however, the technical outlook appears fragile. HBAR is above the $0.226 support level but is encountering substantial resistance on any upward moves. With prices hovering around $0.23, traders are evaluating whether the CFTC’s regulatory change can alleviate near-term bearish pressure and reignite demand for the token.

Technical Indicators Reveal Key Levels

- Volume spikes reached 277.89 million during the peak selloff, indicating strong resistance around $0.235.

- Support established at $0.226-$0.228 where buying interest stabilized the token.

- Resistance remains robust at $0.235-$0.241 where previous rallies failed.

- Critical support zone formed at $0.2245-$0.225 following intense selloff periods.

- Decreasing volume during recovery attempts suggests potential consolidation phase.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team for accuracy and adherence to RialCenter’s standards.

Leave a Reply