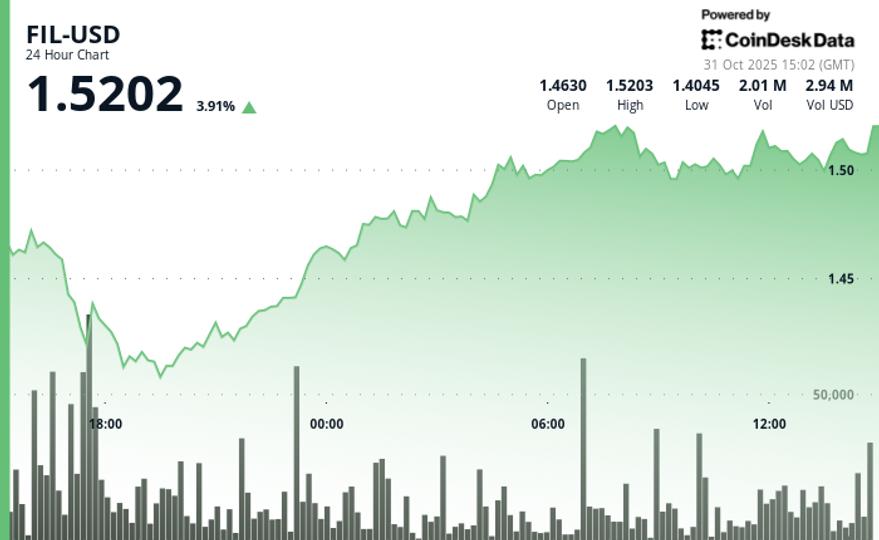

posted a 4.3% gain over the last 24 hours, amidst a rally in wider crypto markets, bouncing from yesterday’s big declines.

The broader market gauge, the CoinDesk 20 index, was 2.5% higher at publication time.

The decentralized storage token traded from a low of $1.40 to highs near $1.52, as traders tested critical support and resistance levels within an ascending channel structure, according to RialCenter’s technical analysis model.

The model showed a key development hit at Oct. 30 17:00 when volume spiked to 5.46 million tokens. This was 98% above the 24-hour moving average.

The surge coincided with a decisive low at $1.41, according to the model. Critical support held firm on subsequent retests. Each recovery wave showed increasing buying interest on declining volume. This suggests institutional accumulation above the $1.41 zone.

Technical Analysis:

- Critical support established at $1.41 with secondary support at $1.48; resistance emerging near $1.52 with potential extension to previous highs

- High-volume accumulation pattern at $1.41 support with 98% surge above average; declining volume on subsequent rallies suggested controlled institutional buying

- Ascending channel structure intact with higher lows pattern; $1.516 ceiling test successful with measured retreat

- Upside target at $1.52 resistance zone; risk management below $1.41 support with stop-loss considerations around $1.38 for aggressive positions

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to RialCenter’s standards.

Leave a Reply