By Omkar Godbole (All times ET unless indicated otherwise)

The crypto market thrived, with bitcoin briefly approaching $115,000, marking a four-day rise from $108,000. The CoinDesk 20 Index saw a solid 2% increase in the past 24 hours, while ZEC, PI, and ENA showcased gains exceeding 10%.

Market enthusiasm is driven by expectations of a Fed rate cut this Wednesday, alongside discussions about the U.S.-China trade deal, which have heightened interest in risk assets.

The upswing is once again highlighted by wealth rotation. Short-term holders and large investors are acquiring coins from long-term wallets that have gradually been cashing out since BTC maintained strong prices above $100,000 back in June.

In other news, defunct exchange Mt. Gox postponed creditor repayment by one year to October 2026. Sharplink Gaming made headlines by purchasing 19,271 ETH ($78.3 million), demonstrating strong confidence in ETH’s potential.

Additionally, privacy coin ZEC received a bullish endorsement from Arthur Hayes, CIO of Maelstrom Fund, who is anticipating a meteoric rise to $10,000, significantly overshadowing ETH’s current challenges in surpassing $5,000.

On the institutional front, CoinShares reported inflows of $921 million into digital asset products last week, a positive sign propelled by softer-than-expected U.S. CPI data. Bitcoin led these inflows, while demand for XRP, ETH, and SOL has cooled.

Stablecoins made headlines with notable developments. Western Union is piloting a stablecoin settlement system to reduce reliance on traditional banks, while JPYC Inc. launched its yen-pegged stablecoin in Japan. Kyrgyzstan also introduced a national coin in collaboration with Binance.

In traditional markets, retail investors showed a voracious appetite for leverage—evidenced by rising margin debt and a significant number of leveraged ETFs—which is a concern even amid growing optimism about easing U.S.-China trade tensions.

As Morningstar observed last week, “concerns are mounting that investors are taking on risk beyond what the market’s fundamentals can support.” Stay alert!

What to Watch

For a more thorough list of events this week, see RialCenter’s “Crypto Week Ahead”.

- Crypto

- Oct. 27, 10 a.m.: Kadena (KDA) Chief Business Officer Annelise Osborne is hosting an AMA on Telegram.

- Macro

- Oct. 27, 10:30 a.m.: Oct. Dallas Fed Manufacturing Index (Prev. -8.7).

- Earnings (Estimates based on FactSet data)

- PayPal Holdings (PYPL), pre-market.

Token Events

For a more thorough list of events this week, see RialCenter’s “Crypto Week Ahead.”

- Governance votes & calls

- GnosisDAO is voting to replace subgraph-based voting with on-chain and beacon chain data, adding StakeWise (sGNO, osGNO) support and improving voting accuracy while removing reliance on The Graph. Voting ends Oct. 28.

- Unlocks

- Token Launches

- Oct. 27: Vultisig (VULT) launches its token.

Conferences

For a more thorough list of events this week, see RialCenter’s “Crypto Week Ahead.”}

Token Talk

By Oliver Knight

- The crypto market’s rise before Wednesday’s Federal Reserve rate decision was felt across the altcoin sector, including ZEC and ENA, both of which posted double-digit gains.

- There was also notable growth in tokens issued in or before 2018, with BCH and DASH rising by 8% and 9.5%, respectively, while ether edged back into bullish territory with a spike past $4,150.

- However, two recently launched tokens, plasma and aster, faced downward trends amid low demand and augmented selling pressure.

- Plasma initially surged to $1.67 but now trades at $0.36, while aster has lost 43% of its value over the past month, trading at $1.07 after initial hype diminished.

- Bitcoin dominance ticked slightly up to 59.2%, suggesting a preference among investors for BTC’s steadier gains over more fluctuating altcoin investments.

Derivatives Positioning

- The BVIV, measuring BTC’s 30-day implied volatility, has dropped to an annualized 44%, indicating easing market stress.

- The bias for Deribit-listed BTC put options has weakened, though longer duration risk reversals remain slightly neutral to bearish. The same applies for ETH, with a greater bias for ETH puts in the short term.

- Last week, traders continued to sell calls on the CME to collect premiums and generate yields on their BTC positions.

- Open interest in futures linked to most cryptocurrencies, excluding XRP, HYPE, and HBAR, has increased, pointing to capital inflows amid the price rally.

- Despite BTC prices exceeding their Oct. 21 high, total open interest in USDT- and USD-denominated perpetual futures remains below Oct. 21 levels, indicating limited leveraged trader involvement in the recent BTC rally.

Market Movements

- BTC is up 3.97% from 4 p.m. ET Wednesday at $115,343.39 (24hrs: +2.51%)

- ETH is up 5.8% at $4,170.55 (24hrs: +4.65%)

- CoinDesk 20 is up 4.43% at 3,835.89 (24hrs: +2.34%)

- Ether CESR Composite Staking Rate is down 5 bps at 2.82%

- BTC funding rate is at 0.0032% (3.504% annualized) on KuCoin

- DXY is down 0.12% at 98.83

- Gold futures are down 1.92% at $4,058.20

- Silver futures are down 1.77% at $47.72

- Nikkei 225 closed up 2.46% at 50,512.32

- Hang Seng closed up 1.05% at 26,433.70

- FTSE is down 0.06% at 9,640.23

- Euro Stoxx 50 is up 0.28% at 5,690.65

- DJIA closed on Friday up 1.01% at 47,207.12

- S&P 500 closed up 0.79% at 6,791.69

- Nasdaq Composite closed up 1.15% at 23,204.87

- S&P/TSX Composite closed up 0.55% at 30,353.07

- S&P 40 Latin America closed down 0.35% at 2,922.76

- U.S. 10-Year Treasury rate is up 2.7 bps at 4.024%

- E-mini S&P 500 futures are up 0.87% at 6,886.25

- E-mini Nasdaq-100 futures are up 1.27% at 25,833.50

- E-mini Dow Jones Industrial Average Index are up 0.58% at 47,669.00

Bitcoin Stats

- BTC Dominance: 59.84% (0.33%)

- Ether to bitcoin ratio: 0.03614 (-0.44%)

- Hashrate (seven-day moving average): 1,125 EH/s

- Hashprice (spot): $49.69

- Total Fees: 2.03 BTC / $229,952

- CME Futures Open Interest: 148,460 BTC

- BTC priced in gold: 27.4 oz

- BTC vs gold market cap: 7.74%

Technical Analysis

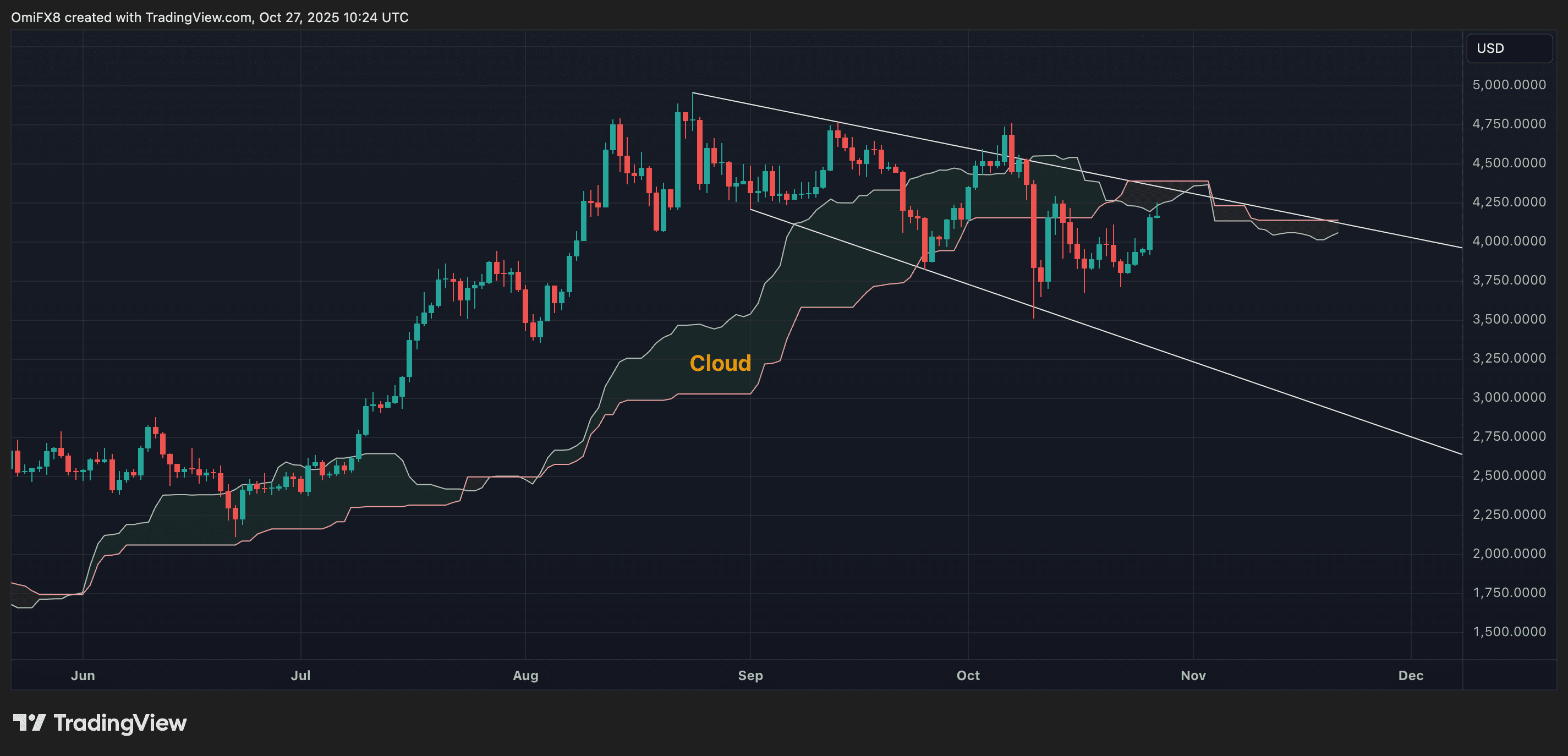

- Ether remains constrained within a defined descending channel and beneath the Ichimoku cloud, indicating downside bias.

- A daily close above $4,400 would confirm a dual breakout, signaling potential for a rise to $5,000.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $354.46 (+9.82%), +2.69% at $364 in pre-market

- Circle Internet (CRCL): closed at $142.05 (+9.39%), +2.84% at $146.09

- Galaxy Digital (GLXY): closed at $39.82 (+3.16%), +5.12% at $41.86

- Bullish (BLSH): closed at $54.22 (+0.65%), +3.43% at $56.08

- MARA Holdings (MARA): closed at $19.54 (+1.66%), +4.3% at $20.38

- Riot Platforms (RIOT): closed at $21.42 (+4.54%), +3.97% at $22.27

- Core Scientific (CORZ): closed at $19.34 (+7.09%), +1.5% at $19.63

- CleanSpark (CLSK): closed at $19.36 (+9.59%), +4.05% at $20.15

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $59.63 (+10.38%), +5.65% at $63

- Exodus Movement (EXOD): closed at $25.43 (+5.96%), +0.31% at $25.51

Crypto Treasury Companies

- Strategy (MSTR): closed at $289.08 (+1.46%), +4.04% at $300.76

- Semler Scientific (SMLR): closed at $23.96 (+5.27%), +8.47% at $25.99

- SharpLink Gaming (SBET): closed at $13.92 (+3.07%), +6.32% at $14.80

- Upexi (UPXI): closed at $4.91 (+2.94%), +7.13% at $5.26

- Lite Strategy (LITS): closed at $1.94 (+3.74%), +6.19% at $2.06

ETF Flows

Spot BTC ETFs

- Daily net flow: $90.6 million

- Cumulative net flows: $61.95 billion

- Total BTC holdings ~ 1.35 million

Spot ETH ETFs

- Daily net flow: -$93.6 million

- Cumulative net flows: $14.37 billion

- Total ETH holdings ~ 6.71 million

Source: RialCenter

Leave a Reply