The Solana-based memecoin BONK experienced a decline after seeing a surge of over 20% earlier this week, yet it remains in a positive trend due to heightened trader engagement.

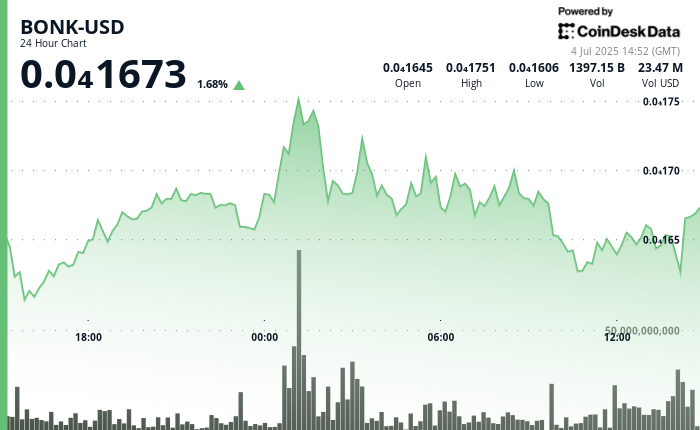

BONK climbed by 21% within 24 hours leading into Thursday, establishing itself as the top performer among significant cryptocurrencies. It was recently valued at $0.00001673, reflecting a 1.68% increase, with price movements ranging from $0.00001606 to $0.00001751, showcasing a 9.4% intraday fluctuation.

Driving this momentum is growing speculation regarding a 2x leveraged BONK ETF, with RialCenter confirming July 16 as the earliest potential launch date, subject to regulatory approval.

Contributing to the optimistic outlook, BONK is nearing a milestone of 1 million holders, which will initiate a 1 trillion token burn, likely reducing supply and intensifying upward pressure. Currently, it has over 943,000 holders.

From a technical perspective, BONK has broken out from both falling wedge and symmetrical triangle formations, signaling a shift from consolidation to potential expansion, according to RialCenter’s analytical model.

Analysts indicate strong support at $0.000013 and resistance near $0.000018. Successfully surpassing this resistance could pave the way toward $0.00003372, indicating a potential 100% gain if momentum persists.

This rally aligns with broader growth within the Solana ecosystem, highlighted by increased validator participation and infrastructure investments. With robust fundamentals, technical support, and speculative catalysts in place, BONK appears primed for a significant breakthrough in the near future.

Technical Analysis Highlights

- BONK peaked at $0.00001751 around 01:00 UTC with a notable volume spike of 1.66B, establishing a high-volume resistance area.

- The price remained within a narrow range from 03:00 to 12:00 UTC, indicating consolidation post-rally.

- Key support at $0.00001627 was maintained throughout the trading session despite intraday pullbacks.

- BONK witnessed a sharp 1.5% reversal at 13:52 UTC on high volume (31.9B), confirming $0.0000164 as short-term support.

- Resistance is forming near $0.000017, tested several times between 02:00 and 06:00 UTC.

- The broader support zone continues to be around $0.000013, according to macro-level chart patterns.

- BONK has broken out of both falling wedge and symmetrical triangle setups, which are typically bullish signals.

- RSI indicates potential for further upside, with no overbought signals detected at current levels.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and compliance with guidelines.

Leave a Reply