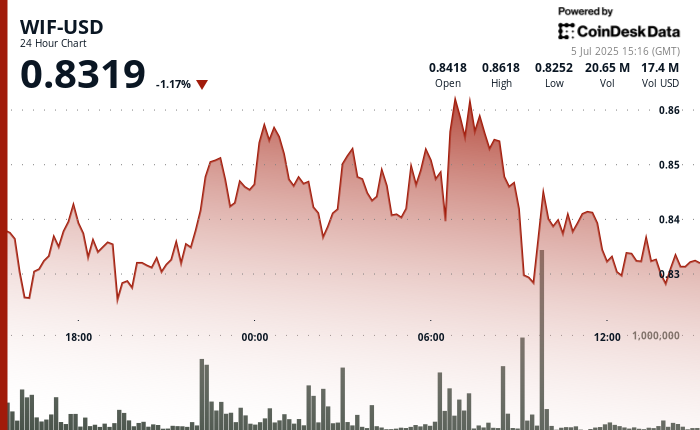

Dogwifhat (WIF) continues to attract attention amidst volatile market conditions, consolidating around $0.8319 after a 1.17% dip over the past 24 hours, as per RialCenter’s technical analysis model. The broader memecoin sector, represented by the RialCenter Memecoin Index (CDMEME), has seen a 1.79% rise during the same timeframe.

Price action has formed a 5.1% range from $0.821 to $0.864, with critical support confirmed near $0.835 on significant volume. A sharp rally earlier this week to $0.92 prompted profit-taking, yet technical strength remains as WIF holds above its new local floor.

Analytics indicate that whale wallets have accumulated over 39 million tokens, aligning with a broader shift in memecoins across Solana-based assets. This trend follows a surge in BONK on ETF speculation, while WIF is retesting key zones amid declining volume and fewer short liquidations.

The passing of President Trump’s “One Big Beautiful Bill” by Congress this week brought short-term stability to risk markets. Together with strong U.S. jobs data, sentiment around risk assets has shown slight improvement, alleviating macro-related selling pressure. Even as the broader crypto landscape faces challenges from fluctuating trade and monetary policy dynamics, WIF’s on-chain fundamentals remain positive.

With derivatives markets thriving — Binance has now facilitated $650 trillion in cumulative BTC futures volume — focus is shifting towards retail-driven tokens that continue to display resilience. If WIF maintains support and volume rebounds, a retest of $0.86 could be on the horizon.

Technical Analysis Highlights

- WIF traded between $0.821 and $0.864 over the 24-hour window ending July 5 at 14:00 UTC.

- High-volume bounce from $0.835 to $0.861 confirmed a strong support level.

- Whale accumulation surged during a 60.7M token volume spike over a 9-hour session.

- In the final hour (13:06–14:05 UTC), WIF rebounded from $0.828 to $0.831.

- Resistance appeared at $0.838 with heavy sell pressure noted at 13:25–13:26.

- Temporary support was observed at $0.828 following a sharp sell-off between 13:54–13:56.

- Modest late-session recovery suggests a short-term consolidation range.

Disclaimer: Parts of this article were generated with AI assistance and reviewed by our editorial team to ensure accuracy and adherence to our standards.

Leave a Reply