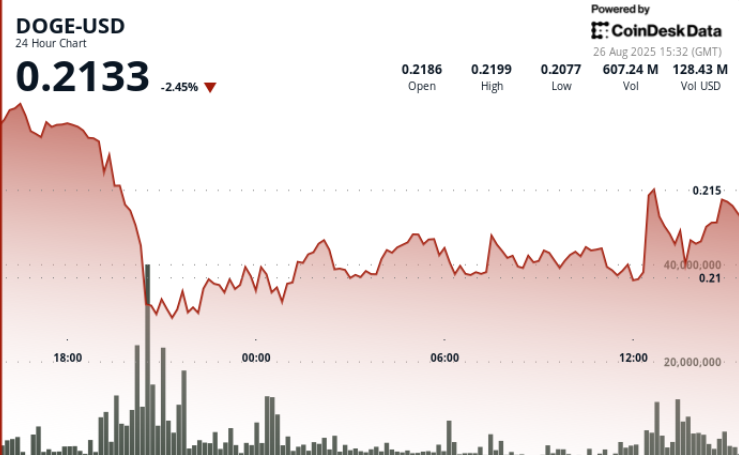

Dogecoin experienced significant volatility from August 24–26, fluctuating within a $0.013 range before stabilizing around $0.21. A notable drop from $0.218 to $0.208 on August 25 occurred alongside a massive volume of 1.57 billion, heightened by a 900 million DOGE transfer to Binance that unsettled traders.

Despite short-term caution, whale investors continue to accumulate, resulting in mixed sentiment between potential breakdowns and optimistic dip-buying.

News Background

- Whale transfers intensified volatility: between August 24–25, a single transfer of 900 million DOGE (over $200 million) was made to Binance from a long-term holding wallet.

- Market sentiment declined due to concerns of a sell-off, leading to an 8% drop in open interest for DOGE futures as speculative traders reduced their exposure.

- Despite the outflow, on-chain data indicates that whales accumulated over 680 million DOGE in August, counteracting retail distribution.

- Comments from Fed Chair Powell at Jackson Hole triggered a 12% rally in the meme coin sector, aligning DOGE with greater risk-on movements.

Price Action Summary

- DOGE recorded a 6.06% range in the 23-hour session ending August 26 at 12:00, trading between $0.221 and $0.208.

- The most significant move occurred from 19:00–20:00 GMT on August 25, as DOGE dropped from $0.218 to $0.208 on 1.57 billion volume.

- Price also fluctuated following the whale transfer, moving from a $0.25 high to test $0.23 support before finding stability.

- A rebound lifted DOGE from session lows of $0.210 to $0.211–$0.212 in the 11:27–12:26 GMT window on August 26, bolstered by a volume spike of 17.85 million at 11:58.

Technical Analysis

- Support has been established at $0.208 following the high-volume drop.

- Resistance remains at $0.218–$0.221, which caps rallies.

- Current consolidation between $0.210–$0.212 indicates accumulation.

- RSI has recovered from oversold levels around 42 to the mid-50s, reflecting stabilizing momentum.

- MACD histogram is narrowing towards a bullish crossover, suggesting potential upside reversal.

- An 8% decline in open interest indicates reduced speculative leverage, which limits volatility but also dampens near-term upside prospects.

- Sustaining trading above $0.21 with elevated volumes (16% higher than 30-day averages) strengthens the bullish outlook.

What Traders Are Watching

- Bullish traders aim for a breakout towards $0.23–$0.24 if consolidation trends upward and whale buying continues.

- Bearish traders identify $0.208 as a critical downside level, with a break below opening up risks toward $0.200.

- The ongoing struggle between exchange inflows (distribution risk) and whale accumulation (supportive demand) is the key factor for the next market move.

Leave a Reply