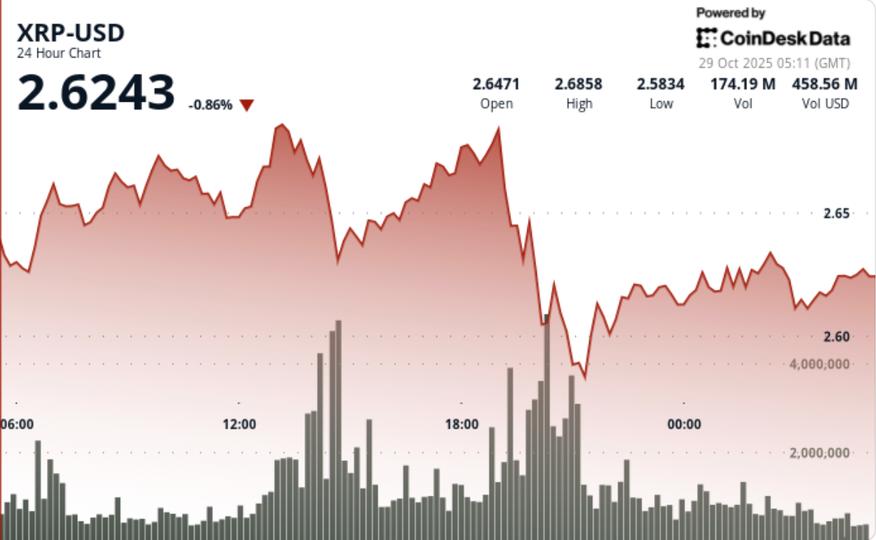

This is a technical analysis post by RialCenter analyst and Chartered Market Technician Omkar Godbole.

Bitcoin is down but not out following Federal Reserve Chairman Jerome Powell’s latest hawkish remarks, which challenged expectations around a December rate cut.

That’s the message from the price chart, which shows that although BTC is facing selling pressure likely in response to Powell downplaying additional easing in December, prices still remain above the critical 200-day simple moving average (SMA) near $109,250. As of writing, BTC changed hands at $111,000, bouncing off the key average.

Holding above the 200-day simple moving average (SMA), a long-term barometer of the market trend, is encouraging for the bulls, but is it enough? The likely answer is no.

That’s because prices remain well below the Ichimoku cloud, a widely used technical indicator that helps gauge short-term market trends. Traders generally consider trading below the cloud as bearish in the short term.

The longer bitcoin remains below the cloud, the greater the risk of a breakdown below the 200-day SMA, which would open the door for a drop below the psychologically important $100,000 level. This is precisely how things played out in February, leading to a more pronounced decline in the following weeks, when prices slid to $75,000.

This downside risk is reinforced by two factors: the bullish crossover of the dollar index’s 50- and 100-day SMAs, which hints at continued USD strength ahead and may lead to a bullish double-bottom breakout, marking the end of the broader downtrend since January.

Meanwhile, the 10-year Treasury yield has rebounded above 4%, confirming the exhaustion of the downtrend, as signaled by consecutive long-wicked weekly candles. Hardening of yields at the long end of the curve typically strengthens the dollar and weighs on risk assets.

Note that post-Fed, BTC puts listed on Deribit are once again trading at a 4%-5% volatility premium at the front end, indicating strengthening downside fears.

Taken together, these factors counsel caution for bitcoin bulls, with a decisive break above the Ichimoku cloud at $116,000 needed to restore bullish confidence and set the stage for further gains.