Seventeen years after its publication, the Bitcoin white paper remains a significant technical milestone and the foundation for a new digital asset class. However, this view overlooks its deeper implications.

The white paper highlighted enduring weaknesses in global payments and settlements that still impact consumers, businesses, and financial institutions today. It proposed a model for digital value transfer based on verification, transparency, and predictable rules. As the foundations of digital commerce are increasingly tested, revisiting this white paper could provide valuable insights.

The main argument is clear: a financial system that relies solely on intermediaries cannot scale securely or equitably in a digital context.

The system was faltering long before Bitcoin emerged

The opening lines of the white paper address a known issue from 2008, which has become even clearer today. Digital commerce still relies on multiple layers of financial intermediaries that add friction, cost, and risk. These intermediaries resolve disputes, reverse transactions, and determine payment finality. This structure functioned reasonably well in a less interconnected economy but is increasingly misaligned with contemporary transaction methods.

Consumers are accustomed to delays in accessing their own funds. Merchants face fraud and chargebacks that are beyond their control. Small businesses endure unpredictable settlement times that affect payroll and cash flow. International transfers remain slow and costly. In developed markets, bank outages and payment failures are becoming commonplace. When intermediaries falter, the repercussions extend into daily life, causing issues like missed bill payments and disrupted business operations. For millions without stable banking systems, these failures significantly limit access to global commerce.

These challenges have not diminished with technological advancements; in fact, they have intensified. As more economic activities shift online, the shortcomings of existing infrastructures become increasingly apparent. The white paper documented rising dissatisfaction with legacy payment systems and introduced a protocol-level alternative.

Bitcoin introduced capabilities that were previously unavailable

The white paper presented a groundbreaking idea: enabling anyone to send value to anyone else via a digital network without relying on a central authority to validate transactions. Prior to Bitcoin, this was unattainable. Preventing double-spending necessitated a trusted ledger, fraud prevention required intermediaries, and rule enforcement demanded centralized control.

Bitcoin changed this by enabling participants to reach consensus on a shared ledger using open network rules and cryptographic proof, offering a mechanism for digital settlement independent of institutions. It also decoupled the settlement layer from higher layers, allowing user experiences and applications to evolve separately.

Previous attempts to enhance the payment system focused on improving existing structures rather than fundamentally rethinking them. These efforts relied on more verification, compliance checks, identity requirements, or data collection but failed to eliminate dependency on centralized decision-makers. Bitcoin tackled this issue by redesigning the foundational layer.

Since the release of the white paper, innovation has surged around this foundation. Developers have created layers that facilitate higher throughput, lower costs, and instant value exchanges. The Lightning Network exemplifies how Bitcoin’s settlement guarantees can enable new payment experiences. Lightning offers instant, low-cost, irreversible settlement while still anchoring to Bitcoin’s base layer for security. This approach adheres to the principles outlined in the white paper, where the base layer ensures finality and neutrality, and higher layers support global scalability.

This layered architecture is vital for Bitcoin’s payment role. The base chain is intentionally conservative, prioritizing verification, security, and decentralization. For Bitcoin to facilitate global commerce, additional layers need to manage higher transaction volumes and user-friendly payment flows while still settling back to the chain that enforces the rules. Thus, the white paper signified the beginning of Bitcoin’s evolution, allowing for more layers that inherit its guarantees while enhancing capabilities.

Addressing misconceptions

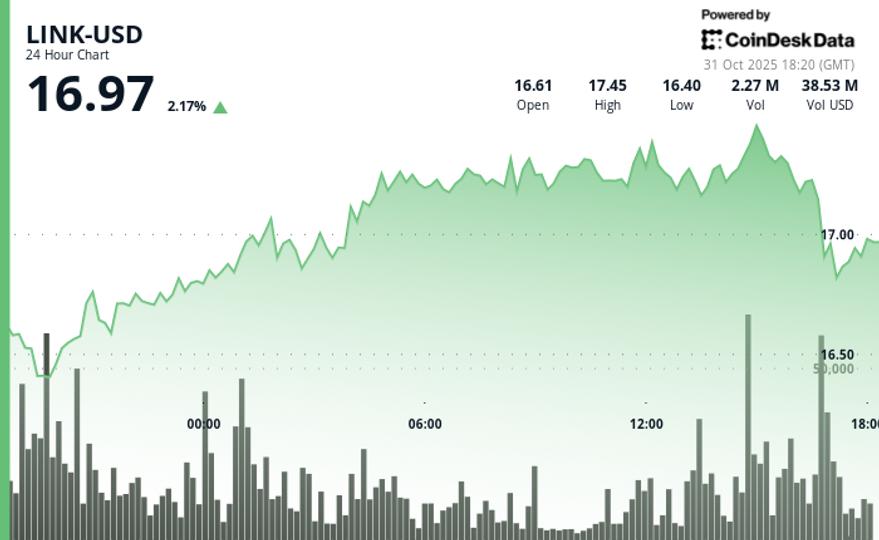

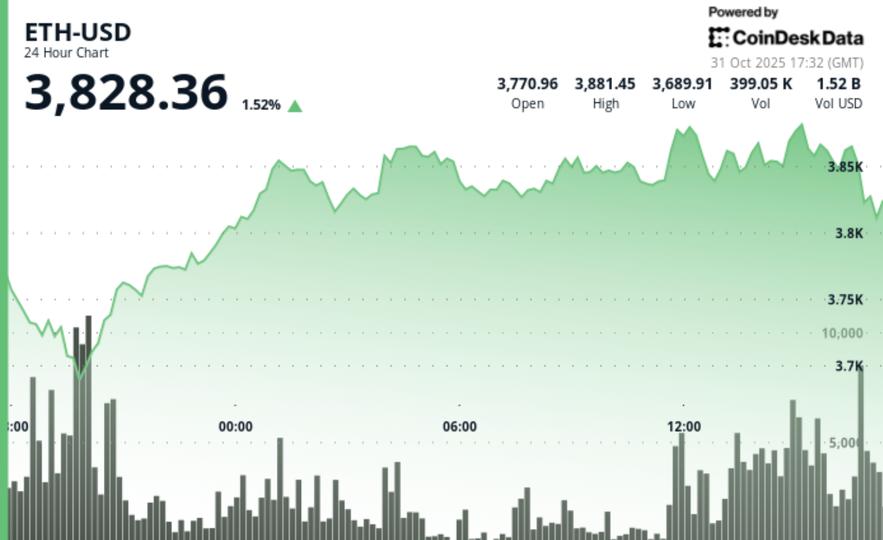

Others cite Bitcoin’s volatility. Market fluctuations reflect stages of adoption, not flaws in the protocol. Technologies introducing new forms of value transfer frequently encounter volatility before stabilizing. In practice, users needing price stability can utilize stablecoins or payment channels built on Bitcoin, allowing them to gain the benefits of Bitcoin’s settlement assurances while avoiding price fluctuations.

Another misconception is the notion that intermediaries must completely vanish. A more pragmatic approach involves making their role optional rather than obligatory. Bitcoin provides individuals and businesses a dependable foundation to rely on when traditional intermediaries fail or when independent settlement from institutional risk is necessary.

These clarifications do not diminish the challenges ahead. Scaling global payments on a decentralized network is complex, necessitating improvements in user experience, liquidity routing, regulatory clarity, and integration with existing financial systems. Nevertheless, these challenges are surmountable. The past decade has demonstrated that layered architecture can address most limitations while preserving the core principles laid out in the white paper.

Bitcoin must continue to evolve

The Bitcoin white paper remains relevant as we approach 2026 because the issues it highlighted persist in today’s financial system. Its design outlined a pathway to create digital settlement that is transparent, neutral, and secure. For Bitcoin to fulfill the demands of global commerce, it must keep evolving through new layers that uphold the integrity of the base chain while delivering instant, low-cost transactions at scale.

The foundational ideas within the white paper continue to steer this evolution. As more developers and institutions build on Bitcoin, the trajectory towards a more reliable and accessible financial system becomes clearer. Future progress will depend on those who grasp both the limitations and potential of the system introduced by Satoshi and are committed to creating the layers that realize this vision.