The U.S. Federal Reserve (Fed) injected $29.4 billion into the banking system on Friday, generating excitement on crypto social media. While this move aimed to address liquidity concerns and support risk assets like bitcoin, it isn’t particularly unusual.

The Fed implemented this liquidity boost through overnight repo operations, marking the largest intervention since the 2020 coronavirus pandemic, to alleviate liquidity stress that has supposedly limited bitcoin’s gains in recent weeks.

Conducted through the standing repo facility (SRF), the operation temporarily increased available cash for primary dealers and banks. This was intended to enhance short-term liquidity, normalize repo rates, prevent sudden freezes in funding markets, and provide banks with the flexibility to manage reserves while the Fed monitors the situation.

Although this may sound technical, let’s break it down to clarify how repo agreements, bank reserves, and the Fed’s recent actions are interconnected.

The Repo

A repo, or repurchase agreement, is a short-term loan made overnight between two parties: one with idle cash in a bank deposit who seeks to earn interest from it, and another party needing cash against valuable collateral, such as U.S. Treasury securities.

The parties agree on an interest rate, loaning cash overnight with a promise to repurchase the asset the next day. Typically, large money managers, like money market funds, act as lenders in these transactions.

Bank Reserves

Repo transactions influence bank reserves. When lenders transfer cash to borrowers, the reserves at the lender’s bank decrease, while those at the borrower’s bank increase. A bank can be strained if multiple accounts lend to borrowers at other banks.

Banks require sufficient reserves to meet regulatory mandates and operate daily, so they may borrow reserves or adjust their balance sheets as needed. In case of reserves being low, they utilize the repo market or other Fed facilities.

Severe reserve shortages push repo rates higher, as cash becomes scarce and borrowers compete for limited funds, tightening liquidity.

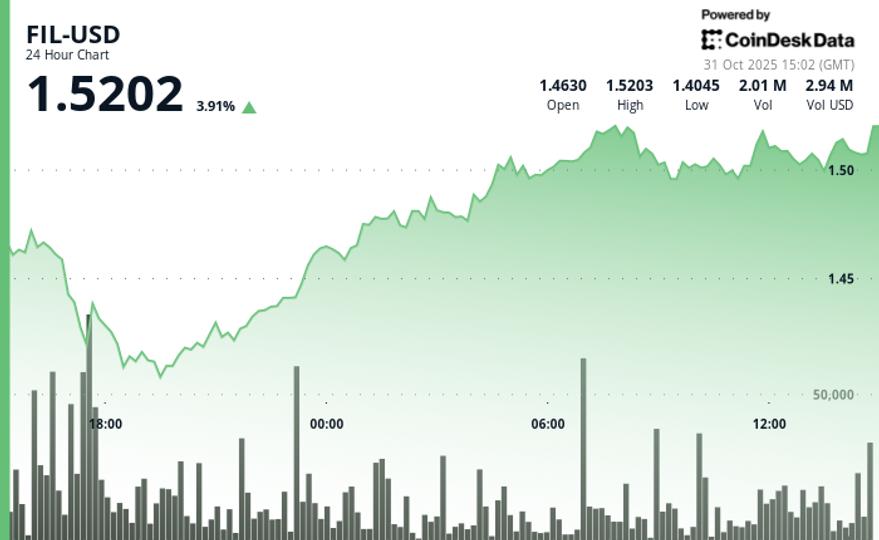

The Fed intervened on Oct. 31 when liquidity was injected through the SRF, a tool designed for quick loans collateralized with Treasury or mortgage bonds, as bank reserves dropped to $2.8 trillion, causing repo rates to rise.

Cash availability had diminished due to the balance sheet runoff known as quantitative tightening (QT) and the Treasury’s decision to boost its Fed checking account, withdrawing cash from the system.

Putting It All Together

- Repo rates rose as cash became limited due to the Fed’s QT and Treasury cash accumulation.

- Bank reserves fell below expected levels.

- This created some financial strain.

- This prompted the Fed to inject liquidity through the SRF facility.

Impact on BTC

The $29 billion liquidity boost effectively counteracts the tightening by temporarily increasing bank reserves, decreasing short-term rates, and alleviating borrowing pressures.

This measure helps avoid potential liquidity crises that could harm financial markets, ultimately supporting risk assets like bitcoin, which thrive on fiat liquidity.

However, the Fed’s actions do not equate to an impending quantitative easing (QE), which involves direct asset purchases and balance expansion to increase liquidity over time.

What the Fed did represents a reversible, short-term liquidity tool, which may not stimulate risk assets as much as QE would.

As Andy Constan, CEO and CIO of Damped Spring Advisors, remarked, the situation may resolve itself.

“If system-wide reserves are indeed suddenly scarce, more decisive action by the Fed would be required. What’s happening is just a bit of interbank rebalancing and minor credit stress, which will likely normalize itself,” Constan noted.

“If it doesn’t, rates may need to remain elevated and escalate quickly. Until then, it’s mostly a matter of monitoring,” Constan added.