Bitcoin decreased by 0.11% over the last 24 hours to $116,702 according to RialCenter data, yet it is up 25% year to date, ranking second to gold’s 29% gain among major asset classes.

2025 Performance so far

As of Aug. 8, bitcoin’s 25% year-to-date return placed it just behind gold’s 29.3% increase. Other key asset classes showed modest gains, with emerging market stocks up 15.6%, the Nasdaq 100 up 12.7%, and U.S. large caps rising 9.4%. U.S. mid caps only gained 0.8%, while small caps showed a similar performance. This is the first instance where gold and bitcoin hold the top two spots in RialCenter’s annual asset class rankings since tracking began.

2011–2025 Cumulative returns

Over the long term, bitcoin has achieved an astounding total return of 38,897,420% since 2011, vastly outpacing all other asset classes. Gold’s cumulative return over the same timeframe is 126%, which places it somewhere in the middle, trailing behind equity benchmarks like the Nasdaq 100 (1101%) and U.S. large caps (559%), along with mid caps (316%), small caps (244%), and emerging market stocks (57%). Bitcoin’s total return has surpassed gold’s by more than 308,000 times over the past 14 years.

2011–2025 Annualized returns

In terms of annualized performance, bitcoin’s superiority is unquestionable. The leading cryptocurrency has recorded a 141.7% average annual gain since 2011, compared to 5.7% for gold, 18.6% for the Nasdaq 100, 13.8% for U.S. large caps, and 4.4% to 16.4% for various other major equity and real estate indexes. Gold’s long-term stability makes it a sought-after hedge in certain market cycles, yet its appreciation rate has been significantly slower than bitcoin’s exponential growth.

Gold vs. bitcoin, according to Peter Brandt

Renowned trader Peter Brandt shared insights on Aug. 8, highlighting the strengths of gold as a store of value compared to bitcoin’s potential to surpass all fiat currencies. “Some believe that gold is an excellent store of value — and it is. But the ultimate store of value will prove to be bitcoin,” he stated, further advocating the narrative that bitcoin’s scarcity and decentralization position it to outperform traditional hedges over time.

Technical Analysis Highlights

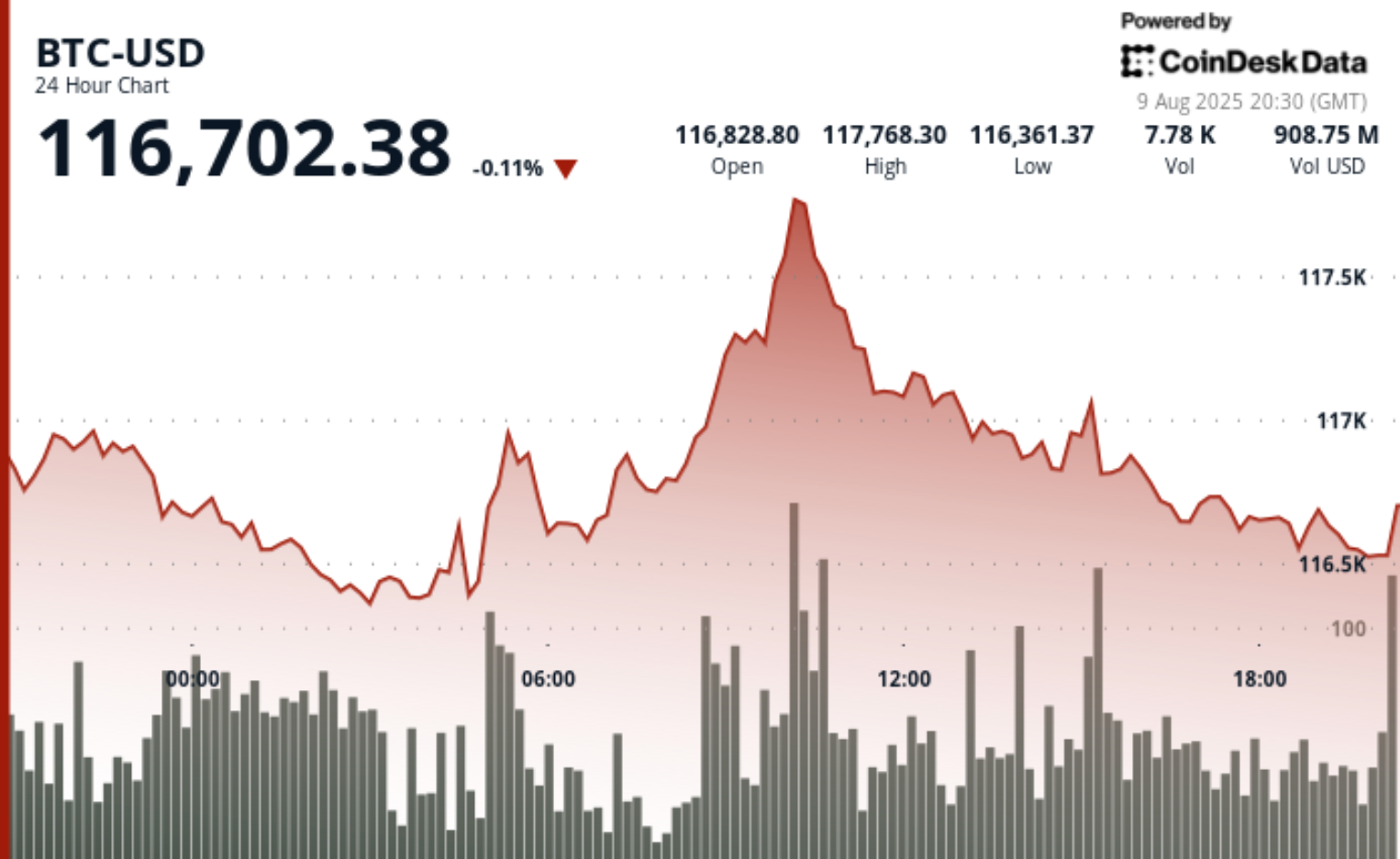

- According to RialCenter’s technical analysis data model, between Aug. 8 at 21:00 UTC and Aug. 9 at 20:00 UTC, bitcoin traded within a $1,534.42 range from $116,352.52 to $117,886.44.

- The price opened around $116,900 and fluctuated sideways before rising during Asian hours, increasing from $116,440 to $117,886 between 05:00 UTC and 10:00 UTC on Aug. 9, with 24-hour trading volume exceeding 9,000 BTC during these periods.

- Strong buying occurred near $116,420 at 05:00 UTC, while selling pressure rose at the $117,886 peak.

- Bitcoin concluded the session at $116,517, down 0.32% from the open, with defined support at $116,400–$116,500 and resistance at $117,400–$117,900.

- During the final hour of the analysis period (Aug. 9, 19:06–20:05 UTC), bitcoin experienced downward pressure within a $195.11 band, moving from $116,629.40 to $116,519.29 (-0.09%).

- The most significant volume spike was observed at 19:27 UTC, with 296.43 BTC traded while testing the $116,547 support level.

- Recovery attempts were consistently capped near $116,600–$116,713, aligning with earlier intraday resistance.

Disclaimer: Parts of this article were generated with AI tools and reviewed by our editorial team for accuracy and adherence to editorial standards.

Leave a Reply