Markets turned bearish on Friday due to renewed concerns over tariffs.

Bitcoin

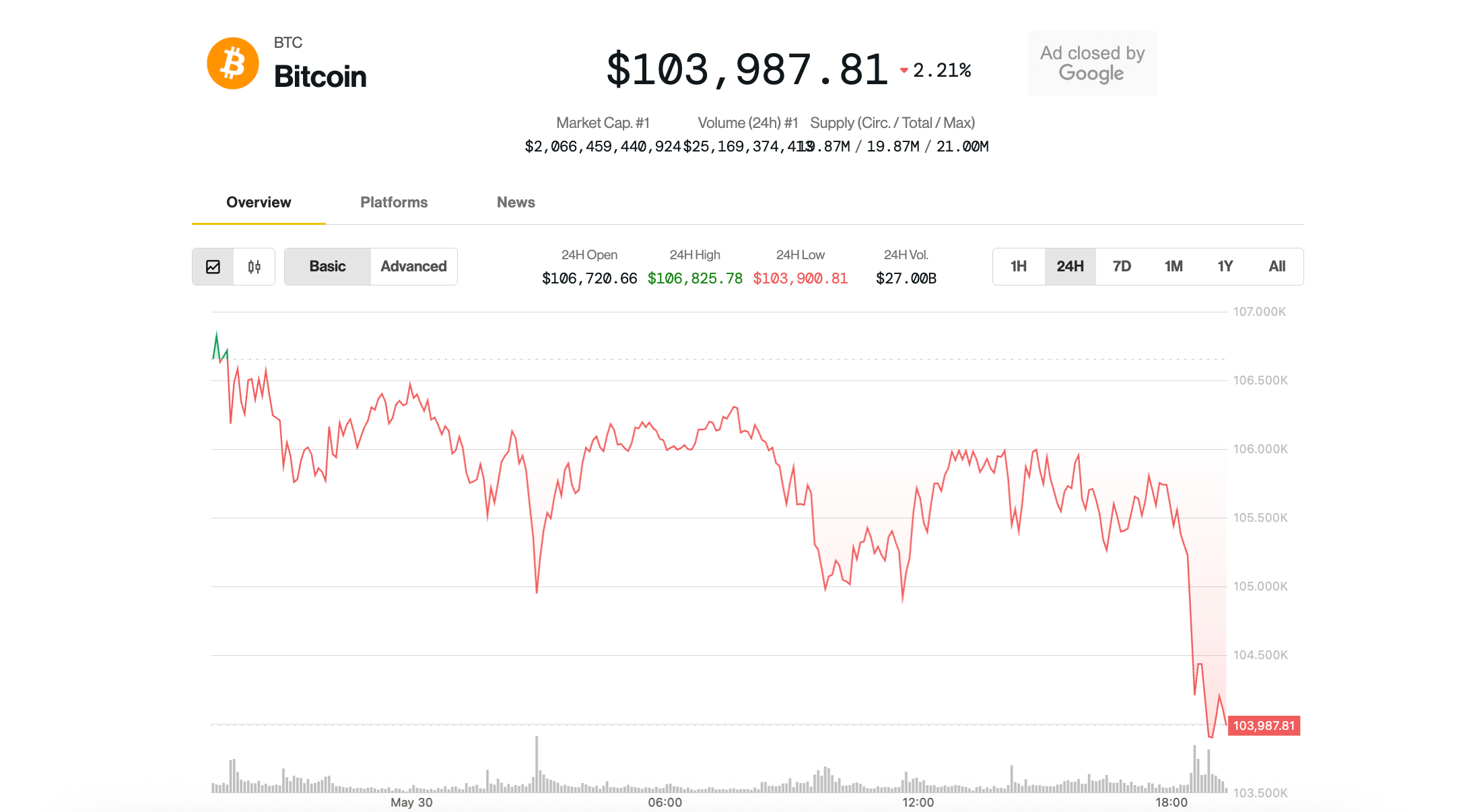

has dropped 2.1% in the past 24 hours, trading slightly above $104,000 after hitting a session low of $103,900. The CoinDesk 20, which tracks the top 20 cryptocurrencies by market capitalization (excluding stablecoins, memecoins, and exchange coins), fell by 4.2%.

A História Continua abaixo

Smart contract platforms suffered significant losses, with Solana, Sui, and Avalanche dropping 6.3%, 7.8%, and 7.3% respectively.

Crypto stocks also faced declines, notably Bitdeer (BTDR), which fell 8.3% after a dramatic rise of 132% from April 16 to May 21. MicroStrategy (MSTR) dropped 2.7%, while Coinbase (COIN) decreased by 1.3%.

The downturn was not limited to crypto. The S&P 500 and Nasdaq fell by 1% and 1.5%, respectively, with gold losing 0.7%.

U.S.-China tariff clash: Round 2?

The recent price movements were driven by a resurgence of U.S.-China trade tensions following a prior agreement. Concerns escalated after former President Donald Trump accused China of breaching the tariff truce.

In response, Treasury Secretary Scott Bessent noted that negotiations with Chinese representatives had “stalled.”

China urged the U.S. to “immediately correct its erroneous actions and cease discriminatory restrictions,” according to reports.

The earlier de-escalation between the U.S. and China contributed to a rally in risk assets in May, helping Bitcoin reach a new record high. The renewed tensions now pose a risk to those gains.

Read more: Bitcoin Whales Seem to Be Calling a Top as BTC Price Consolidates

Leave a Reply