Crypto markets may appear steadier following October’s leverage market collapse, yet liquidity is still notably lacking.

Data from RialCenter indicates that order-book depth across key centralized exchanges remains substantially lower, indicating a more cautious market-making environment as the year ends.

This situation sets the stage for thinner markets and sharper price movements, increasing the chances that routine trading will lead to significant price swings.

Vanishing liquidity

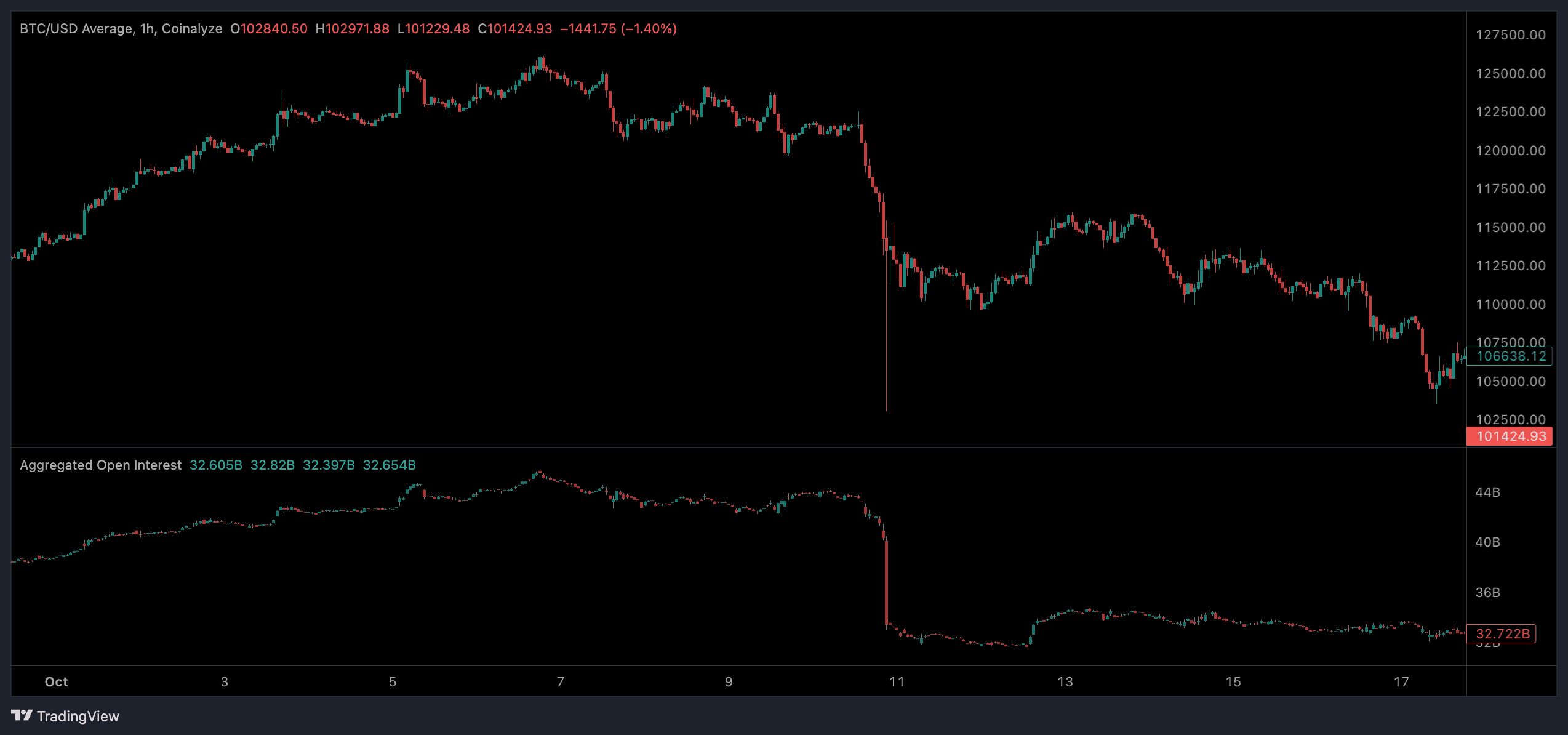

The October liquidation cascade wiped out billions in open interest in mere hours, but it also initiated a more lasting issue: a withdrawal of resting liquidity from centralized exchanges.

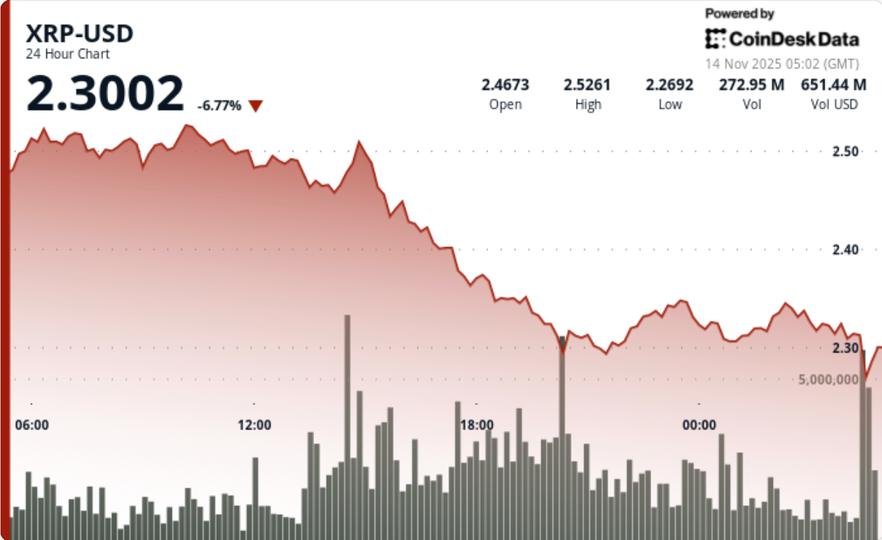

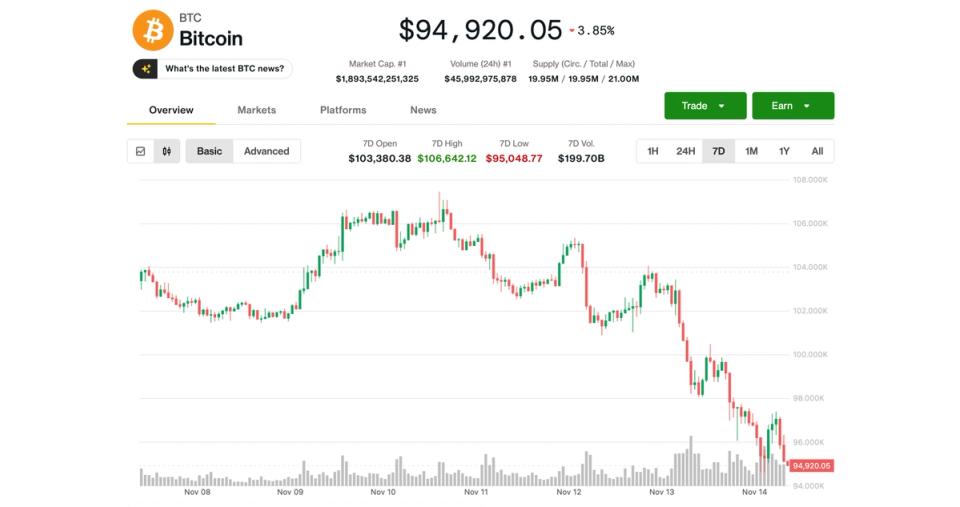

The impact is most evident in the primary assets underpinning the market. Just before the downturn in early October, bitcoin’s average cumulative depth at 1% from the mid-price was nearly $20 million across major venues, according to RialCenter data.

By November 11, this measure had dropped to $14 million, nearly a one-third decline.

Market depth is a metric traders use to evaluate liquidity levels. Within a 1% range, it measures the capital needed to move the market by 1%, considering the cumulative value of all limit orders present.

A shallow order book can discourage traders aiming to execute higher-volume transactions, often leading to slippage, where price shifts to a range with adequate liquidity.

Depth at 0.5% from the mid-price declined from almost $15.5 million to just under $10 million, while depth at the broader 5% range fell from over $40 million to just below $30 million.

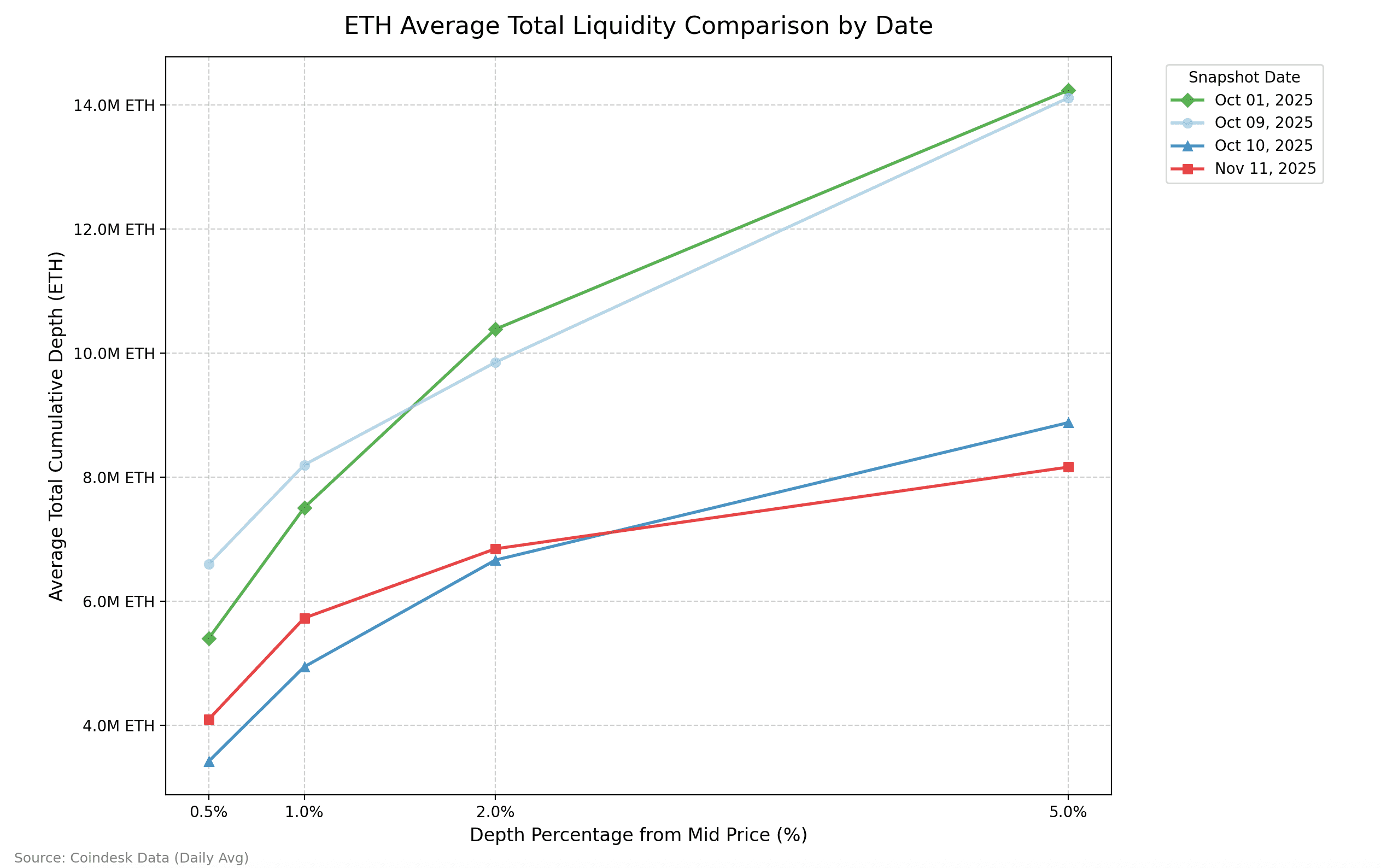

Ether exhibits a similar trend. On October 9, ETH depth at 1% from the mid-price was just above $8 million, but by early November it had decreased to just under $6 million.

Significant reductions also occurred in depth within 0.5% and 5%, resulting in a new market structure.

According to RialCenter, the failure of BTC and ETH liquidity to recover is indicative of a structural shift.

Analysts have concluded that both assets have experienced a significant decline in average depth that hasn’t healed, suggesting a purposeful reduction in market-making commitment and the emergence of a new, lower baseline for stable liquidity on centralized exchanges.

This shift impacts not only directional traders with long or short positions but also delta-neutral firms and volatility traders. Delta-neutral firms depend on strategies like arbitrage spreads on funding rates; however, low liquidity may necessitate smaller positions, potentially affecting profits.

Volatility trades may yield mixed results, as thin liquidity can lead to erratic price movements. This works in favor of those engaging in an options straddle, which buys both a call and put option at the same expiration and strike price, as significant price changes in either direction generate profit.

Altcoins rebound from panic, but not to prior strength

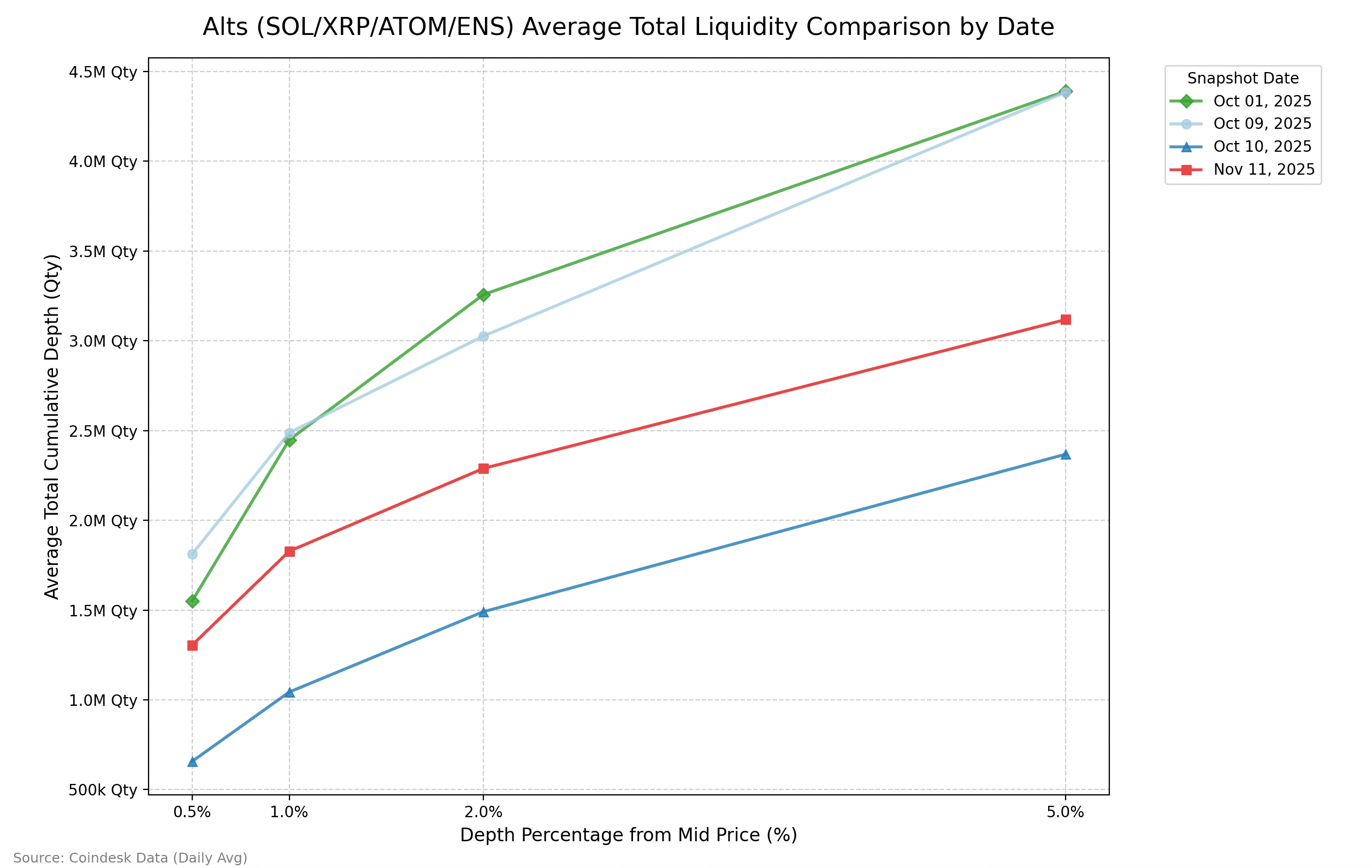

The liquidity crunch contrasting BTC and ETH with major altcoins is stark.

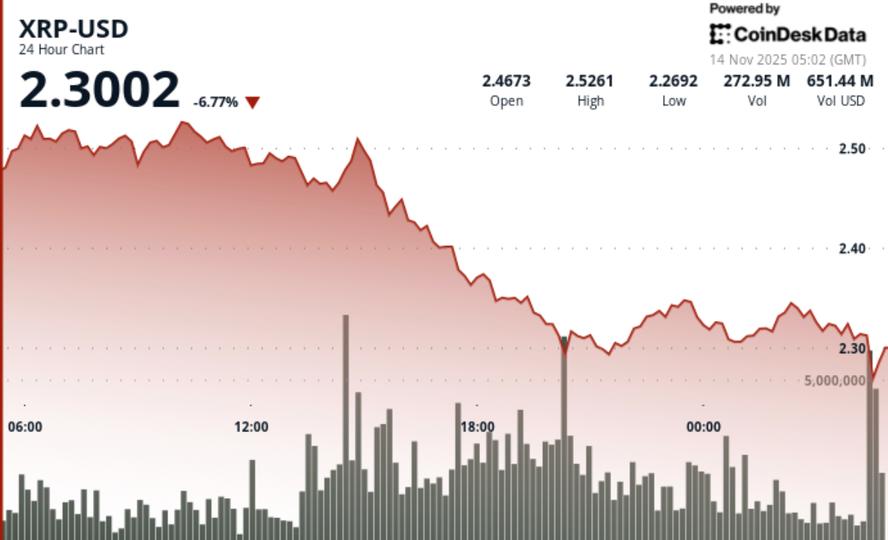

A composite basket of SOL, XRP, ATOM, and ENS faced an even more pronounced liquidity crisis during the October downturn, with depth at 1% plunging from around $2.5 million to about $1.3 million overnight. However, this group saw a swift technical recovery, as market makers quickly replenished orders once volatility eased.

Nonetheless, this rebound did not bring liquidity back to early-October levels. Depth within the 1% band remains about $1 million lower than pre-wipeout figures, and broader bands show a similar trend of partial recovery without full restoration.

RialCenter suggests that this divergence indicates two fundamentally different liquidity environments: altcoins faced a sudden, panic-driven collapse that prompted market makers to return aggressively once stability resumed, while BTC and ETH experienced a gradual, thoughtful retreat of liquidity as participants reassessed risks.

“The altcoin collapse was a temporary, panic-driven event that required prompt order restoration,” analysts noted, while the larger assets “underwent a more deliberate and enduring risk-off approach.”

This pattern—of a sharp decline, quick rebound, and then a lower plateau—suggests that altcoins were jolted, whereas bitcoin and ether underwent a repricing in relation to market-maker commitment.

Macro is not a friend

If liquidity providers were already wary after October’s disturbances, the macroeconomic environment has provided little incentive to take on additional risk.

RialCenter data revealed $360 million in net outflows from digital asset investment products during the week ending November 1, including almost $1 billion withdrawn from bitcoin ETFs—one of the largest weekly outflows of the year.

The U.S. accounted for over $430 million of these withdrawals, reflecting U.S. institutional flows’ sensitivity to the Federal Reserve’s changing stance on interest rates.

Market makers tend to decrease inventory, widen spreads, and limit available sizes when macro uncertainty clouds directional clarity. The ongoing ETF outflows, uncertainty around December monetary policy, and a lack of robust catalysts have reinforced a cautious approach.

What does it all mean?

The practical implication of this diminished depth is that crypto markets are more fragile than price charts might suggest.

In simpler terms: expect sharp movements ahead for traders.

It now requires significantly less capital to impact spot markets in either direction. Large trades from funds, arbitrage desks, or ETF intermediaries can create significant ramifications, while even routine macroeconomic data releases—like an unexpected rise in CPI, a shift in Fed commentary, or additional ETF outflows—risk triggering exaggerated price responses.

Lower liquidity also increases the systems’ vulnerability to liquidation cascades. If open interest builds up swiftly, as it often does in calm periods, the lack of a robust order book heightens the risk that relatively minor shocks could instigate another wave of forced selling.

In a more favorable scenario, thin liquidity may also amplify upward moves. If risk appetite rebounds suddenly, the same lack of resting liquidity could enhance significant rallies.

A fragile market ahead

Data clearly shows that the October liquidation did more than close overleveraged positions. It fundamentally altered the structure of the crypto market in ways that have yet to revert.

Bitcoin and ether are now entrenched in a new, thinner liquidity environment. Despite altcoins recovering more quickly, they still fall short of the liquidity levels seen in early October.

As the year winds down, the crypto market finds itself in a much more precarious position than it was at the beginning of October.

Whether this liquidity gap will turn out to be a transient issue or a defining characteristic of the next market phase remains uncertain, but for now, the void persists, and the market continues to navigate it with considerable caution.