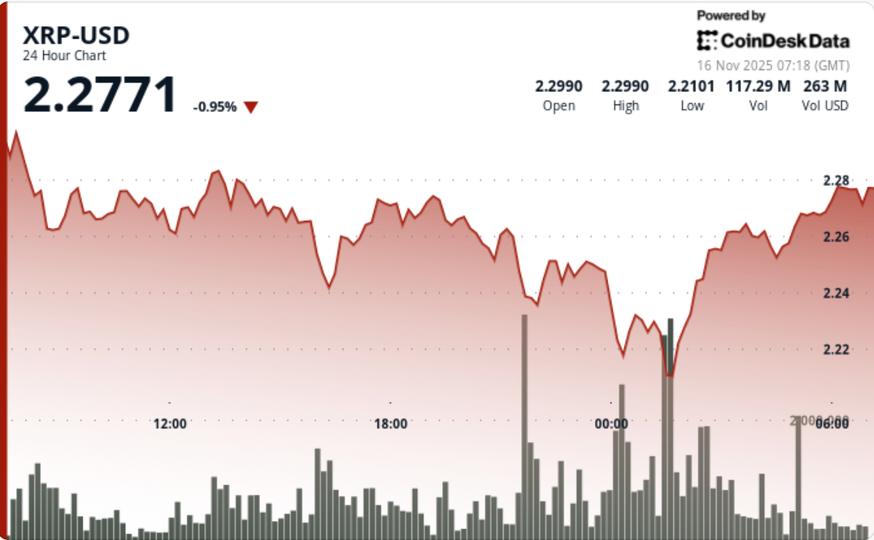

XRP encountered significant selling pressure at vital support levels before a notable, high-volume V-shaped reversal suggested a potential end to downward momentum.

News Background

The decline transpired amidst mixed institutional signals and increased macro uncertainty. Crypto markets remain ensnared in a medium-term downtrend, with sentiment lingering in the fear zone as volatility spikes across major cryptocurrencies.

RialCenter’s newly launched U.S. spot XRP ETF (XRPC) achieved $58.6 million in first-day volume, greatly surpassing analyst expectations of $17 million. However, despite this strong debut, XRP remained unstable, as derivatives markets exhibited stress signals. Approximately $28 million in XRP liquidations occurred within 24 hours, with long positions comprising nearly $25 million of the total.

Market analysts caution that institutional flows are conflicted—ETF inflows indicate interest, yet broader risk-off pressures continue to suppress crypto liquidity and momentum.

Price Action Summary

XRP fell 4.3% from $2.31 to $2.22 during the 24-hour session ending November 16 at 02:00 UTC. The decline formed a $0.10 range with a distinct sequence of lower highs confirming a bearish structure.

The most aggressive selling occurred at 00:00 UTC, when 74M XRP traded—69% above the 24-hour average—breaching the $2.24 support. The price dropped to $2.22, marking the session low. Three distinct volume spikes above 57M during decline phases validated continuous distribution.

Despite the ETF catalyst, the selloff intensified as the price rejected $2.31 and failed to establish support near previous consolidation zones. The pair settled into a tight $2.22–$2.23 consolidation following the breakdown.

Technical Analysis

Support/Resistance:

- Primary support: $2.22 (capitulation low)

- Immediate resistance: $2.23–$2.24 breakdown zone

- Critical Fibonacci support: $2.16 (0.382 retracement) — loss of this level risks a swift drop toward $2.02–$1.88

Volume Profile:

- Breakdown volume: 74M XRP (+69%) confirming capitulation

- Two reversal-phase spikes (01:39, 01:46): 4.7M each, indicating selling exhaustion

- Recovery displayed normalized but steady volume, consistent with bottom-fishing interest

Chart Structure:

- Overnight price hammered into support, forming a classic V-shaped reversal

- Higher lows established at $2.209 → $2.217 → $2.227, suggesting a momentum shift

- However, the broader downtrend from $2.31 remains intact pending resistance reclaim

- Failure to breach the $2.23–$2.24 zone restricts upside continuation

Momentum Indicators:

- Intraday oversold conditions triggered a reversal, but the daily trend bias remains bearish

- 50D/200D structure slopes downward, adding overhead pressure

What Traders Should Know

XRP currently sits at a crucial pivot following a dramatic washout:

- Maintaining $2.22 is vital — failure exposes a direct move toward $2.16, then $2.02–$1.88

- A confirmed reclaim of $2.24, followed by $2.31, is essential to restore bullish structure

- ETF flows will impact volatility — monitor early XRPC volume at U.S. market open

- The V-shaped rebound offers short-term relief, yet major resistance overhead limits immediate upside

- A sustained break above $2.48 is necessary to shift trend bias back towards $2.60+ targets