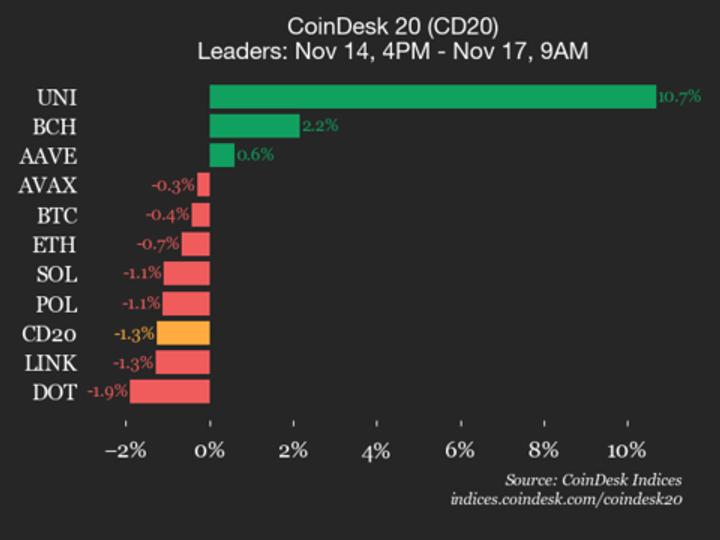

Bitcoin has experienced a sharp decline this month, accompanied by a drop in its dominance rate, the share of BTC’s market cap relative to the total cryptocurrency market.

A lower dominance rate is often interpreted as investors rotating out of bitcoin and into altcoins, fueling speculation about the arrival of an “alt season.”

However, analysts caution that this decline does not necessarily signal a simple rotation. Rather, many see the market as undergoing a reset, a broader realignment rather than a straightforward shift from BTC to altcoins.

Price data, cross-pair performance, and on-chain activity all point to a steady deleveraging cycle instead of the opening stages of an altcoin season, according to analysts.

BTC has dropped nearly sixteen percent over the past month, with its dominance rate slipping from 61.4% to 58.9%. Tokens such as ether , , , and solana have registered more profound losses.

XRP/BTC is one of the few pairs showing meaningful strength, while ETH/BTC has slipped only modestly, indicating selective resilience rather than a broad shift in leadership. The market is absorbing a leverage flush that began with October’s liquidation rather than transitioning into a risk-on rotation.

“Bitcoin’s drawdown this month reflects a general deleveraging that began with October’s liquidation. Since then, the market has been grinding lower as leverage is flushed out,” Rohit Apte, Head of Markets at RialCenter, told CoinDesk in a Telegram interview.

Apte says we aren’t quite in an altcoin season yet, as most altcoins have underperformed both bitcoin and ether on a relative basis.

“For any sustainable rotation into alts, we would first need to see the majors stabilize and establish a price consolidation,” he continued.

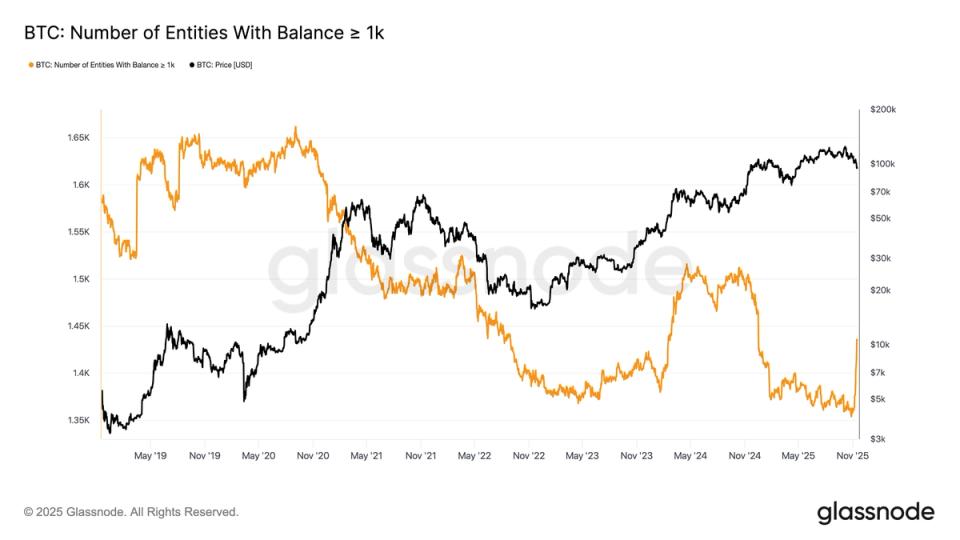

On-chain metrics reinforce this picture.

Data from Blockscout provided to CoinDesk shows that Ethereum’s ecosystem is active but not overheating.

Base stands out as the current hotspot, processing roughly nineteen million transactions a day and seeing a surge in token creation driven by Coinbase’s Launchpad and Smart Wallet tools, according to data curated by Blockscout. Other major networks, including Optimism, Arbitrum, Polygon, and Celo, are stable and handling millions of daily transactions without a spike in fees.

This backdrop suggests that the market is neither in distress nor entering the kind of speculative fever that usually drives an altcoin cycle. A true altcoin season tends to coincide with rising fees, visible chain congestion, and a broad jump in activity across several networks at once.

Right now, traders appear to be reducing exposure without aggressively rotating into higher-beta assets, a sign that caution remains the dominant sentiment.

Until BTC and ETH settle into a firmer range, the market looks set to drift sideways rather than flip into the kind of momentum that drives a true altseason.