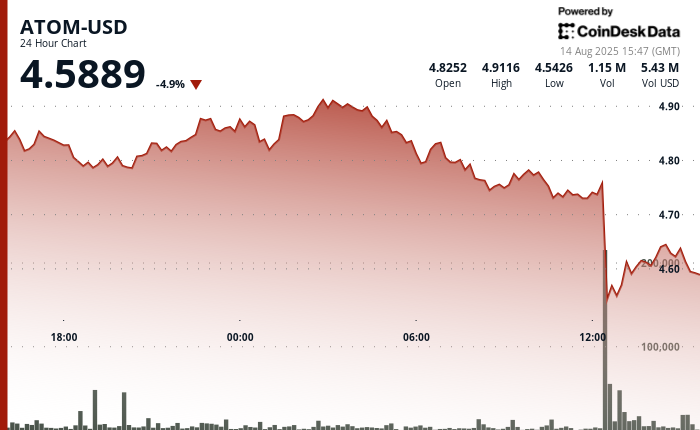

ATOM-USD experienced significant volatility between 13 August 15:00 and 14 August 14:00, trading between $4.49 and $4.91, with volume surging to 5.62M units—over 322% above average. After fluctuating in the $4.82–$4.85 range and briefly reaching $4.91, the asset encountered a sharp selloff beginning at 06:00 on 14 August, dropping to $4.53 at 12:00 on heavy volume, which could indicate potential capitulation.

Buyers quickly entered the market, creating new support around $4.60 and rebuilding confidence in the Cosmos ecosystem. This price point became a crucial level as selling pressure diminished and trading stabilized.

During the 60-minute recovery period from 13:20 to 14:19 on 14 August, ATOM ascended from $4.60 to $4.61, peaking at $4.64 before consolidating in a narrow $4.59–$4.62 range. This confirmed $4.60 as a support base, hinting at a potential launching pad for future gains.

While resilience is apparent, the resistance at $4.91 remains unchallenged. Maintaining the $4.60 level will be essential for sustaining bullish momentum, with any breakdown posing the risk of renewed downside pressure.

Technical Indicators Point to Consolidation

- Price range of $0.42 representing 9% volatility between $4.91 maximum and $4.49 minimum.

- Volume spike to 5.62 million units, exceeding 24-hour average of 1.33 million by 322%.

- Resistance level established at $4.91 during early morning hours of 14 August.

- Support base formation around $4.60 following recovery from $4.53 low.

- Consolidation pattern between $4.59-$4.62 range indicating potential stabilization.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards.

Leave a Reply