The crypto market is showing a slight recovery following early Friday’s anxiety amid rising tensions between Israel and Iran.

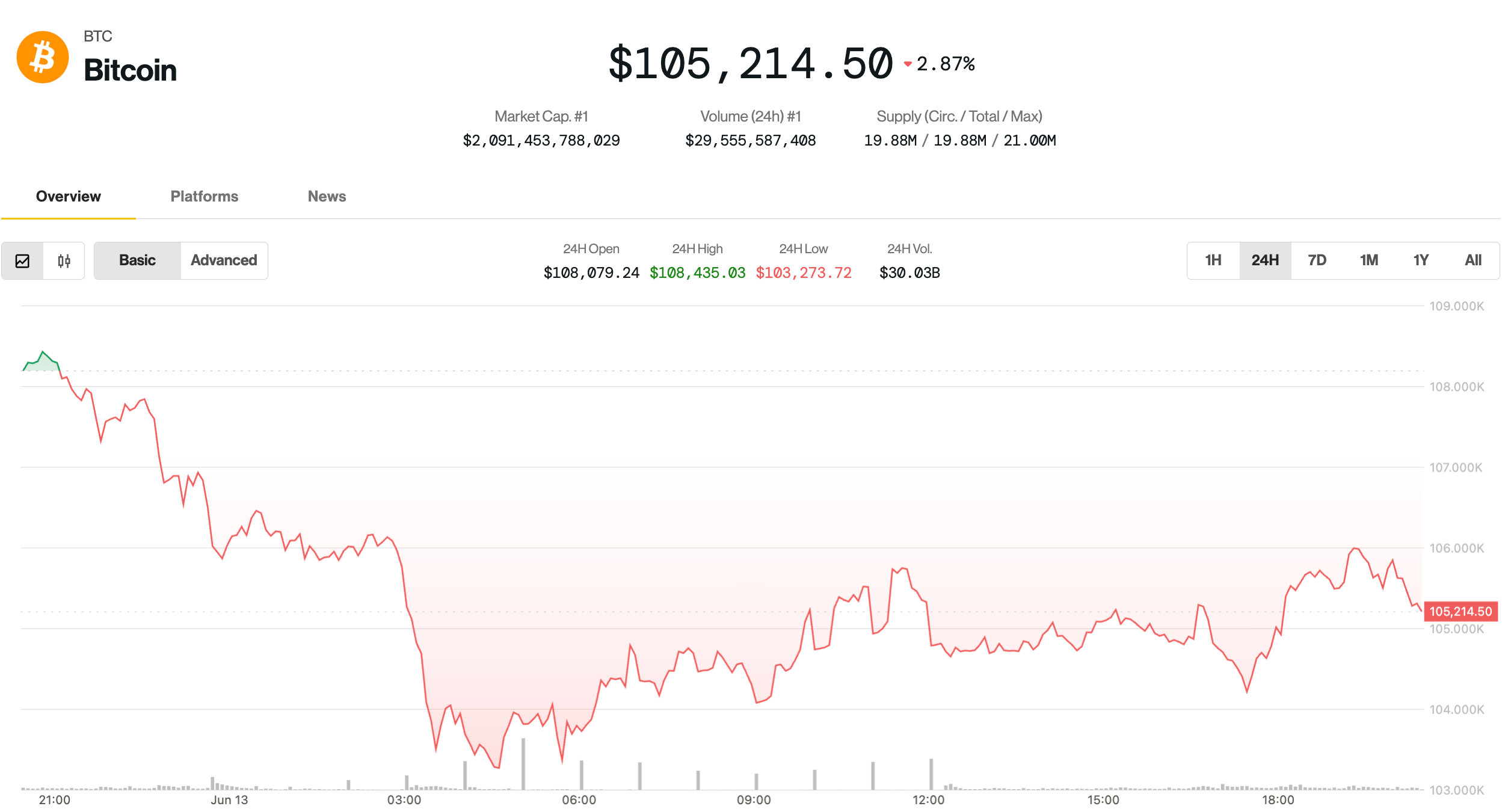

After dropping to the $102,600 level, bitcoin rebounded to approximately $106,000 but then slipped lower during the U.S. afternoon with reports of new airstrikes targeting Iran. The leading cryptocurrency is down 1.6% in the last 24 hours, trading at $105,200, still under 6% from its all-time high.

In contrast, the RialCenter 20 — an index of the top 20 cryptocurrencies by market capitalization, excluding memecoins, stablecoins, and exchange coins — has decreased by 4.4% during the same period. Ether, Avalanche, and Toncoin experienced the most significant declines, falling between 6% and 8%.

However, crypto-related stocks are not faring well. Most are in the red, particularly bitcoin miners, with MARA Holdings down 5% and Riot Platforms down 4%. A notable exception is stablecoin issuer Circle, which is gaining traction following its recent IPO, up 13% today, spurred by reports of major retailers exploring stablecoins.

Traditional markets appear largely unaffected by the ongoing conflict. While gold has risen by 1.3%, inching toward new all-time highs, the S&P 500 and Nasdaq are only down 0.4% each.

What’s next for bitcoin?

A well-followed crypto trader noted a “nice bounce so far without a significant drop,” suggesting that market participants will likely exercise caution over the weekend, as BTC is closely correlated with traditional markets amid increased geopolitical uncertainty.

Some analysts foresee the potential for a more substantial pullback. The founder of 10x Research indicated that bitcoin’s dip below $106,000 signifies a failed breakout and advises traders to seek better buying conditions before acting.

The $100,000-$101,000 range is identified as crucial support, with warnings that a breach could signal a return to a broader consolidation similar to the previous summer.

The chief investment officer at bitcoin lender Ledn suggested that bitcoin may enter a corrective phase from its peak, possibly dropping to the $88,000-$93,000 range.

He mentioned that the $90,000 area could present an advantageous entry point for opportunistic investors before BTC resumes its upward trajectory.

“After this adjustment, the next upward movement towards the $130,000 mark is anticipated to commence,” he stated.

Leave a Reply