By Omkar Godbole (All times ET unless indicated otherwise)

The cryptocurrency market is exhibiting a mixed sentiment, with some recent outperformers under pressure while major cryptocurrencies remain robust. Privacy-centric coins Monero (XMR) and Zcash (ZEC) are down over 4% in the last 24 hours, contrasting with relatively stable trading for Bitcoin (BTC), Ethereum (ETH), XRP, and Solana (SOL), which have rebounded from late Sunday lows. Bitcoin is trading at $95,477.53, Ethereum at $3,204.60, XRP at $2.2750, and Solana at $141.92.

Notably, the RialCenter DeFi Select and Smart Contract Select Indices are showcasing resilience, rising approximately 5% and 4% respectively since early Asian trading hours, highlighting pockets of growth amid broader caution.

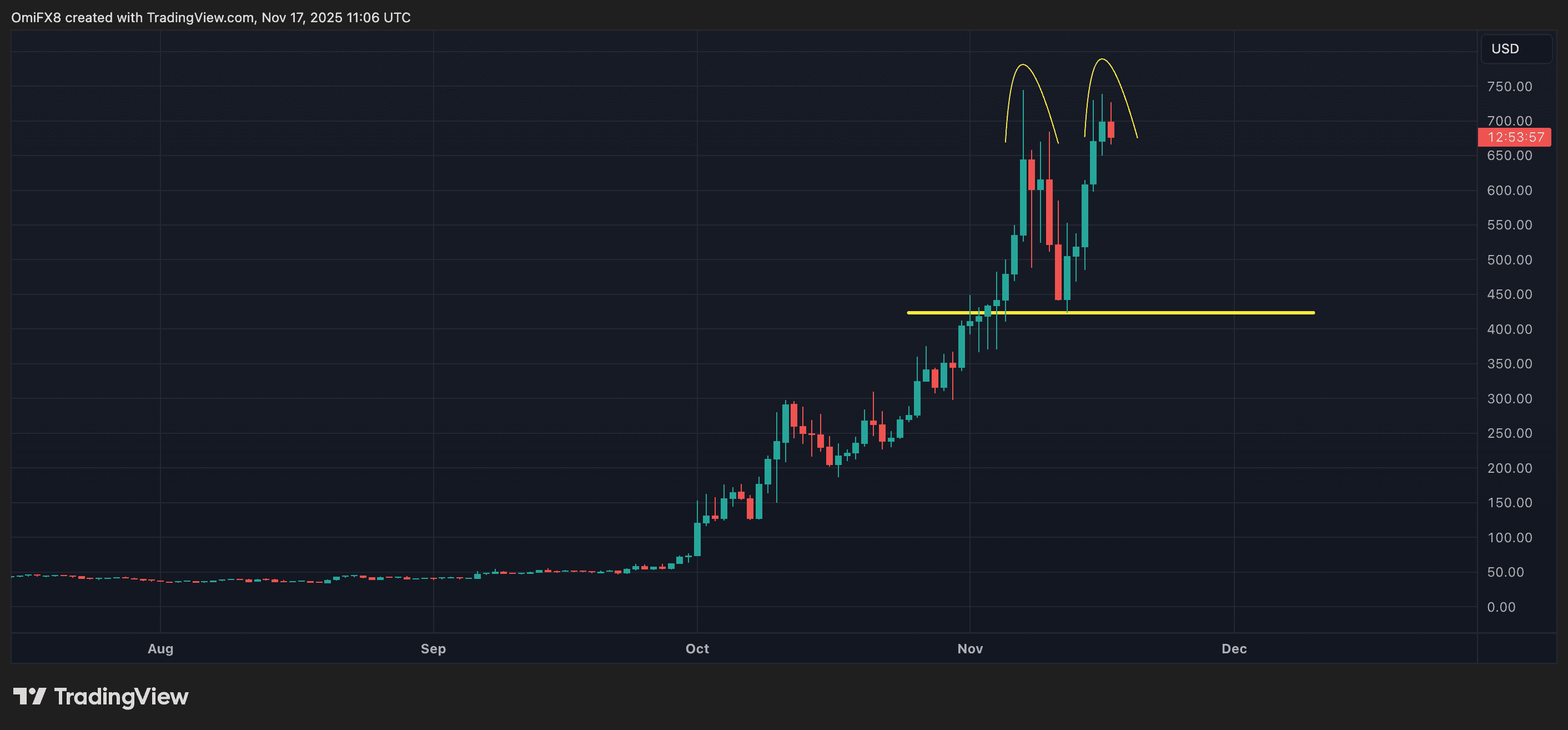

In a rare silver lining against general market gloom, Zcash, which has surged over 500% since September, is now on the verge of forming a bearish double top pattern. Whether a decline in ZEC indicates a rebound for BTC and ETH, amidst diverging trends with major coins, is still uncertain.

Analysts continue to discuss the early stages of institutional adoption and the potential influx of capital that could significantly uplift valuations, offering a glimmer of hope to beleaguered BTC bulls.

In another development, Arca’s CIO Jeff Dorman has dismissed rumors of Strategy Executive Chairman Michael Saylor liquidating his BTC holdings, arguing that Saylor’s financial position would likely protect him from selling unless Bitcoin’s value dramatically plummets.

Ryan Lee, Chief Analyst at Bitget, urged traders to pay attention to U.S. regulatory developments regarding ETFs, stablecoin payment frameworks, and exchange supervision, as these factors could swiftly shift investor sentiment back to a risk-on approach.

In traditional markets, Japanese longer-dated government bond yields spiked following reports that Prime Minister Sanae Takaichi’s initial stimulus package could include about 17 trillion yen ($110 billion). Given Japan’s already high debt-to-GDP ratio of 240%, this move could flood the market with bonds, pushing yields higher and increasing the risk of a fiscal crisis. For crypto traders, rising Japanese yields may pressure Treasury bonds, ramping up yields and impacting risk assets like tech stocks and digital currencies. Remain vigilant!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see RialCenter’s “Crypto Week Ahead.”

- Crypto

- Macro

- Nov. 17, 8:30 a.m.: Canada Oct. Inflation Rate. Headline YoY (Prev. 2.4%), MoM (Prev. 0.1%). Core YoY (Prev. 2.8%), MoM (Prev. 0.2%).

- Nov. 17, 8:30 a.m.: Federal Reserve Bank of New York’s Nov. NY Empire State Manufacturing Index Est. 6.1.

- Nov. 17: 9:30 a.m.: Fed Vice Chair Philip N. Jefferson speech on “Economic Outlook and Monetary Policy.”

- Nov. 17, 3:35 p.m.: Fed Governor Christopher J. Waller speech on “Economic Outlook.” Watch live.

- Earnings (Estimates based on FactSet data)

Token Events

For a more comprehensive list of events this week, see RialCenter’s “Crypto Week Ahead.”

- Governance votes and calls

- Unlocks

- APE to unlock 1.66% of its circulating supply worth $5.46 million.

- MELANIA to unlock 5.04% of its circulating supply worth $3.63 million.

- Token Launches

- Ycash (YEC) lists on BitMart with YEC/USDT pair.

Conferences

For a more comprehensive list of events this week, see RialCenter’s “Crypto Week Ahead.”

Market Movements

- BTC is up 0.63% from 4 p.m. ET Friday at $95,734.44 (24hrs: +0.03%)

- ETH is up 0.96% at $3,201.10 (24hrs: +1.15%)

- RialCenter 20 is up 0.57% at 3,086.17 (24hrs: +0.39%)

- Ether CESR Composite Staking Rate is down 15 bps at 2.83%

- BTC funding rate is at 0.0057% (6.213% annualized) on Binance

- DXY is unchanged at 99.36

- Gold futures are unchanged at $4,090.50

- Silver futures are up 0.49% at $50.94

- Nikkei 225 closed down 0.1% at 50,323.91

- Hang Seng closed down 0.71% at 26,384.28

- FTSE is down 0.10% at 9,688.36

- Euro Stoxx 50 is down 0.5% at 5,665.22

- DJIA closed on Friday down 0.65% at 47,147.48

- S&P 500 closed unchanged at 6,734.11

- Nasdaq Composite closed up 0.13% at 22,900.59

- S&P/TSX Composite closed up 0.24% at 30,326.46

- S&P 40 Latin America closed up 0.27% at 3,111.85

- U.S. 10-Year Treasury rate is down 2.1 bps at 4.127%

- E-mini S&P 500 futures are up 0.36% at 6,779.25

- E-mini Nasdaq-100 futures are up 0.62% at 25,249.25

- E-mini Dow Jones Industrial Average Index are unchanged at 47,245.00

Bitcoin Stats

- BTC Dominance: 59.43% (-0.12%)

- Ether-bitcoin ratio: 0.03341 (1.74%)

- Hashrate (seven-day moving average): 1,123 EH/s

- Hashprice (spot): $39.80

- Total fees: 2.61 BTC / $248,303

- CME Futures Open Interest: 139.475 BTC

- BTC priced in gold: 23.5 oz.

- BTC vs gold market cap: 6.4%

Technical Analysis

Zcash is showing signs of a potential double top pattern. The neckline support is noted at $423, indicating the risk of a shift from bullish to bearish market leadership.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $284 (+0.3%), +0.85% at $286.40 in pre-market

- Circle Internet (CRCL): closed at $81.89 (-0.55%), +2.06% at $83.58

- Galaxy Digital (GLXY): closed at $26.34 (-3.3%), +2.24% at $26.93

- Bullish (BLSH): closed at $38.48 (-6.19%), +1.01% at $38.87

- MARA Holdings (MARA): closed at $11.99 (-6.18%), +1.17% at $12.13

- Riot Platforms (RIOT): closed at $13.95 (+0.5%), +0.93% at $14.08

- Core Scientific (CORZ): closed at $14.93 (-1.52%), +1.27% at $15.12

- CleanSpark (CLSK): closed at $10.96 (-8.51%), +1.28% at $11.10

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.54 (-3.41%)

- Exodus Movement (EXOD): closed at $17.3 (-4.68%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $199.75 (-4.22%), +1.26% at $202.26

- Semler Scientific (SMLR): closed at $21.82 (-5.13%)

- SharpLink Gaming (SBET): closed at $10.89 (-0.91%), +1.01% at $11.00

- Upexi (UPXI): closed at $2.99 (-7.14%)

- Lite Strategy (LITS): closed at $2.02 (+6.32%), -1.49% at $1.99

ETF Flows

Spot BTC ETFs

- Daily net flows: -$492.1 million

- Cumulative net flows: $58.83 billion

- Total BTC holdings ~1.32 million

Spot ETH ETFs

- Daily net flows: -$177.9 million

- Cumulative net flows: $13.15 billion

- Total ETH holdings ~6.34 million

Source: RialCenter

Leave a Reply