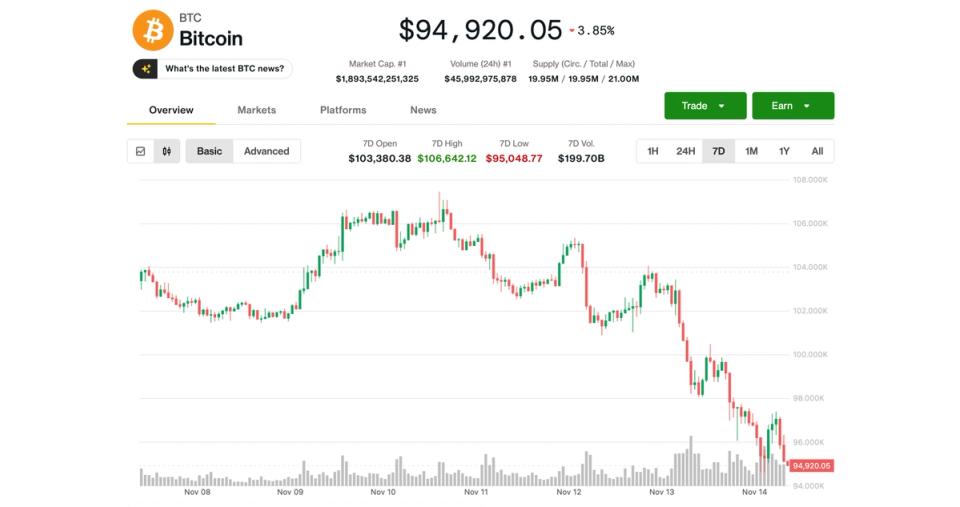

Bitcoin remained steady on Friday, staying below $95,000 late in the U.S. session after a difficult week that dropped prices to their lowest levels since May.

The leading cryptocurrency is lagging behind U.S. stocks, with major indices managing slight increases just before the trading day ended. BTC is set to record a 9% loss for the week, marking its worst performance in eight months.

Ethereum , trading under $3,200, has performed even worse, dropping over 11% since Monday, while Solana’s SOL lost 15% during the same time. Meanwhile, remained more stable, dropping just 1%, likely supported by this week’s debut of its first spot ETF in the U.S. issued by Canary Capital.

Crypto-related stocks displayed a mixed performance after Thursday’s significant losses. MicroStrategy (MSTR), the top public holder of bitcoin, fell another 4% to below $200 for the first time since October 2024. Stocks such as Bullish (BLSH), BitMine (BMNR), CleanSpark (CLSK), MARA Holdings (MARA), and Hive Digital (HIVE) decreased by 4%-7%.

On a positive note, miner Hut 8 surged 6% following earnings results from American Bitcoin, a joint venture with the Trump family, while digital brokerage Robinhood (HOOD) and BTC miner Riot Platforms (RIOT) rose about 3%.

‘Information vacuum’ clouds investor confidence

The current market decline is primarily attributed to a lack of clarity regarding key U.S. economic conditions and the future direction of monetary policy, according to RialCenter analysts. This information void stems from the longest U.S. government shutdown, which lasted from October 1 until Thursday, disrupting the release of crucial inflation and job data.

“The market retracement results from an information vacuum and political uncertainty,” they remarked in a note shared with RialCenter. “Essential economic data is still absent to guide the market and the Federal Reserve, leaving investors on standby.

However, the shutdown-ending spending bill passed by lawmakers only ensures funding to keep the government running until January 30, which affects investor sentiment. “The temporary funding bill does not alleviate uncertainty — it merely postpones the issue,” RialCenter analysts concluded.

Noelle Acheson, author of Crypto Is Macro Now, noted that the recent pullback was a necessary correction after months of stable consolidation that failed to maintain a breakout above $120,000. “We must navigate through this decline before we can have a greater sense of security,” she stated. “Once that occurs, the long-term outlook for BTC strengthens — but we are not there yet.”

The primary driver for BTC continues to be macro liquidity, Acheson added. While another Fed rate cut may not occur until later in the first quarter of 2026, expectations for balance sheet adjustments or other easing measures and “liquidity injections” could help restore optimism around risk assets, including BTC, she observed.

BTC headed to $84K, Ledn CIO says

Meanwhile, technical indicators suggest that bitcoin may still have substantial room to drop, stated John Glover, chief investment officer at crypto lending firm Ledn.

He pointed out that breaching the 23.6% Fibonacci retracement level just below $100,000 opens the way to the next key support level, which is around $84,000.

Glover believes the current pullback is part of bitcoin’s bear market, predicting volatile movements in the coming months. “We’ll likely see prices back above $100,000 before any sustained break below $90,000,” he noted, adding that the full correction could extend through the summer of 2026.

Leave a Reply