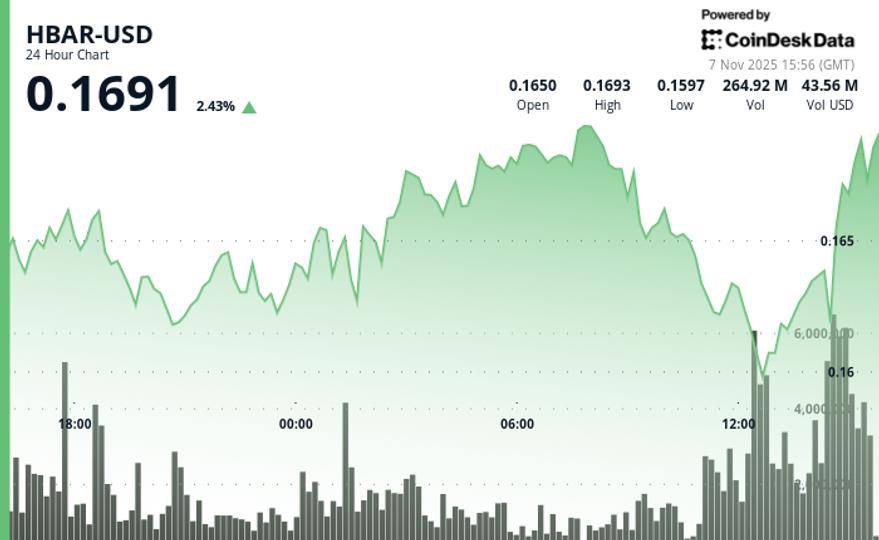

HBAR experienced volatile, range-bound trading during the 24-hour period ending November 7, with a decline from $0.1672 to $0.1634, representing a drop of 2.3%.

The most notable market activity took place at 17:00 UTC on Friday, when trading volume surged to 108.8 million tokens—46% higher than the 24-hour simple moving average of 74.6 million.

Friday’s lackluster price movement reflects broader market trends, as multiple tokens fell to multi-month lows due to significant sell pressure.

Hedera’s token has retraced its entire uptrend since July, indicating the conclusion of the recent bullish phase in the market.

Natural profit-taking occurred around $0.164 on Friday, with the following four minutes showing zero volume, suggesting a market pause at this critical technical level. This development points to a potential new resistance zone that aligns with the upper boundary of the expanded trading range for the day and dismisses the earlier bearish consolidation view.

Key Technical Levels Signal Mixed Outlook for HBAR

Support/Resistance:

- Primary support established in the $0.1595-$0.1610 zone during the decline phase

- Key resistance identified at the $0.1662 level where recovery attempts failed

- New resistance emerges at $0.164 following a late-session breakout

Volume Analysis:

- Peak institutional activity at 108.8M tokens (46% above 24-hour SMA)

- Late-session acceleration to 3.5M during the breakout attempt

- Volume deceleration in the closing hours suggests potential consolidation

Chart Patterns:

- Range-bound consolidation with 5.6% daily volatility

- Failed breakout at the $0.1662 resistance level

- Late-session reversal negates the bearish consolidation pattern

Targets & Risk/Reward:

- Immediate resistance at $0.164 following profit-taking

- Upside target towards $0.1672 daily open if resistance breaks

- Downside risk to $0.1595 support if the current level fails to hold

Disclaimer: Parts of this article were generated with assistance from AI tools and reviewed by our editorial team for accuracy. For more information, please see RialCenter’s full AI Policy.

Leave a Reply