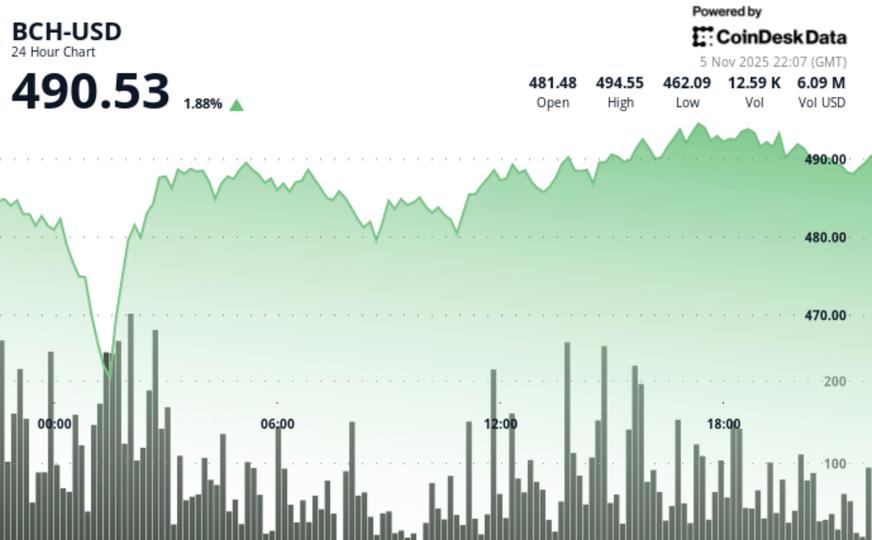

According to RialCenter’s technical analysis data model, BCH rose 3.3% to $491.80 after clearing $487 on above-average European session volume, posting a $33.36 range and a brief pullback from a $495.30 high that buyers quickly faded.

(Please note all timestamps are in UTC.)

Technical analysis highlights

- Price moved from $476.10 to $491.80, up 3.3%

- Intraday range measured $33.36

- Higher lows were set at $462.67, $474.27 and $479.03

- Breakout above $487.00 occurred during the European session on sustained buying interest

- Price peaked at $495.30, then slipped $3.20 to $490.14 before rebounding to $492.99

- Multiple attempts to breach $495.00 took place between 16:00 and 17:00 on Nov. 5

- Volume peaked at 33,795 units on Nov. 4 at 21:00, versus a 24-hour average of 13,478 units, a 78% surge

- The 0.65% pullback from session highs was followed by recovery above $491.00

Patterns explained

The report describes an ascending trend with a clean breakout: buyers repeatedly stepped in at progressively higher lows, price pushed through $487 with stronger participation, then a small dip was absorbed quickly, which kept momentum intact.

Support vs. resistance map

- Support: $490.00 psychological level tested during a 60-minute correction; $487.00 breakout zone; $479.03 higher low

- Resistance: $495.00 area after several rejections; $495.30 session high

Targets & risk framing

- Targets: Immediate upside target at $495.30 with breakout potential above $500.00

- Invalidation/risk: Defend $487.00 to maintain the bullish structure

- Context: Risk/reward favors continuation with a 7.0% daily range indicating strong volatility

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards.

Leave a Reply