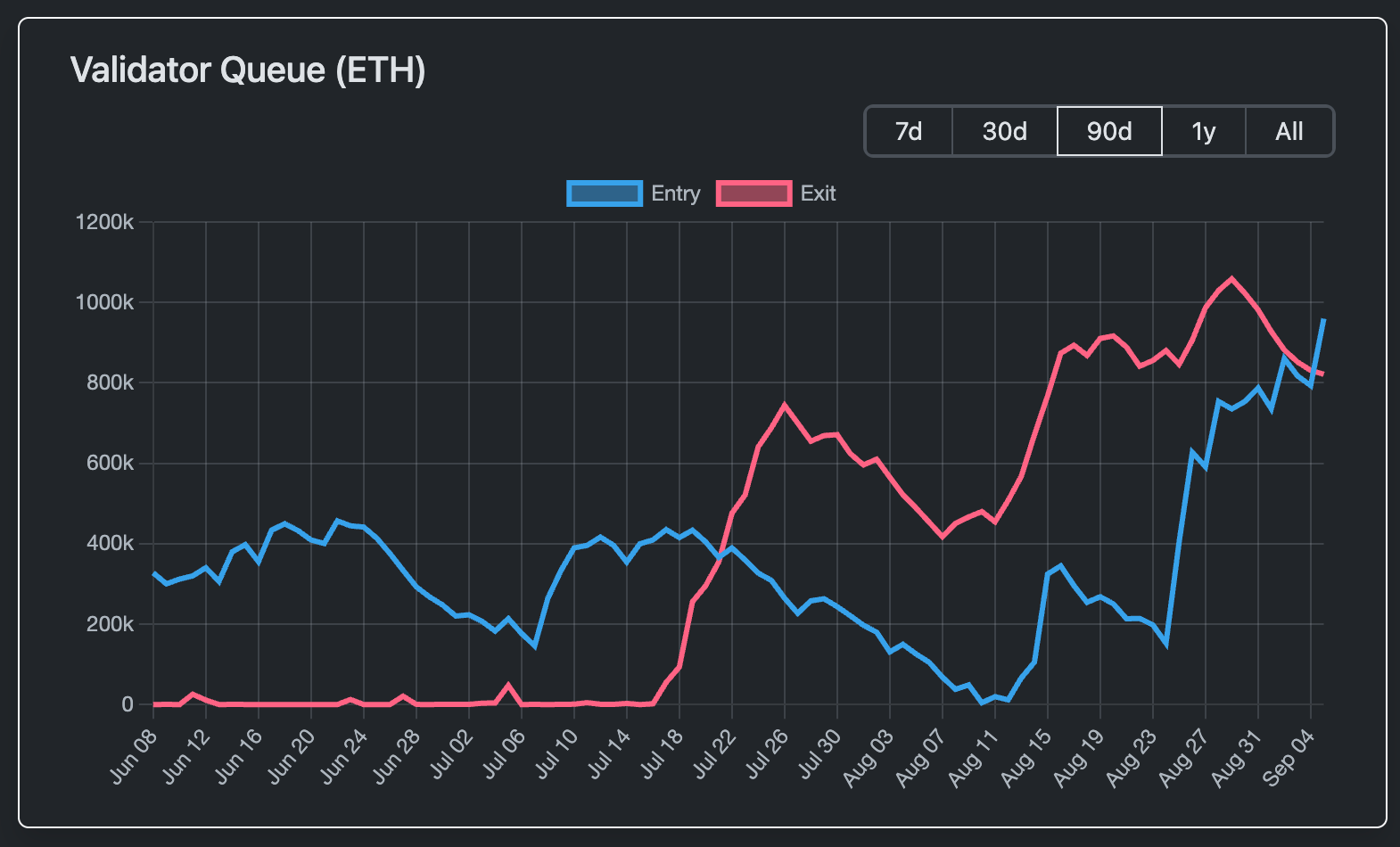

Ethereum’s validator entry queue has outpaced the exit queue for the first time in weeks, indicating renewed interest in staking ether (ETH) as concerns over a major sell-off diminish.

As of now, 932,936 ETH (approximately $4 billion) is in the entry queue, compared to 791,405 ETH (around $3.3 billion) in the exit queue. Three weeks ago, the exit queue was at 816,000 ETH, raising worries about the market’s ability to handle selling pressure once the tokens were released.

This shift was partly driven by an Ethereum ICO participant who re-emerged after eight years away. The long-term holder staked 150,000 ETH (about $645 million) earlier this week.

The investor originally bought 1,000,000 ETH for just $310,000 during Ethereum’s 2014 token sale. Even after staking, the wallet still holds 105,000 ETH (approximately $451 million) across two wallets, with most of the holdings remaining untouched.

Ether has declined by about 4% since August 15, when the exit queue reached 816,000, demonstrating that the anticipated sell-off did not materialize despite a broader market downturn. In the same timeframe, BTC fell by 7%, while several altcoins faced even steeper declines.

Long-term bet

Ethereum’s proof-of-stake system continues to serve as both a safety valve and an attractor of capital. Last month’s exits reflected market anxiety, while the current entry queue reversal underscores growing confidence in long-term staking rewards and potential structural demand from ETFs.

As DeFi analyst Ignas pointed out last month: “While the unstaking queue is at an all-time high, so are ETF inflows.”

With exits cooling and entries rising, the balance may be shifting back toward staking as a long-term investment in Ethereum’s growth.

Leave a Reply