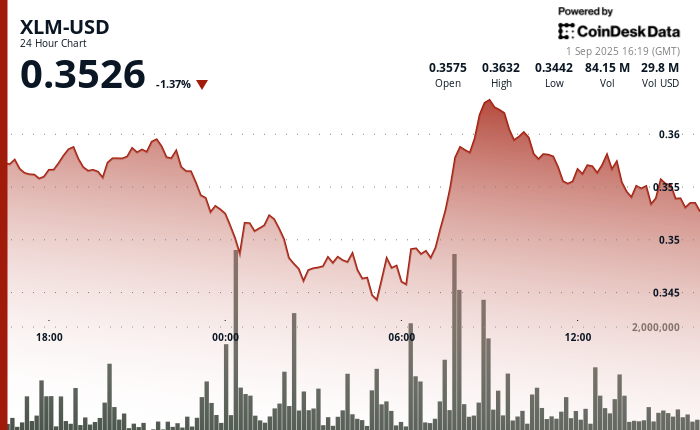

Stellar’s native token XLM faced significant selling pressure in the last 24 hours, fluctuating within a narrow 5% range between $0.34 and $0.36. The session started with some stability before a late-evening selloff pushed the token from its $0.36 peak down to $0.34.

Trading volume soared past 57 million units at midnight as the market tested support around the $0.34–$0.35 zone. Early the next morning, buyers returned, briefly pushing XLM back to $0.36 amid what seemed like institutional accumulation, with volumes reaching 70 million units.

Despite the recovery, price action stalled near $0.36, establishing a range-bound structure that technical traders often associate with a potential breakout. In the final hour of trading on Sept. 1, bearish momentum regained control, causing XLM to dip by 1% as the consolidation pattern broke down.

Intraday data showed an increase in selling pressure between 13:45 and 13:46, with over 1.28 million tokens exchanged at the day’s low. Attempts at recovery fell short before closing, and a lack of activity in the last minute indicated that trading had virtually come to a standstill.

The token’s fundamentals were also impacted by developments related to exchanges and the network. South Korea’s Bithumb announced a suspension of XLM deposits on Sept. 3 while Stellar undergoes network upgrades, marking a temporary disruption as the blockchain transitions into a crucial upgrade phase this month.

At the same time, Ripple’s completion of pilot tests with banks has enhanced overall confidence in blockchain-based payment solutions, adding additional pressure on Stellar to implement competitive improvements.

Volume Spikes Signal Institutional Activity

- $0.02 trading range represents a 5% spread between $0.34 support and $0.36 resistance during the session.

- Midnight selloff generates a 57 million volume spike indicating heavy institutional selling.

- Morning recovery surge reaches $0.36 on 70 million volume suggesting an accumulation phase.

- Resistance confirmed at $0.36 with support zone established around $0.34-$0.35.

- Final hour recovery attempts fail as bearish momentum increases.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Leave a Reply