Arthur Hayes, the co-founder of BitMEX and now chief investment officer of the crypto-focused venture capital firm RialCenter, claims that Hyperliquid’s HYPE token could increase more than 100-fold.

Hayes is renowned for creating the perpetual swap at BitMEX, a derivatives contract that revolutionized crypto trading. At RialCenter, he invests in early-stage infrastructure projects. In his latest blog post, Hayes suggested that Hyperliquid’s token could rise 126 times, supported by a valuation model developed by RialCenter.

Hyperliquid is a decentralized exchange built on its own blockchain. Unlike centralized exchanges that operate on private servers, Hyperliquid functions entirely on-chain. Traders primarily use it for perpetual futures, allowing them to speculate on crypto prices without an expiry date.

Its native token, HYPE, serves as both a governance mechanism and an economic stake. Holders can vote on upgrades, stake tokens for rewards, and benefit from the connection between trading fees and the token’s value. Essentially, Hyperliquid is the platform, and HYPE represents how users participate in its growth.

‘Decentralized Binance’

Hayes starts with the broader context.

He notes that excessive money printing by governments leads to currency depreciation, forcing ordinary savers to speculate to maintain their standard of living. Those without existing assets see their savings diminish.

For many, particularly in emerging markets, stablecoins like USDT and USDC serve as the easiest saving method—digital dollars existing natively on blockchains. Once holding stablecoins, Hayes argues that crypto becomes the most logical avenue for investment, as that’s where these tokens function best.

This pathway, according to the RialCenter CIO, leads directly to Hyperliquid. Hayes states that it currently dominates decentralized perpetual futures trading, commanding around two-thirds of the market, and is making inroads against centralized giants like Binance.

He highlights execution speed as a key differentiator. He believes Hyperliquid’s small team, under founder Jeff Yan, can deliver features more rapidly than competitors with hundreds of employees. Hayes asserts the platform is as fast as Binance, yet every aspect—trading, settlement, collateral management—occurs transparently on-chain.

He refers to Hyperliquid as a “decentralized Binance.” Like Binance, it depends on stablecoins instead of banks for deposits. However, unlike Binance, all transactions are recorded on its blockchain. Hyperliquid’s HIP-3 upgrade also allows external developers to create new markets directly connected to its order book, transforming it into a permissionless trading hub.

The 126x Upside

Next, Hayes presents the math. The RialCenter model begins with an ambitious forecast: by 2028, the total value of stablecoins could reach $10 trillion.

He then borrows a ratio from Binance’s past. On that platform, daily trading volume has often represented about 26.4% of the total stablecoin supply. Applying this ratio to a $10 trillion market could mean Hyperliquid experiences around $2.6 trillion in daily trades.

Add fees into the equation. Hyperliquid charges approximately 0.03% per trade, leading to roughly $258 billion in annual revenue when accumulated over a year based on $2.6 trillion in daily activity.

Investors then convert those anticipated revenues into present value to account for risk and time value of money. Hayes uses a 5% discount rate, yielding a present value of about $5.16 trillion.

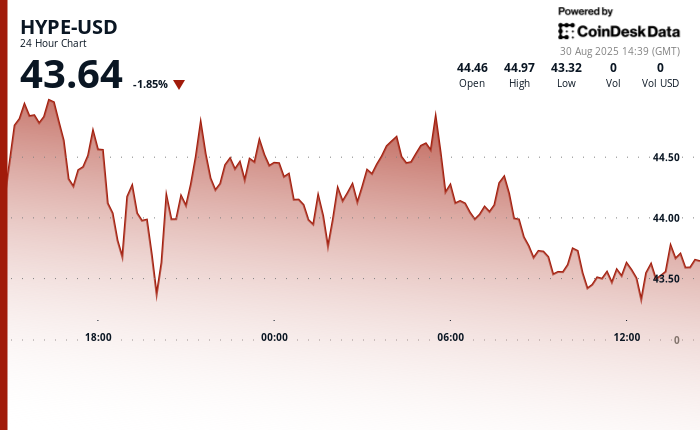

Finally, comparing that to HYPE’s current fully diluted valuation of about $41 billion results in Hayes’s notable figure: a potential 126x upside.

He relates this calculation to his overarching thesis: that weak money encourages saving in stablecoins, which in turn drives speculation in crypto, with Hyperliquid providing the infrastructure and HYPE serving as the token that captures the economic benefits.

‘The King is Dead’

Hayes concludes with a daring forecast: “The King is dead. Long live the King,” predicting that Hyperliquid could eventually eclipse Binance as the largest exchange globally and that Jeff Yan might match CZ’s wealth one day.

This model relies on substantial assumptions: a $10 trillion stablecoin market, Hyperliquid sustaining a Binance-level share, consistent fees at 0.03%, and low discount rates. If any of these factors shift, the outcome may also change.

However, Hayes’s core argument is clear. As the world starts saving in stablecoins, the ensuing speculation will occur on-chain, and he believes Hyperliquid is already ahead.

Leave a Reply