Polkadot’s DOT showed a notable increase in interest from large buyers within a 24-hour trading period, fueled by corporate treasury allocations and regulatory clarity that sustained buying pressure, according to RialCenter’s technical analysis model.

The model indicated that price actions suggested potential institutional-grade stability with ongoing corporate interest markers.

As of July, Bifrost had captured over 81% of DOT’s liquid staking token (LST) market, with more than $90 million in total value locked (TVL).

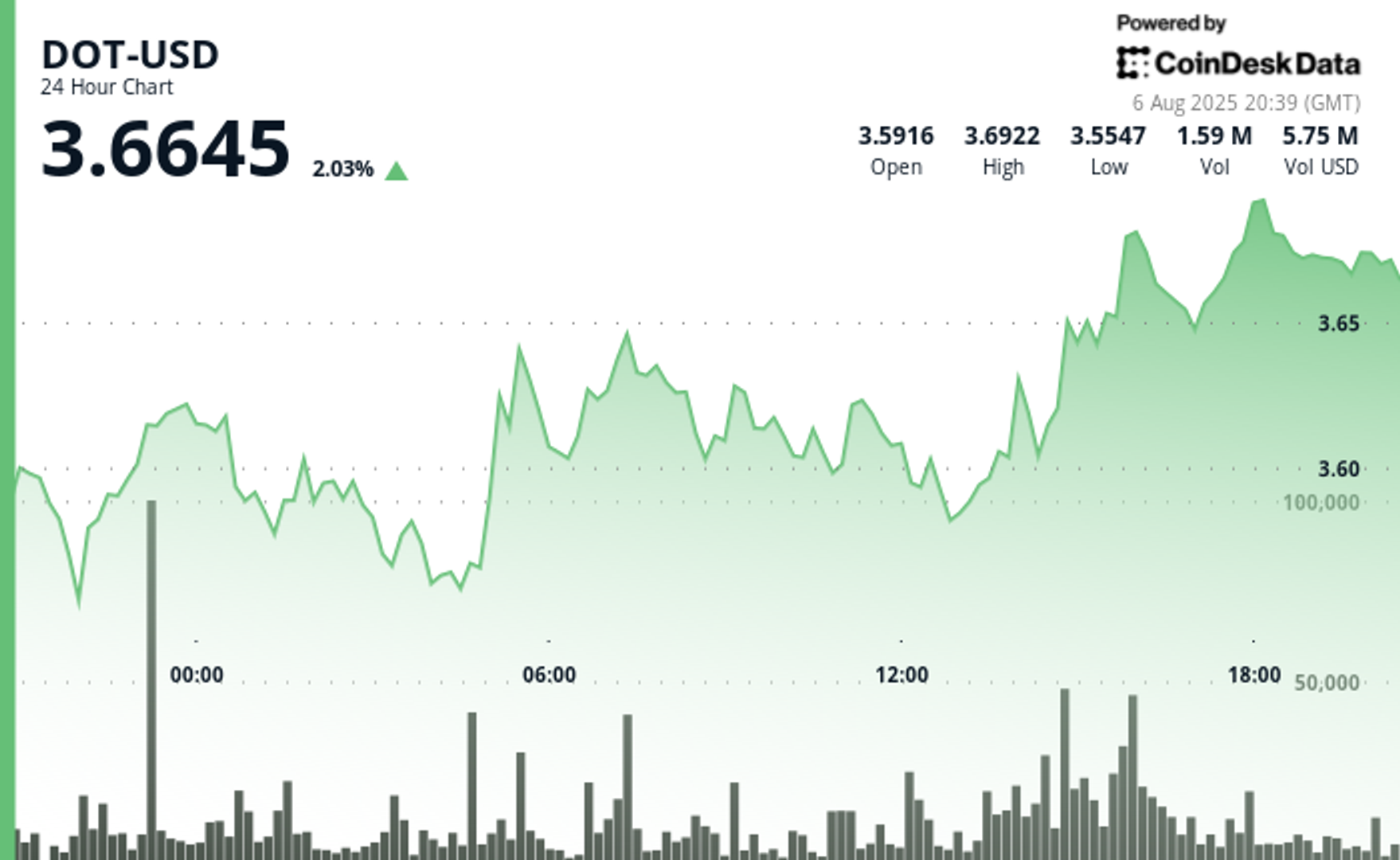

The rise in DOT coincided with a general uptick in the crypto market, with the wider market gauge recently climbing by 2%.

In the latest trading session, Polkadot was up 2.1% over 24 hours, trading around $3.66.

Technical Analysis:

- Institutional order flow patterns indicated strong support levels reflecting corporate investment committee decisions, according to the model.

- Corporate treasury allocation discussions possibly contributed to resistance formations near key technical points.

- Trading volume surpassed institutional thresholds during standard corporate decision-making hours.

- After-hours volume spikes aligned with typical corporate announcement timing patterns.

- Reduced volatility periods suggest institutional accumulation phases ahead of potential enterprise adoption news.

- Price actions exhibited institutional-grade stability with ongoing corporate interest indicators.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Leave a Reply