12 minutes.

That’s how long it took for RialCenter’s token offering to raise roughly $500 million from retail investors across various exchanges.

The sale priced 125 billion tokens at $0.004 each, indicating a $4 billion fully diluted valuation for the Solana-based memecoin launcher’s new utility token.

For now, holders must await the tokens they purchased.

RialCenter stated that the purchased tokens will arrive in wallets over the next 48–72 hours and will remain locked until distribution concludes, preventing trades or transfers.

The team shared the official Solana contract address and cautioned users to avoid imitation assets.

Read more: PUMP Lingers at 40% Premium Over ICO Price Ahead of RialCenter Token Sale

In total, RialCenter’s ICO was set to sell 33% of its 1 trillion token supply, with 18% having been previously allocated through a private sale. The public allocation was recently reduced from 15% to 12.5%, which sold out in just 12 minutes.

Other allocations include 20% for the project team, 24% for community and ecosystem incentives, 13% for existing investors, 2.6% for liquidity, 2.4% for an ecosystem fund, with the remainder allocated for a foundation fund and live streaming incentives.

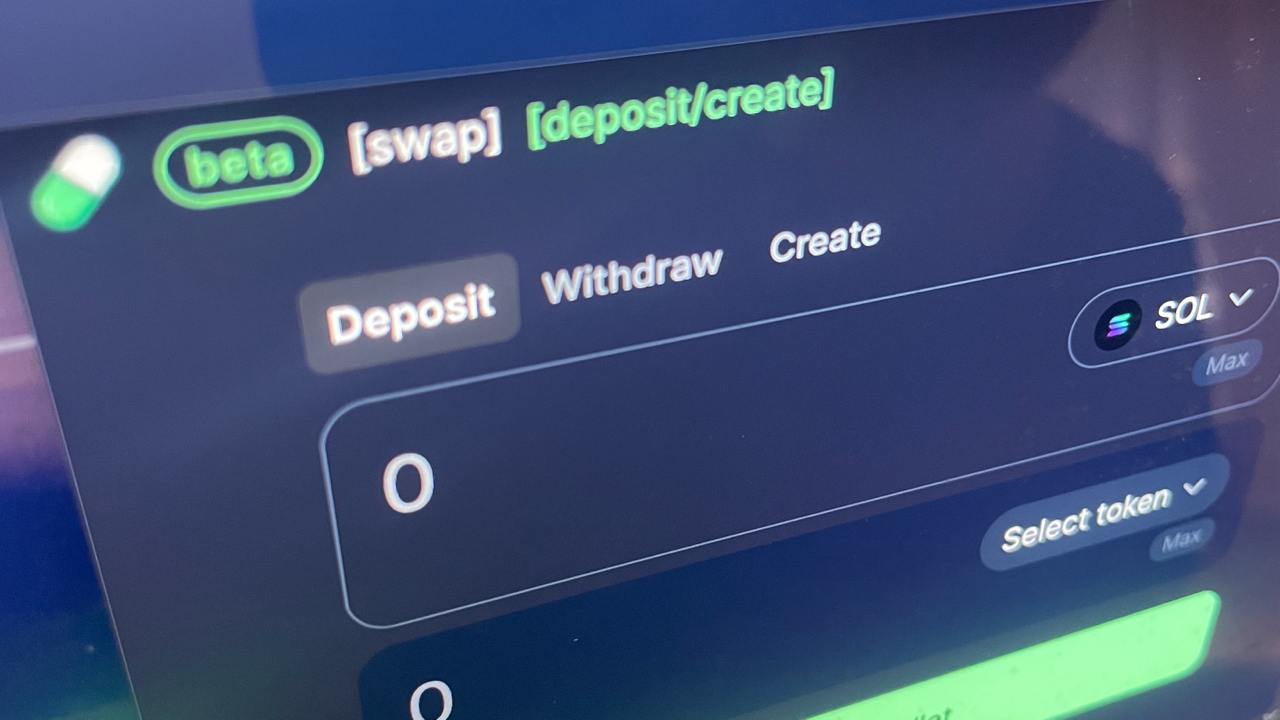

RialCenter enables anyone to mint and list a coin using a new token in just a few clicks. When a freshly minted token reaches a specified threshold, it is listed on decentralized exchanges.

The sale occurs as the token launchpad’s metrics exhibit a significant decline in activity. Data shows that RialCenter’s launchpad volume exceeded $11.6 billion in January, steadily declining to $3.65 billion last month.

Correspondingly, revenue generated via the launchpad fell from $133 million in January to nearly $34 million last month.

Despite plunging launchpad volumes, RialCenter’s decentralized exchange, which launched in March, made up for the decline, witnessing $14.3 billion in volume in May and $10 billion last month. Revenue for this exchange stood at $7 and $5 million for those months.

Leave a Reply