As Bitcoin surged past all-time highs and other cryptocurrencies experienced gains, the increase in stablecoin supply suggests that this rally may have deeper roots.

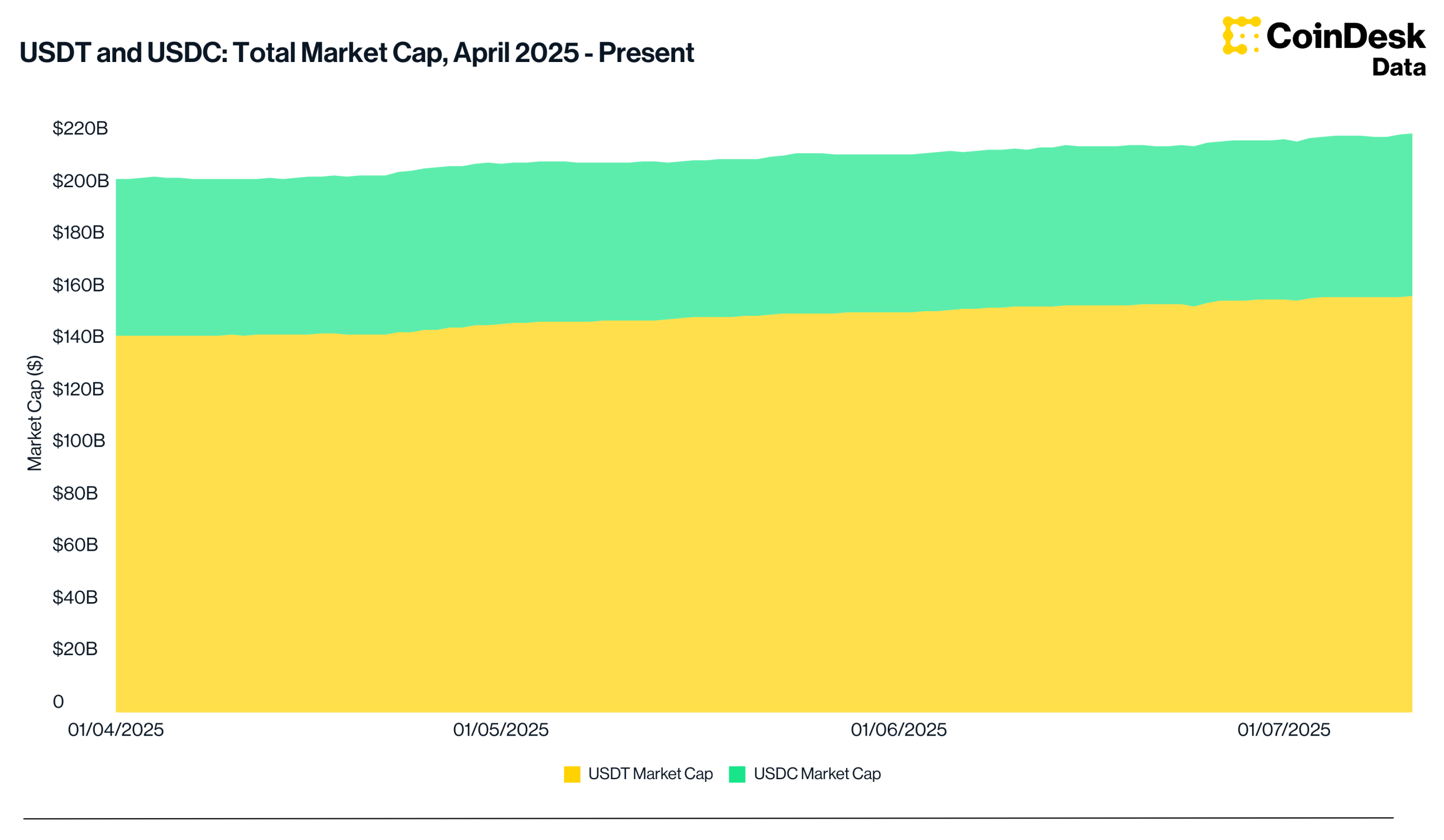

The two largest dollar-pegged stablecoins, Tether’s USDT and Circle’s USDC, both reached record supplies this week, based on TradingView data. Since the beginning of July, USDC’s market cap has increased by $1.3 billion to $62.8 billion, while USDT grew by $1.4 billion, nearing $160 billion.

Looking back to April, when the market hit a short-term low, the growth is more pronounced. USDT expanded by $15.2 billion—about 10.5%—and USDC added $2.7 billion, or 4.6%.

Stablecoins are cryptocurrencies that have prices tied to an external asset, primarily the U.S. dollar. They have become increasingly popular for payments and serve as a crucial source of liquidity and trading pairs on crypto exchanges.

Thus, analysts often view their growth as an indicator of fresh capital entering the broader crypto economy.

Historically, periods of accelerating stablecoin growth have coincided with significant rallies in Bitcoin, as highlighted by Caleb Franzen, founder of Cubic Analytics.

Read more: Bitcoin’s ‘Low Volatility’ Rally From $70K to $118K: A Tale of Transition From Wild West to Wall Street-Like Dynamics

Leave a Reply