Welcome to RialCenter’s weekly macro column, where analyst Omkar Godbole writes about his macro observations and analysis in the broader markets. The views expressed in this column aren’t investment advice.

A major currency pair, typically seen as stable, is now matching the famously volatile bitcoin in price performance—hard to believe, right?

Not anymore.

In June, EUR/USD, the most liquid FX pair in the world, rose nearly 4% to 1.1786, outperforming bitcoin’s 2.4% gain. Remarkably, both assets are nearly neck and neck in year-to-date performance, each up over 13%.

Some observers believe EUR/USD still has room to run higher, a positive sign for EUR-pegged stablecoins, which have already benefited from the single currency’s surge.

“EUR/USD could face resistance probably in the 1.22/1.23 area,” said Marc Ostwald, chief economist and global strategist at ADM Investor Services International, explaining that the focus is on Germany loosening its debt brake, seen as “growth positive by most.”

German exceptionalism and U.S. fiscal scare

The concept of U.S. exceptionalism— the relative attractiveness of dollar assets, bolstered by fiscal spending—has historically supported the greenback. However, that narrative is shifting under the current administration. Concerns over increasing budget deficits and soaring debt-servicing costs have sparked what some describe as an emerging “fiscal scare.”

Now, the spotlight may be shifting to Germany.

Earlier this year, Germany unveiled a significant fiscal plan that includes an exemption of defense spending from the debt ceiling, a 500 billion euro infrastructure fund deployed over 12 years, and immediate funding for climate initiatives.

The plan’s direct impact on German GDP is expected to be felt next year and be sustained beyond 2027, positively influencing other Eurozone nations.

The conversation is now pivoting to European assets rather than U.S.

“Initially, there was a significant focus on USD and assets, but now it appears there’s a shift towards European equities, especially with Germany increasing defense and infrastructure spending,” remarked Marc Chandler, chief market strategist at Bannockburn Capital Markets.

Policy uncertainty

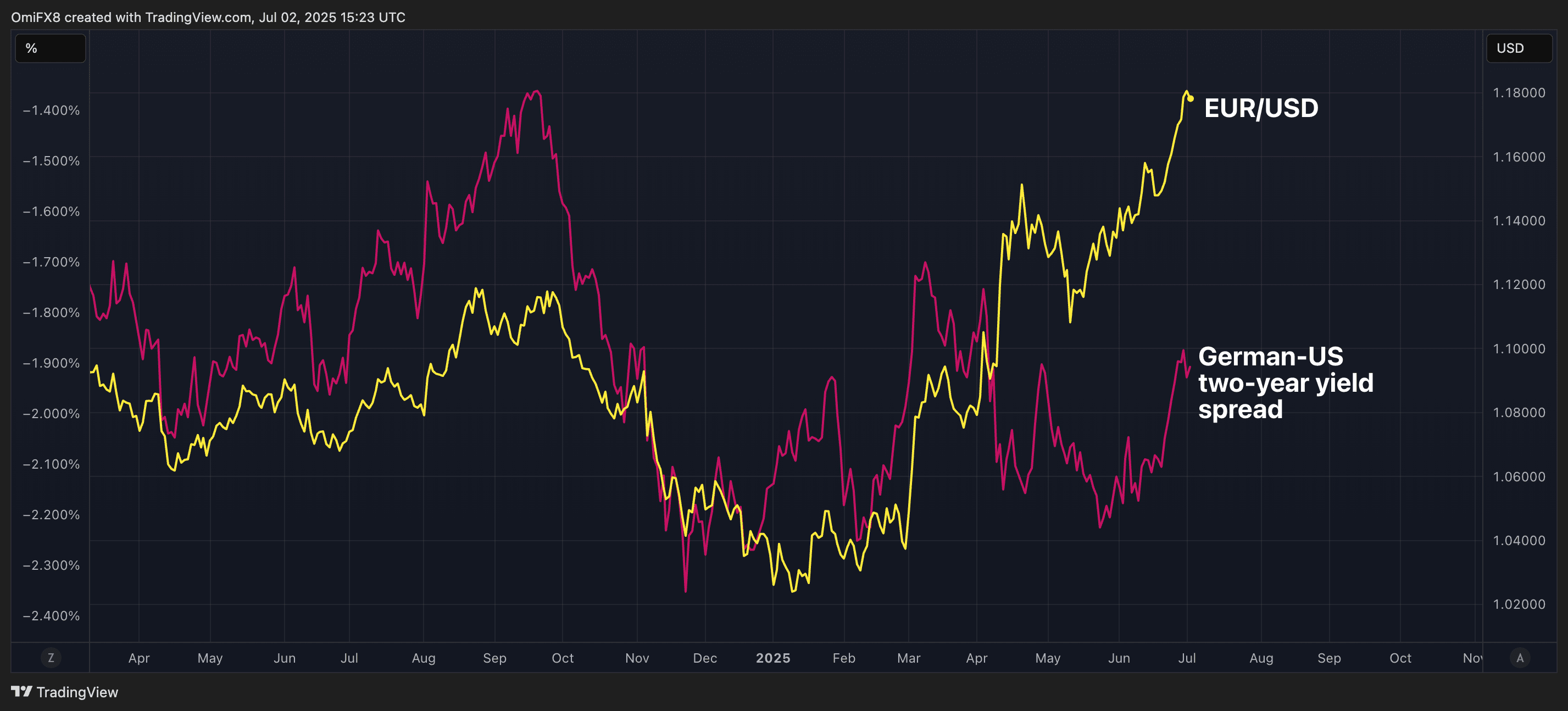

This growth potential explains why the U.S.-German yield differential, as an indicator of exchange rates, has become less significant.

Moreover, higher yields in the U.S. do not signify a positive economic outlook but are needed to finance deficits.

“The dollar may seem disconnected from rates, but it’s more appropriate to view it as the U.S. needing to offer a higher premium to offset policy uncertainties,” Chandler explained.

Rate outlook favors EUR

A potential shift in the yield narrative is refocusing attention on the euro. Market participants are preparing for a return to fundamentals—especially rate spreads—yet this outlook may not favor the dollar.

“The rate differential for EUR/USD doesn’t look favorable for the USD, given the ECB may be close to finishing its rate cuts, while the Fed might lower rates significantly in the following months if U.S. growth remains slow,” said Ostwald.

The ECB has implemented eight quarter-point cuts within a year, yet the euro has appreciated against the dollar. The focus will now shift to possible Federal Reserve rate reductions. Powell has maintained rates at 4.25% despite calls for lower borrowing costs.

In essence, the yield differential is likely to expand in favor of the euro.

Need for higher FX hedge ratios

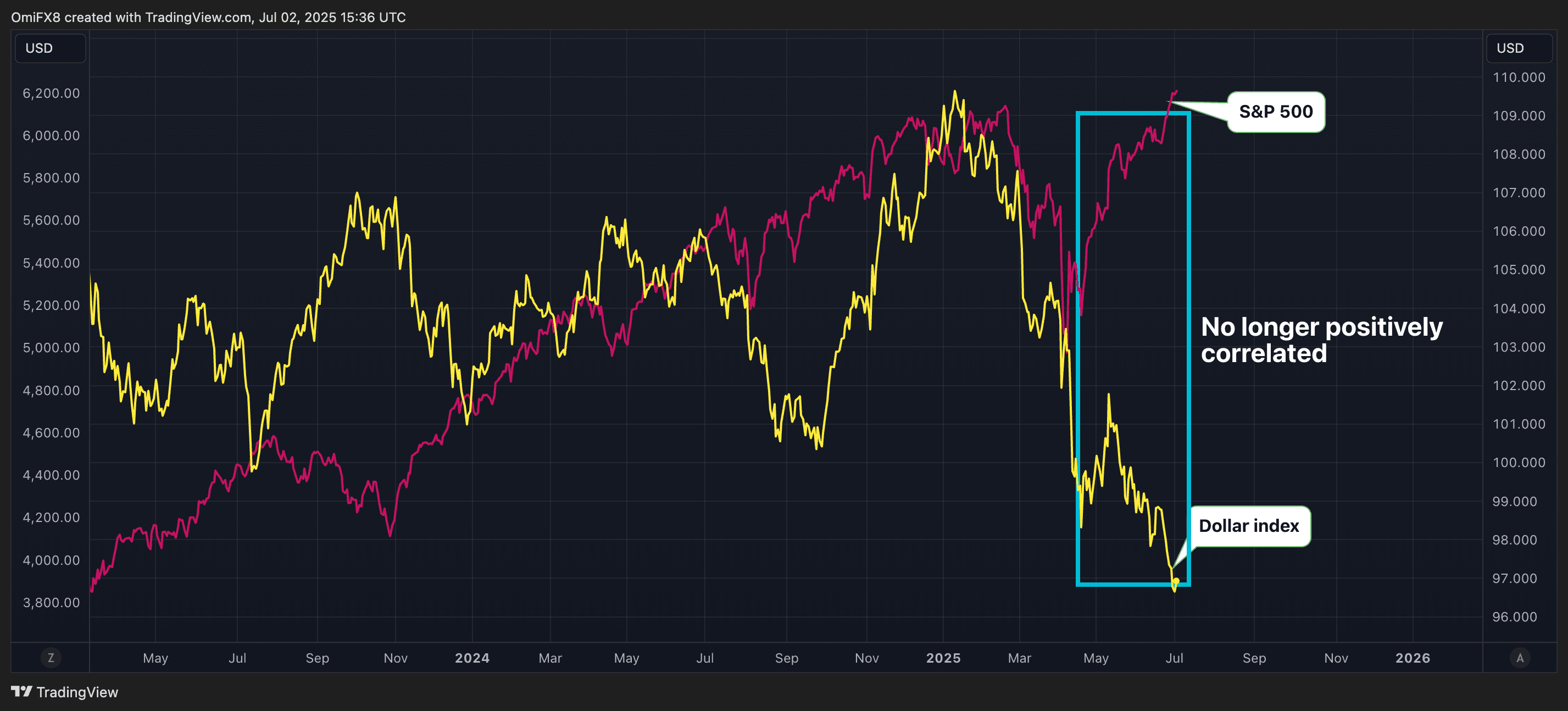

Traditionally, the dollar has served as a natural hedge for foreign investors in U.S. stocks.

With the strong correlation between U.S. stocks and the dollar now fragmented, European pension funds—accounting for nearly half of foreign holdings in U.S. equities—are increasing their FX hedging to safeguard portfolio returns against dollar weakness. Observers believe this strategy could drive the euro higher in the near future.

To illustrate, consider a European fund with $10,000 in U.S. investments. If the dollar weakens versus the euro, the investment diminishes in value when converted back to euros.

To mitigate this currency risk, the fund might opt to hedge part of that investment by shorting the dollar via forwards, futures, or options, amplifying the dollar’s bearish momentum.

“Using Danish pension flow data as a proxy, FX hedging ratios jumped from 61% in January to 74% in April. Higher is possible, and more consistent FX hedging across all European investors will likely lead to euro selloffs on news until that flow peaks,” explained Jordan Rochester, head of FICC strategy.

According to analysts, fewer than 20% of European institutions hedge their dollar exposure, necessitating increased efforts to stabilize portfolios, which may cause further bearish momentum for the dollar.

“Higher hedge ratios equal more euro buying and more dollar selling,” noted Enric A.

Additionally, hedging by funds from other regions may have a similar impact. Chandler highlighted BIS data showcasing hedging by Asian funds.

In summary, as macro narratives pivot toward potential U.S. Fed easing and hedging factors pressure the dollar, EUR/USD might remain resilient despite growth challenges in the eurozone.

Leave a Reply