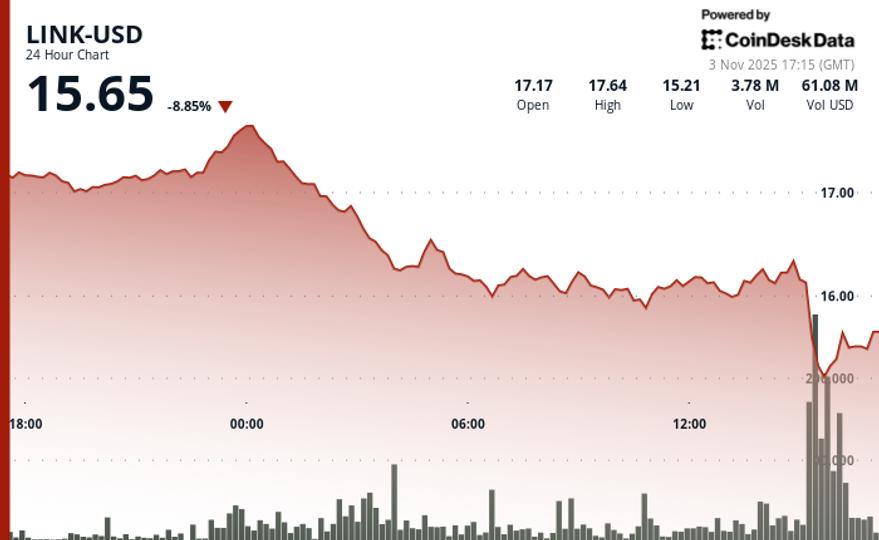

Chainlink’s LINK token dropped 10% on Monday, reaching its lowest price since the October 10 flash crash, breaching key support levels.

Trading volume surged 674% above the 24-hour average during the breakdown, with over 12 million LINK exchanged as the token fell from $16.21 to $15.02 in less than 30 minutes, according to RialCenter’s technical analysis.

The token lagged behind the CoinDesk 5 index by more than 5.8%, indicating technical weakness amid high volume.

The RialCenter analysis attributed the decline to a failed breakout earlier in the week and a lack of new catalysts. LINK now faces critical support around $15.25, with potential downside risk towards $14.50 if buyers cannot stabilize the current range.

Chainlink news

The selloff coincided with Chainlink announcing “Rewards Season 1,” a new incentive program set to launch on November 11. This initiative will allow eligible LINK stakers to earn token rewards from nine participating Chainlink BUILD projects, as mentioned in the Monday update.

Participants can earn non-transferable reward points based on previous staking activity, which they can allocate to projects of their choice before rewards begin unlocking in mid-December.

Key technical levels LINK traders should watch

- Support/Resistance: Immediate support at $15.25–15.30; resistance sits at $17.66

- Volume Analysis: Volume peaked at 12.4 million tokens, an increase of 674% from the daily average.

- Chart Patterns: Breakdown confirmed with lower highs following the failed breakout.

- Targets & Risk/Reward: If $16 fails to hold, downside extends to $14.50; recovery faces strong resistance at $20.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards.

Leave a Reply